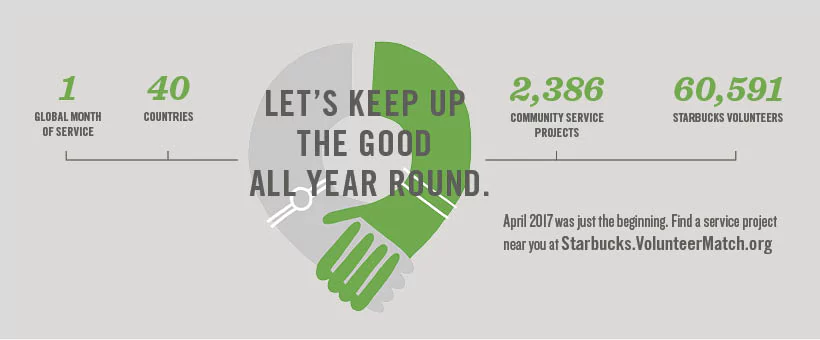

You may think of Starbucks as a great place to grab a coffee, but they actually got a fascinating goal that they were aiming for. Their ambition was to be recognized as much for their commitment to social responsibility – as the quality of their coffee. And they wanted to reach this goal by 2020.

To help reach this worthy ambition, Starbucks planned to offer sustainable coffee, eco-friendly stores, employment opportunities for military veterans (and their spouses), youth and refugees, and food share and community service.

How will they achieve these targets? The company is committed to planting 100 million trees to farmers by 2025, double the recycled content, recyclability and the reusability of Starbucks cups by 2020, hire 25,000 veterans and military spouses, and rescue 100 percent of food available to donate by 2020 in U.S. company-owned stores. (And many more.)

This Starbucks’ plan is essentially based on the SMART goal principles. With a deadline of 2020 (just three years), they’re stretching their potential to get big things done as soon as possible.

