It’s an unwritten law of the corporate world, that the better you work – the more responsibilities you’ll gain.

These responsibilities will typically come in the form of more tasks assigned to you, more projects to manage, and more people (clients, co-workers, etc.) to take care of.

You gain these extra responsibilities when people above you on the career ladder feel that you have the relevant knowledge, context and power to do things better than the average employee.

Despite your positive attributes and obvious capabilities, you may find yourself forever prioritizing tasks based on the dates they need to be completed. These dates could be requested by someone, part of a deadline, or something that your co-workers have agreed to.

Just for a moment, put your working life aside, and imagine that you have own business selling hot dogs. You started your business a few years back, simply selling hot dogs from a little food truck that you parked on the corner of a busy street.

As your hot dogs began to sell, you found yourself beginning to get more and more customers.

Eventually, business was so brisk that you had to hire a few members of staff to help you out.

However, it was at this point that you focus began to change from making and selling hot dogs, to training and mentoring new staff. Unfortunately for you, your newly-hired helpers weren’t as good as you at making hot dogs (despite the training).

Still, your business was doing okay. As more people came to your hot dog truck, plenty of them asked for drinks too. So you decided it would be a good idea to make and sell your own lemonade.

You spent several weeks tweaking your lemonade recipe until you found what you believed to be the perfect taste. You then began to make it – spending hours per day in the process.

Sadly, when it came to launching the drink to your customers, you were dismayed to find that very few of them liked it. And because your new staff hadn’t be able to make the hot dogs as tasty as you did, fewer and fewer customers came.

Looking back, you can see that your initially successful business went badly off track. You were producing sub-standard hot dogs, and a lemonade drink that no one wanted. On top of this, you were spending a significant amount of your time just managing your staff.

The above scenario is a good representation of what happens to most businesses and to the people working in them.

Turn Things Around with the Little-Known ‘Time Pyramid’

I’m guessing that you’ve never heard of the Time Pyramid. Few people have. However, it is a super-useful tool for instantly visualizing what you should be spending your working time on.

