While working is often viewed as a torturing process to make both ends meet, it doesn’t actually need to be like this. Some jobs are dull and tediou, others are fun, interesting and enjoyable. And the pay is awesome too!

To help you find a fun job that makes your life more interesting, here I’ve got you a list of 20 fun jobs in the world that pay well. You may soon regret not reading this earlier.

1. Ferrari Driving Instructor

How fun is it? To be paid to drive a Ferrari while others save so hard just to do so.

How well does it pay? From $90,000 to $120,000 a year

Requirement: Extensive experience in professional racing and expert training.

2. Video Game Player

How fun is it? To play video games for a living as if we are having our leisure time 24/7.

How well does it pay? $50,000 a year, dependent on the demand

Requirement:

- Be really good at the game. Not normal type of good but MLG level of greatness.

- Have a huge love for video games.

3. Private Island Caretaker

How fun is it?

- Very own piece of nature

- Very own solitude

- Embark on your very own adventure on an island

How well does it pay? Up to $100,000 a year

Requirement:

- Good Swimmer.

- Passionate in water sports.

- Adventurous.

- Highly communicative in writing to promote the island and weekly report back to headquarters

4. Food Stylist

How fun is it?

- Turn edible things into a piece of art, preparing and styling them for photo-shooting of magazines and cookery books.

- You may need to brush on some tender chicken and most importantly, after all the “makeup” and “dressing”, they are still okay to eat!

How well does it pay? $77,000 a year

Requirement:

- A great aesthetic sense.

- Profound knowledge on food.

5. Voice Actors

How fun is it?

- Get paid by making funny voices.

- Wear whatever you want in the studio (Pajamas, cosplay costumes, … you name it!)

How well does it pay? Up to $80,000, dependent on the experience

Requirement:

- A great voice and a great control of voice

6. Unexploded Ordnance Technician

How fun is it? Get paid blowing up things!

How well does it pay? A stunning $150,000 a year

Requirement:

- Professional Unexploded Ordnance (UXO) qualifications

7. Ethical Hacker

How fun is it? Hired to legally hack into computer systems (and be proud of doing so).

How well does it pay? $100,000 to $140,000

Requirement:

- Certified Ethical Hacker qualification

- Global Information Assurance Certificate (GIAC) Penetration tester qualification

- Offensive Security Certified Professional (OSCP) qualification

8. Crossword Puzzle Writer

How fun is it? Design your own mind-blowing crossword on newspaper and lead the readers to a maze of words.

How well does it pay? $70,000 a year

Requirement:

- Extensive knowledge on wide-ranging vocabulary

- Able to meet tight schedule

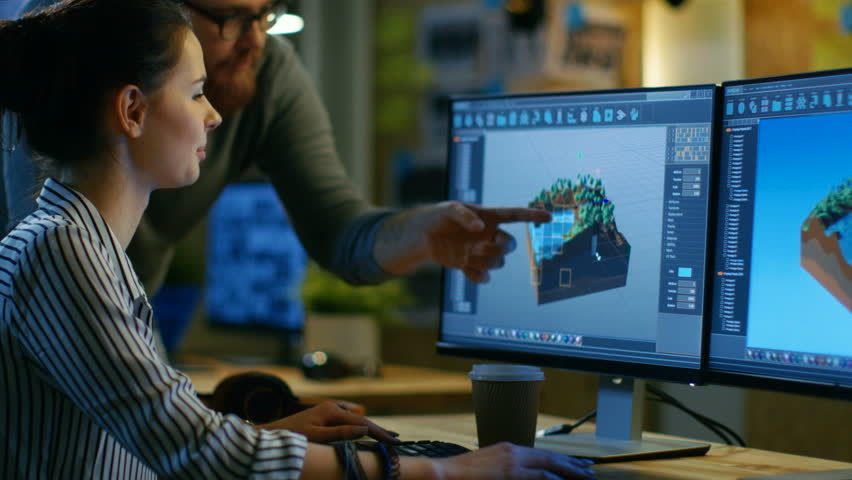

9. Video Game Designer

How fun is it? Unleash your creativity and make your own video game

How Well Does It Pay? Around $80,000 a year, dependent on experience

Requirement:

- Minimum a higher diploma in video game design or computer science. Preferably a bachelor degree.