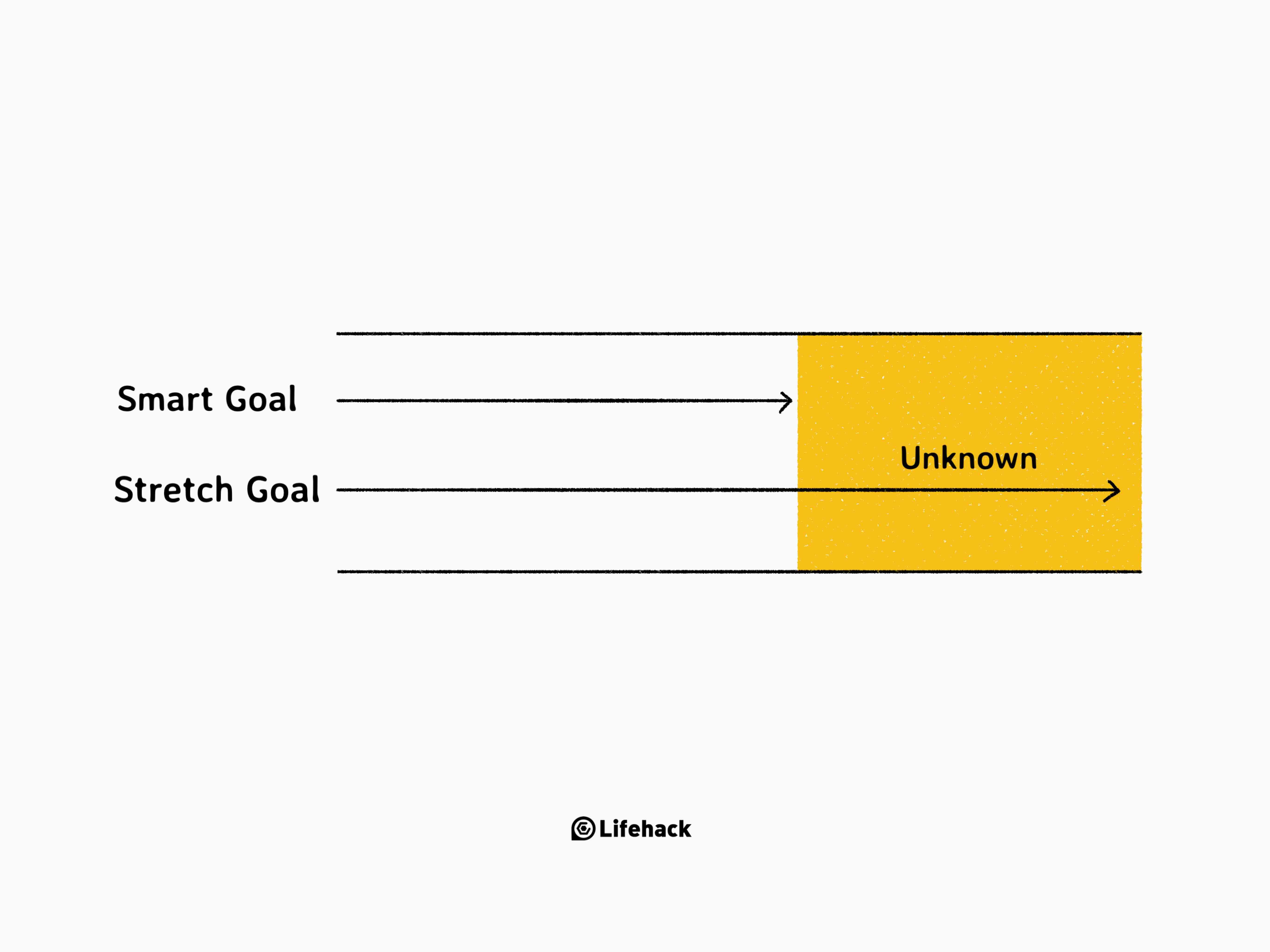

SMART Goal vs Stretch Goal

In November 1981, George T. Doran, a consultant and former Director of Corporate Planning for Washington Water Power Company, published a paper titled: There’s a S.M.A.R.T. Way to Write Management’s Goals and Objectives. It’s believed that this was the first time the acronym SMART was written down.

Maybe you’ve already known or tried a SMART goal, but let’s just have a recap of what SMART stands for:

- Specific – target a specific area for improvement.

- Measurable – quantify, or at least suggest, an indicator of progress.

- Assignable – specify who will do it.

- Realistic – state what results can realistically be achieved given available resources.

- Timeline – specify when the result can be achieved.

This clear and simple framework has revolutionized the way many people and companies implement their goal setting.

