Have you ever had the feeling that time runs out so fast and you can’t finish everything on time? Or sometimes you have a super long to-do list and you have no idea where to start with?

You’re not alone.

Fortunately there are a lot of time management tools that can help. And we’ve also prepared some practical time management tips plus some common mistakes people make.

Time management tools

Toggl: Keep track of your time

Forget about the traditional timesheet. Toggl is the best tool for you to keep track of your time spent on different tasks. It consists of a timer and a dashboard which gives you an overview of how much time you have spent for different tasks in the past week.

Panda Focus Mode: Stay Focused On Your Tasks

Panda Focus Mode is an extension for you to stay focused on your daily tasks. You can simply enter your tasks to be finished on the day and then whenever you open a new tab, you will immediately see them as a reminder.

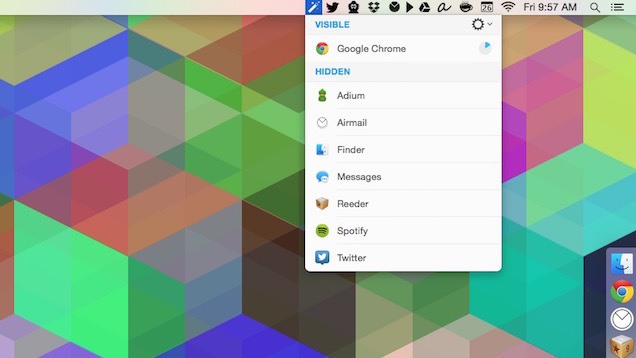

Hocus Focus: Hide your inactive windows automatically

If you always open many apps and they often distract you from your work, you should try Hocus Focus. It is a Mac menu bar utility that hides your inactive windows.

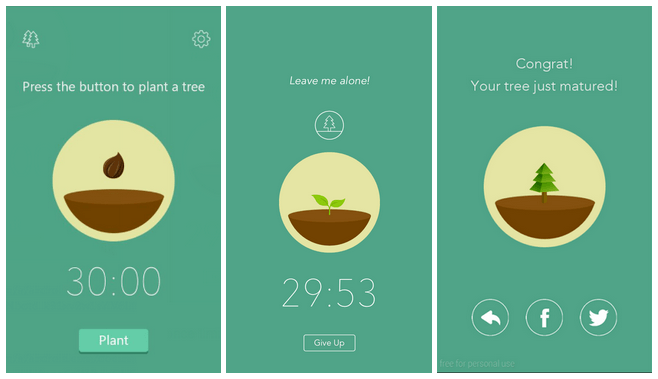

Forest: To beat internet addiction

Forest is an interesting app that helps you to beat Internet addiction. When you press the button to plant a tree, you can’t switch to another app unless you give it up. It helps you to make good use of 30-minutes to fully concentrate on your work and finish it effectively.