- Enthusiasm and knowledge on video games.

10. Blimp Pilot

How fun is it? Fly an eye-catching blimp all day to get your paycheck.

How well does it pay? $70,000 a year

Requirement:

- Preferably over 1,200 hours of flight time

- Preferably a Certified Flight Instructor Certificate

- Preferably a commercial rating

11. Toy Designer

How fun is it? Realize your kidult dream and design toys for the real kids.

How well does it pay? Approximately $70,000 a year

Requirement:

- A degree in any field related to toy design

- Great passion in toys and how toys make children happy

- Knowledge of toys kids at varied ages love to play

12. Fortune Cookie Writer

How fun is it? Spread your wit and wisdom by writing some one-liners that can not only appeal to but also teach others.

How well does it pay? Up to $70,000 a year

Requirement:

- With a tremendous amount of ideas. You have to be really prolific to make sure the 3 billion fortune cookies produced each year has a message inside.

13. Hollywood Stunt Person

How fun is it? Find yourself on the screens in movie theatres, receiving “Wow!”s and applause from the audience.

How well does it pay? Up to $100,000 a year, highly dependent on the scale of the movie, experience and the nature of the stunts.

Requirement:

- Obtained the membership of Joint Industry Stunt Committee Register of Stunt Performers and Coordinators

- Excellent physical fitness

14. Disneyland Face Character

How fun is it? Ever thought of being a Disneyland character? Now you are one. Dress up as your favorite childhood cartoon characters and play as them. (It could be tough though when you had to work under the big costume.)

How well does it pay? – Around $32,000 a year

Requirement:

- Strict height and appearance regulations

- Able to impersonate a character

- Love children and know how to cater to their needs

15. Food Critic

How fun is it?

- Totally free-of-charge dining experience. Never need to worry where to eat and the budget now.

- Chefs and servers giving their best to impress you.

How well does it pay? $47,000 a year

Requirement:

- Outstanding culinary knowledge and sensitive to taste and aroma

- Familiar with the workflow in a restaurant

- Excellent communication (writing) skills, preferably with a degree in communication, journalism or related fields

- Attention to details

16. Ice Cream Taster

How fun is it? An unlimited supply of the ice-cold heart-softening delicacy.

How well does it pay? $60,000 a year

Requirement:

- A degree in food science

- Extraordinary love for ice cream (as you will be having it almost every meal every day)

17. Race Engineer

How fun is it? Closely monitor the race car performance and communicate with the driver. You are actually part of the race!

How well does it pay? $134,000 a year

Requirement:

- A degree in Mathematics and Physics

- Able to work under immense pressure as half a second delayed response can cost a match

- Deep understanding of the racing industry

18. Sommelier

How fun is it?

- Drink wine and recommend them for a living

- Travel around the world to source new wines

How well does it pay? Base annual salary is around $40,000 but a master sommelier can earn up to $150,000 a year.[1]

Requirement:

- Extensive knowledge of wine

- Highly sensitive to taste and smell

- Great communication skills

19. Social Media Professional

How fun is it? While you usually scroll through Facebook, Twitter, Snapchat and Instagram in your spare time, you now do it at work for a living.

How well does it pay? From $55,000 to $83,000 a year, dependent on experience and duties

Requirement:

- Familiar with the latest trend and different social media platforms

- Extensive knowledge in marketing

20. Radio and Television Announcer

How fun is it?

- Working on-air live definitely offers you rush of adreanaline

- Able to meet celebrities and politicians, and even interview them

- On some occasions, you are invited for some free food and to different events

How well does it pay? Around $45,000 a year

Requirement:

- A degree in journalism, broadcasting or related fields

- Specialized knowledge is sometimes required if you are in specific domain

- Outstanding communication and able to work under immense pressure (e.g. don’t stutter and get nervous in an interview with a Hollywood star!)