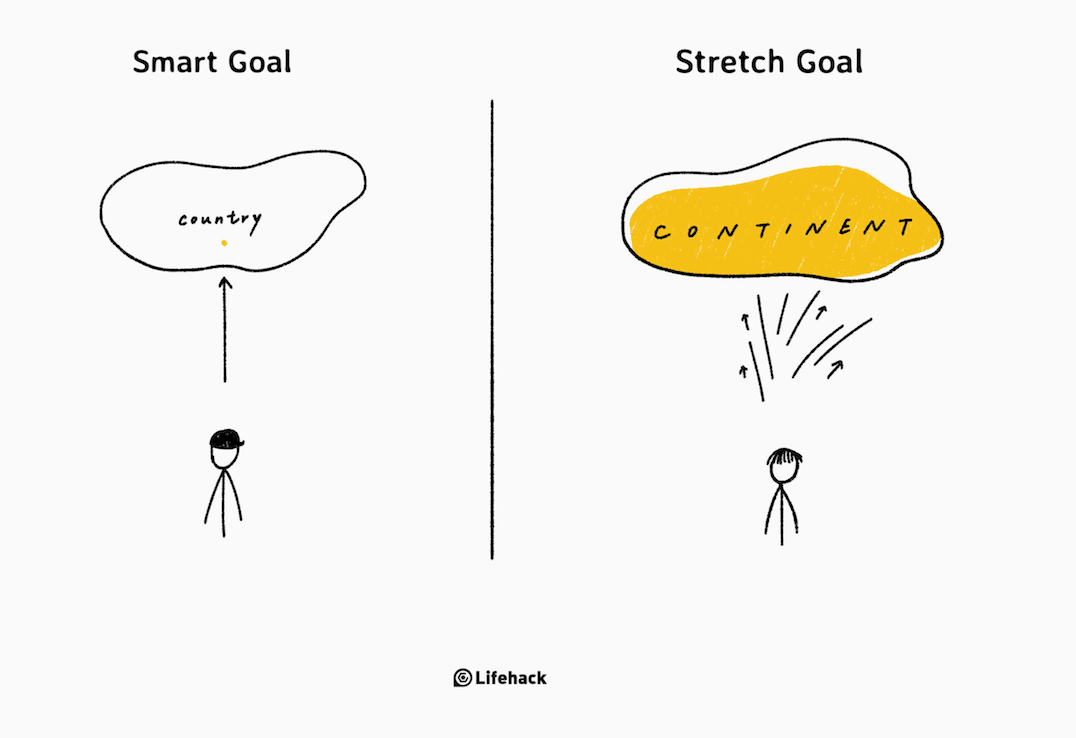

How about Stretch goals? Stretch goals allow you to stretch your imagination, potential and ability. It’s when our creativity and imagination comes up with what we believe are winning ideas – but we don’t necessarily have any concrete steps on how to achieve them. This can often make Stretch goals seem like make-believe, as the goals are often very challenging.