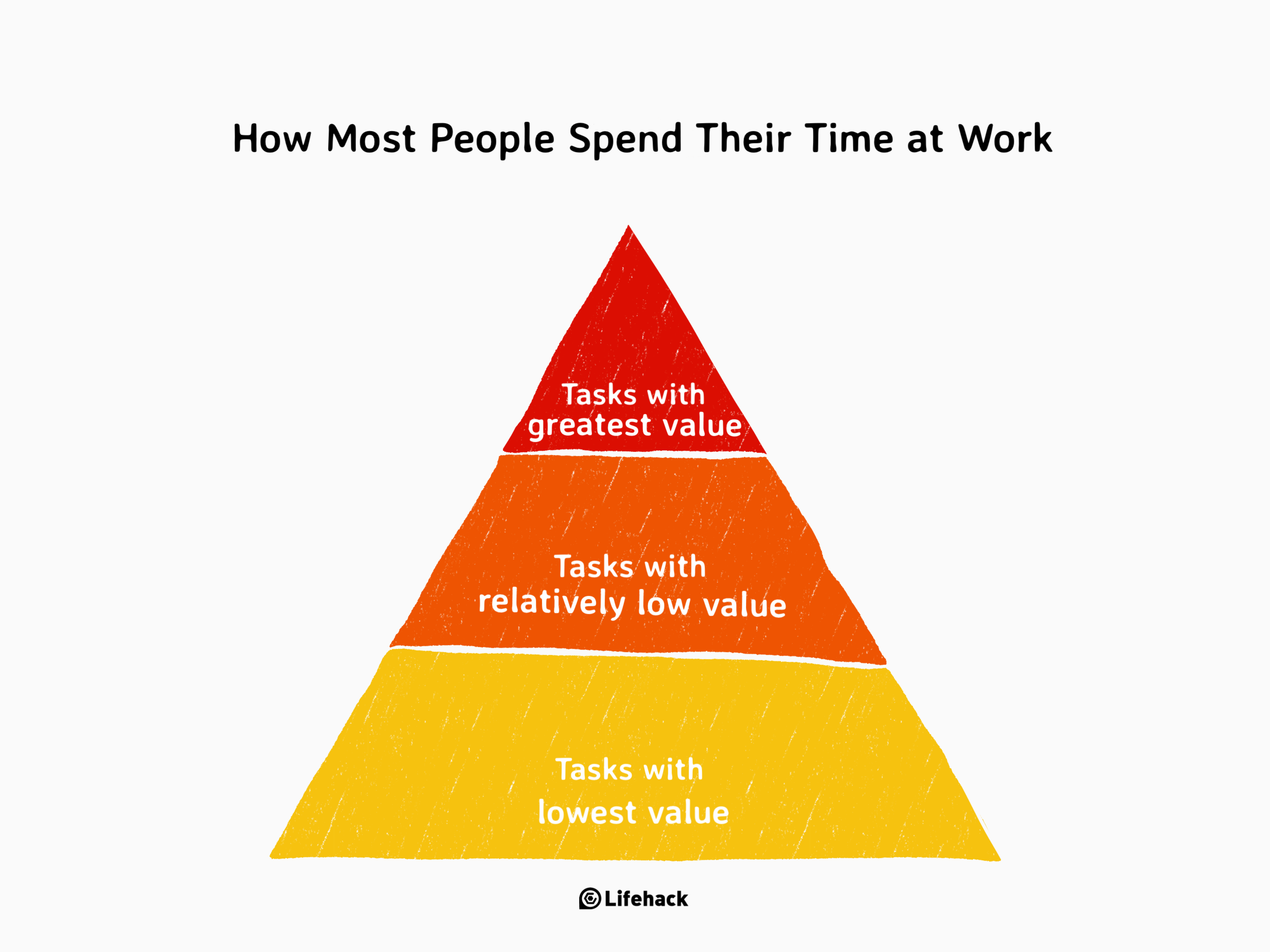

Think for a moment about your own work, do you spend most of your time working on tasks with the greatest values? Most likely not, as the majority of people spend little time on things that have the greatest impact. (Think back to the earlier hot dog selling scenario.)

The time pyramid of how most people spend their time at work looks like this:

As you can see from the image, tasks that fall at the tip of the pyramid is of the greatest value, or have the biggest impact when completed. The middle of the pyramid covers tasks that are important – but are still lower in value than those at the tip. Finally, the base of the pyramid is strictly for tasks with the lowest value or impact.

In reality, most people spend the bulk of their time on tasks with the lowest value. These tasks are like the lemonade making in the hot dog story – they can be nice to do, but often fail to move the needle in the right direction.

Are you wondering how to use the time pyramid to your advantage?