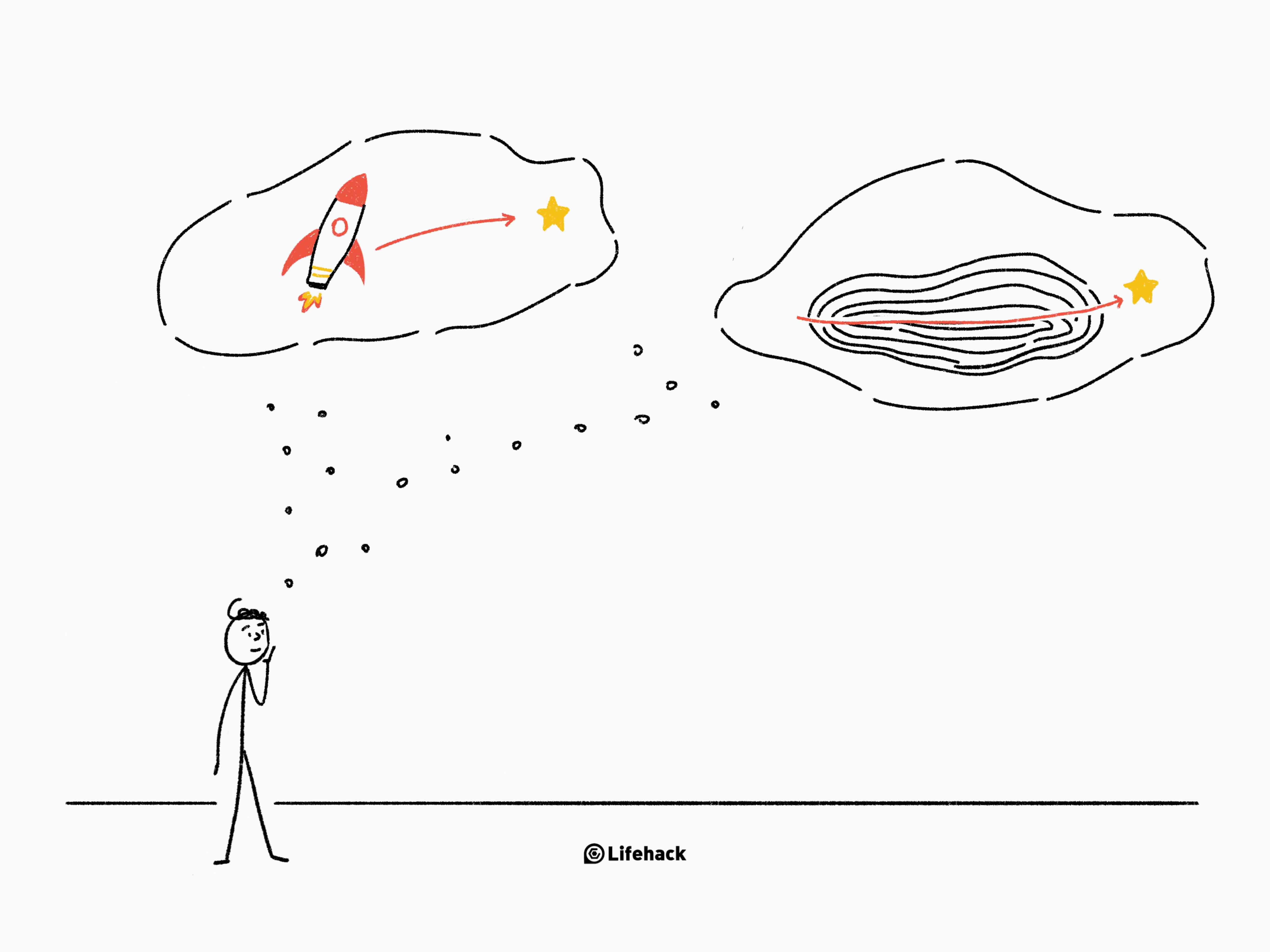

On the left, you can see a straight path leading to a country. This is how your SMART goal looks when in action. You have a clear direction and a definite goal.

On the right, you can see a blurry, meandering path to an unknown continent. This is how your Stretch goal looks when in action. You have an uncertain route to take on the way to a goal that is so big – that you can’t be sure you’ll ever reach it.

SMART Goals are Concrete but Rigid

SMART goals offer a concrete plan of action so people know exactly what to do to achieve the desired goal. They are more motivating because the plan of action demonstrates how the goal is attainable. They also make visualizing progress easy, and missed targets can be spotted quickly.

However, the focus on specific set targets to reach the goal can result in people missing the bigger picture. If the goals are too easy to achieve, then the potential is lost to attain greater success. For creative types, the rigidity of SMART goals may prove to be too robotic or dull.

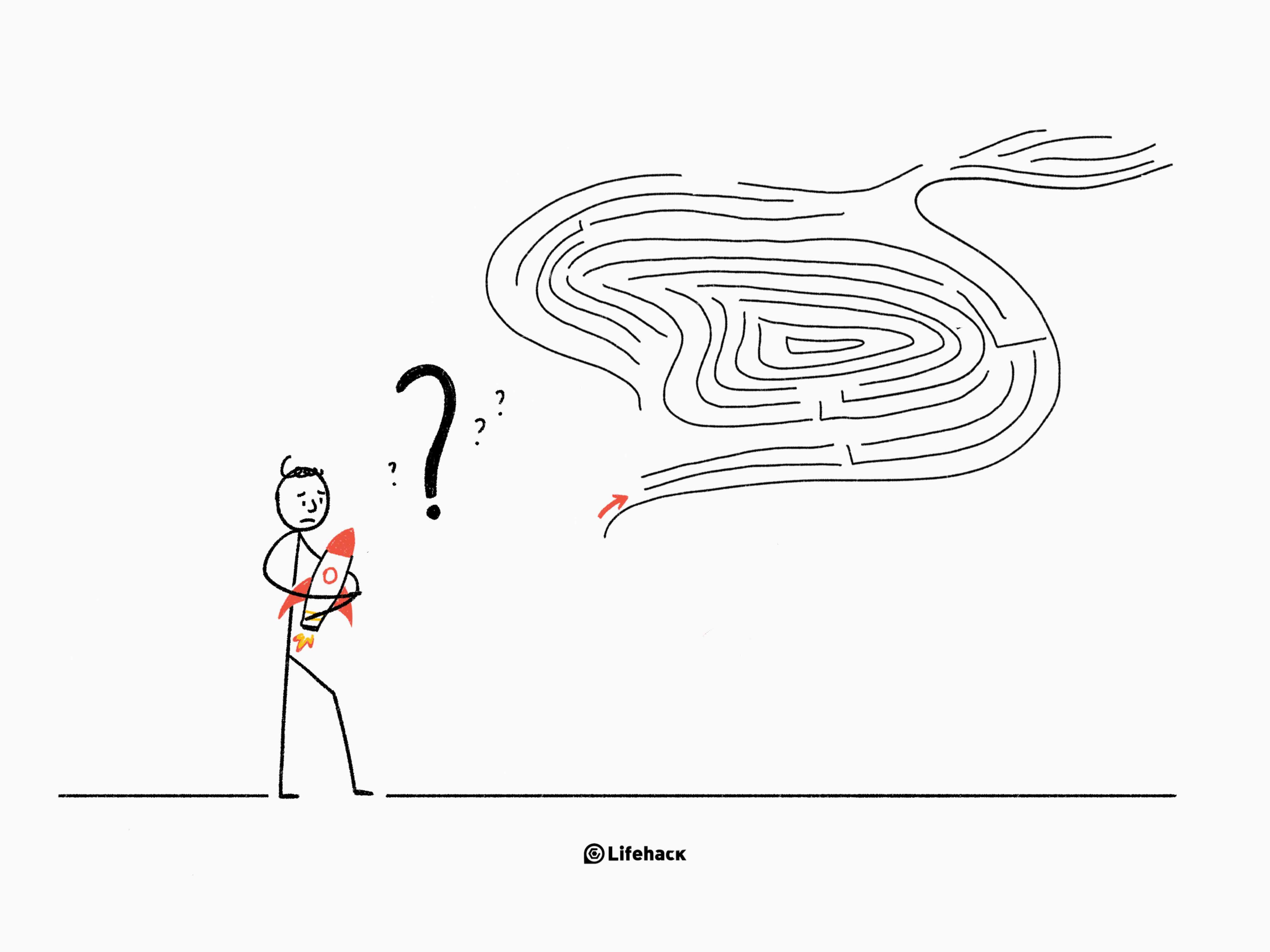

Stretch Goals are Daring but Vague

Stretch goals inspire people to think BIG and push their limits of potential and ability. They allow people to keep their focus on the BIG picture, and encourage creative approaches because often unconventional ways are needed to achieve herculean goals.

But stretch goals can be demotivating. They lack concrete plans on how to get started, and how to progress and can lead to excessive risk-taking.

Go SMART, or Stretch It?

If you choose to go down the SMART goal route, you have the best chance of achieving your goal, but you may miss out on reaching your highest potential.

On the other hand, if you choose to go down the Stretch goal route, you may push yourself to your limits, but ultimately fail to reach your desired destination.

Clearly, SMART and Stretch goals have distinctive pros and cons. However, some circumstances will be best suited to one or the other.

SMART goals are best when:

- You have a vague plan, and have no idea how to turn the plan/idea into results.

- You have a great idea/goal that you want to achieve, but you aren’t sure HOW to make it happen.

- You need to kickstart yourself or your company into some action (e.g., reading one book a week, gaining 100 new customers a month).

Stretch goals are best when:

- You have a concrete plan, and you don’t see a problem making it happen. (It’s probably time to stretch it more!)

- You want to break through stability and take your achievements to the next level (e.g., reading 3 books a week, gaining 500 customers a month).