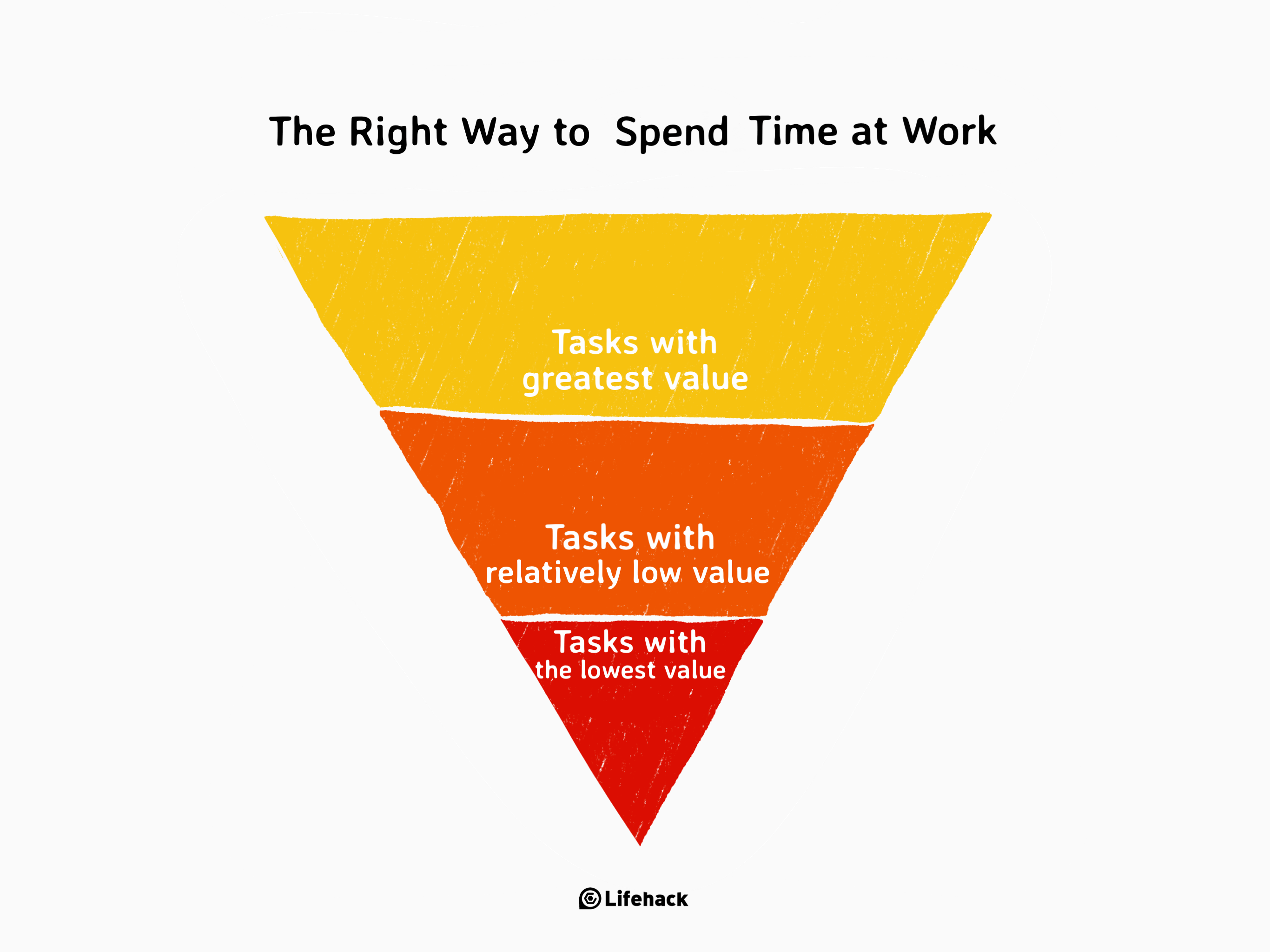

Well, it’s a very good question, and one that actually has a simple answer. You just need to invert your existing pyramid like this:

Tasks with the greatest value that you currently spend the least amount of time on, become your priority. Middle tasks stay the same, and tasks with the lowest value that you currently spend the most amount of time on, are placed at the bottom of the pyramid – where they belong!

How to Use the Time Pyramid

When you begin to use the Time Pyramid correctly, you’ll instantly be able to see the tasks that need your immediate time and attention, and those that don’t. It’ll be surprisingly easy to minimize time spent on low value tasks, while maximizing time spent on those all-important tasks.

By making this simple, but dynamic change to your working pattern, you’ll quickly begin to reap significant rewards.

As an example for you, imagine that you work as a project manager. Before learning about the Time Pyramid, you found yourself spending the best part of your time in meetings, answering emails and dealing with administrative tasks. While all of these things are useful and needed, they stole your time away from actually working on managing projects. Upon coming across the Time Pyramid, you immediately saw the error of your ways. From that day on, you put your efforts into tasks that helped your projects to reach completion in the quickest and smoothest way possible.

It’s truly amazing how much more you can achieve when you spend the bulk of your time working on major tasks. Let’s see now how it’s done.

Maximize time spent on important tasks

Consider implementing things like time blocking (so that clients and co-workers can’t disturb you), scheduling time for important things, and booking meeting rooms for yourself (so you can focus fully on the tasks at hand).

Coming back to the hot dog selling example, time should have been allocated for thinking of ideas to improve and sustain the quality of the hot dogs.

Minimize time spent on low value tasks

Choose to limit the time you spend on these tasks, and schedule specific times to complete them. You should also delegate tasks that aren’t your strength, or that will have more value if done by others.

For example, it’s very easy to get caught up with the endless emails that arrive daily into your mailbox. Most of these will not require urgent attention, so instead of trying to reply to them instantly, it would be better to schedule a period of time each day to go through them. By doing this, you won’t become a victim of incessant distractions.

In the hot dog selling scenario, it’s obvious that the boss should have delegated the task of making lemonade to someone who was genuinely good at it – or simply have bought existing high-quality lemonade.

Getting the Right Things Done

I want to wrap up this article by giving you a sample Time Pyramid that you can adapt to your own working situation. Let’s talk about the hotdog business again.

I assumed that the boss worked an average nine hours per day. This led me to plan the time this way:

- Select five hours per day dedicated to important stuff such as improving and sustaining the quality of the hot dogs, coming up with ideas on how to successfully expand the business.

- For the less important stuff, I chose three hours per day. This would be adequate for food preparation, training staff, etc.

- Finally, for the lowest priority stuff, I allocated just one hour per day. This time would be for things like ordering food and drink supplies.

I can’t state it enough: the Time Pyramid is an incredibly powerful tool. It will help you to immediately prioritize the tasks that really matter to your business, and within days – you’ll begin to experience positive and tangible benefits.

Featured photo credit: Vecteezy via vecteezy.com