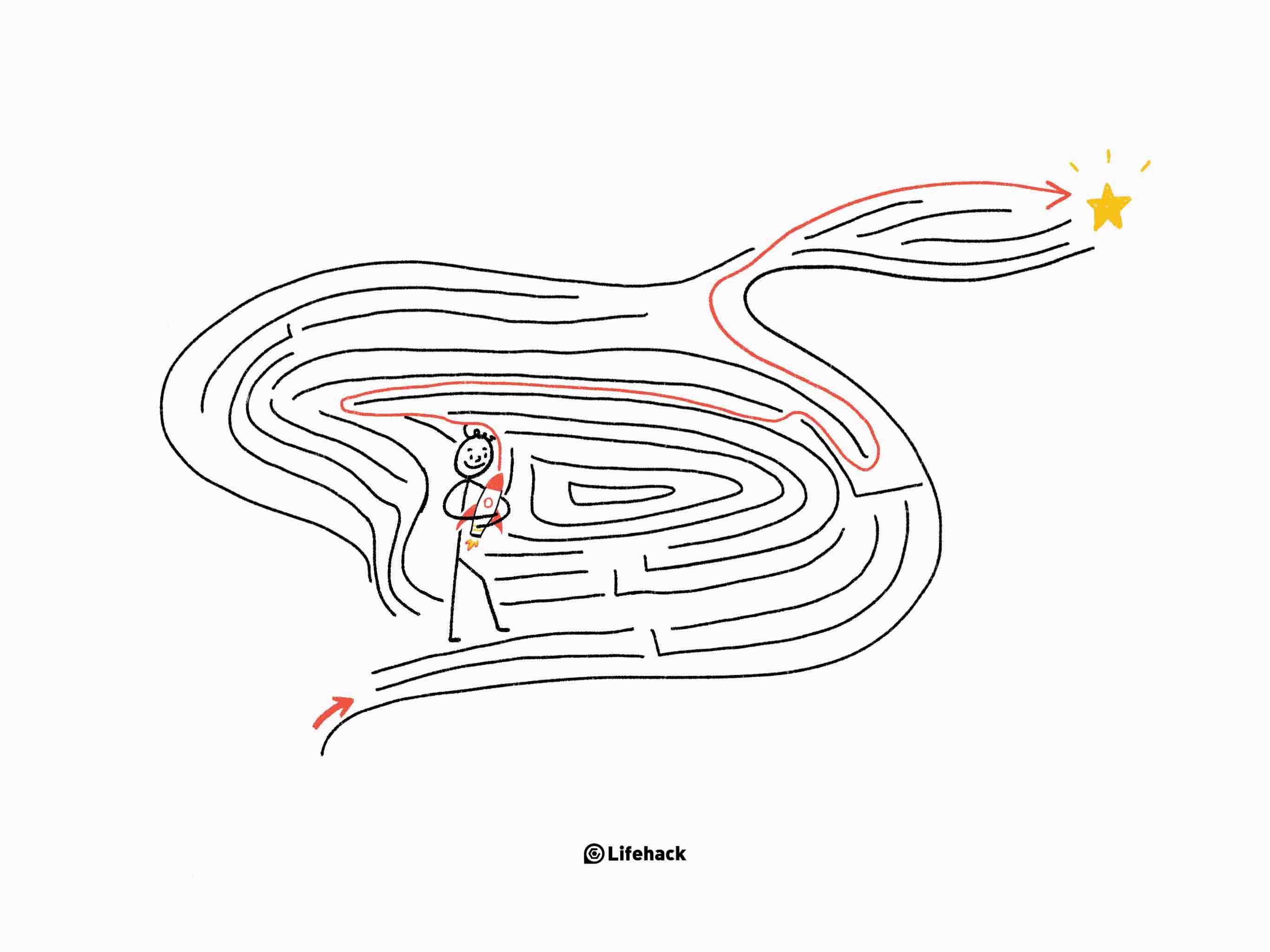

Discover the Sweet Spot

Could there be a ‘middle way’ that combines the pros of each goal type while eliminating the cons? Yes, there certainly is.

If you’re not sure what goal type to choose, then instead, try combining the two goal types into one.

For example, if your goal is to be a competent guitar player, that would lend itself to being a SMART goal. With lessons and practice you could become a competent guitar player in under a year. However, why not blend in some Stretch goal thinking to inject some excitement into your goal. Dream big and outside of the box, and set your Stretch goal as: “To become a full-time, professional musician within three years.”

Now you have the best of both worlds. A short-term attainable goal, backed by a bigger, more inspiring dream.

Again, see yourself in the maze. Walking slowly through it, you know that you can eventually find your way out. However, imagine if you found a rocket in the maze, and you could instantly blast your way to freedom!

Start Achieving Right Now

Ready to start on the road to success? You just need to do three things:

- Stretch your mind.

- Get SMART.

- Get working!

I’ll give you an example of this, so you can see how it’s done.

Imagine that you want to take up running as a hobby and a way to boost your health and fitness. If you lack any goals around this, you may run a few evenings, but then become demotivated and give up.

However, there is another way.

Bring drama and stimulation to the table by choosing a Stretch goal of completing your first ever marathon.

Sounds too much? It should do, as the goal is designed to stretch your potential and ability. However – and here is the real secret – set yourself some SMART goals that specifically prepare you for the end destination… 26 miles of nonstop running!

Your SMART goals could include:

- Specific sub-goal: Run 7 miles without stopping.

- Measurable: Run twice around the park, no walking.

- Achievable?: Sure, if I run three times a week.

- Realistic?: Sure, if I wake up early every Monday, Wednesday and Friday.

- Timeline: Run 3 miles this week, 4 miles next week, 5 miles…

I’m sure you get the idea.

By blending the power of SMART and Stretch goals, you can turn yourself into a super-achiever. And if you have your own company, you can begin putting it on the fast-track to major success.

So, Stretch, be SMART, and enjoy the journey!

Featured photo credit: Freepik via freepik.com