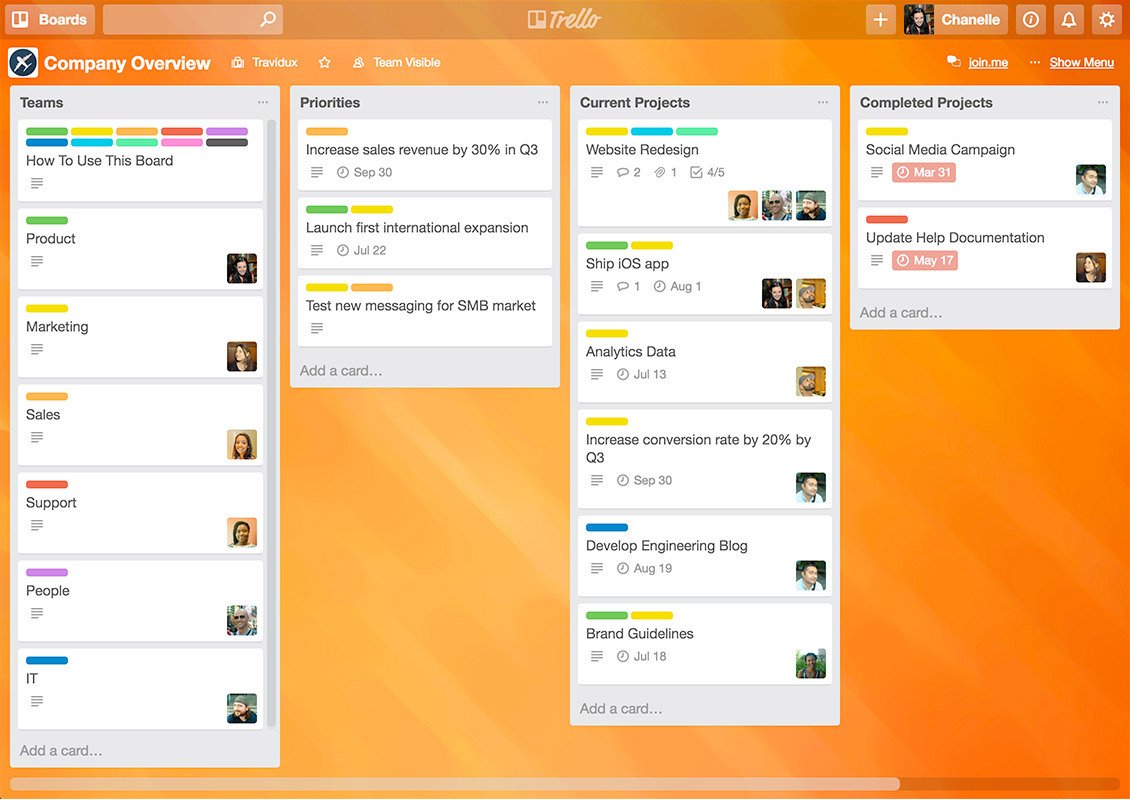

Trello: Organize Your Tasks Well

Trello is a productive app allows a team of people to monitor on the same task together. You can categorize different tasks according to their natures. Everything is just at a glance.

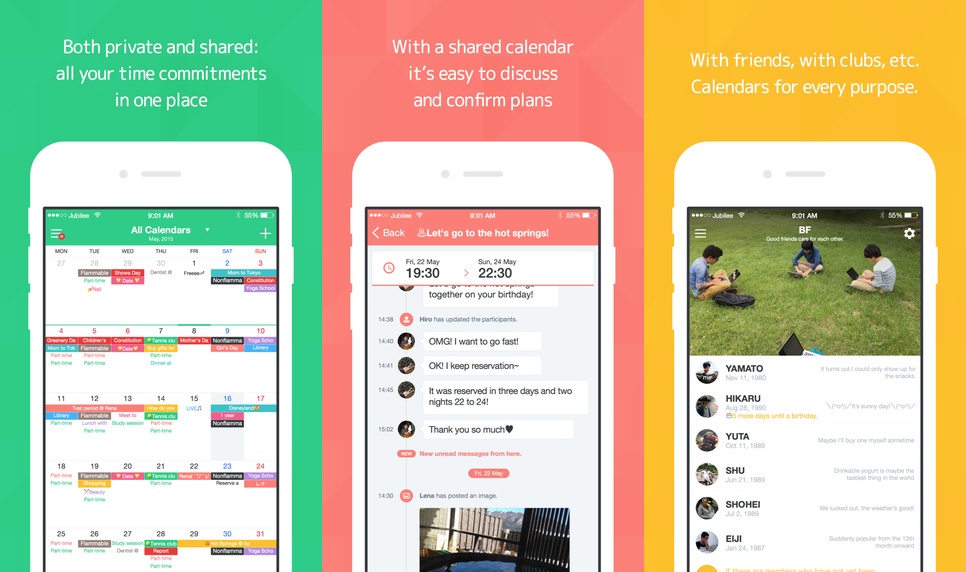

TimeTree: A neat overview of your schedule

TimeTree is a user-friendly app allows you to arrange your schedule with your friends and family. You can share events with them so that you can discuss and confirm plans together. Sorting your schedules by updates allows you to review any updates instantly.

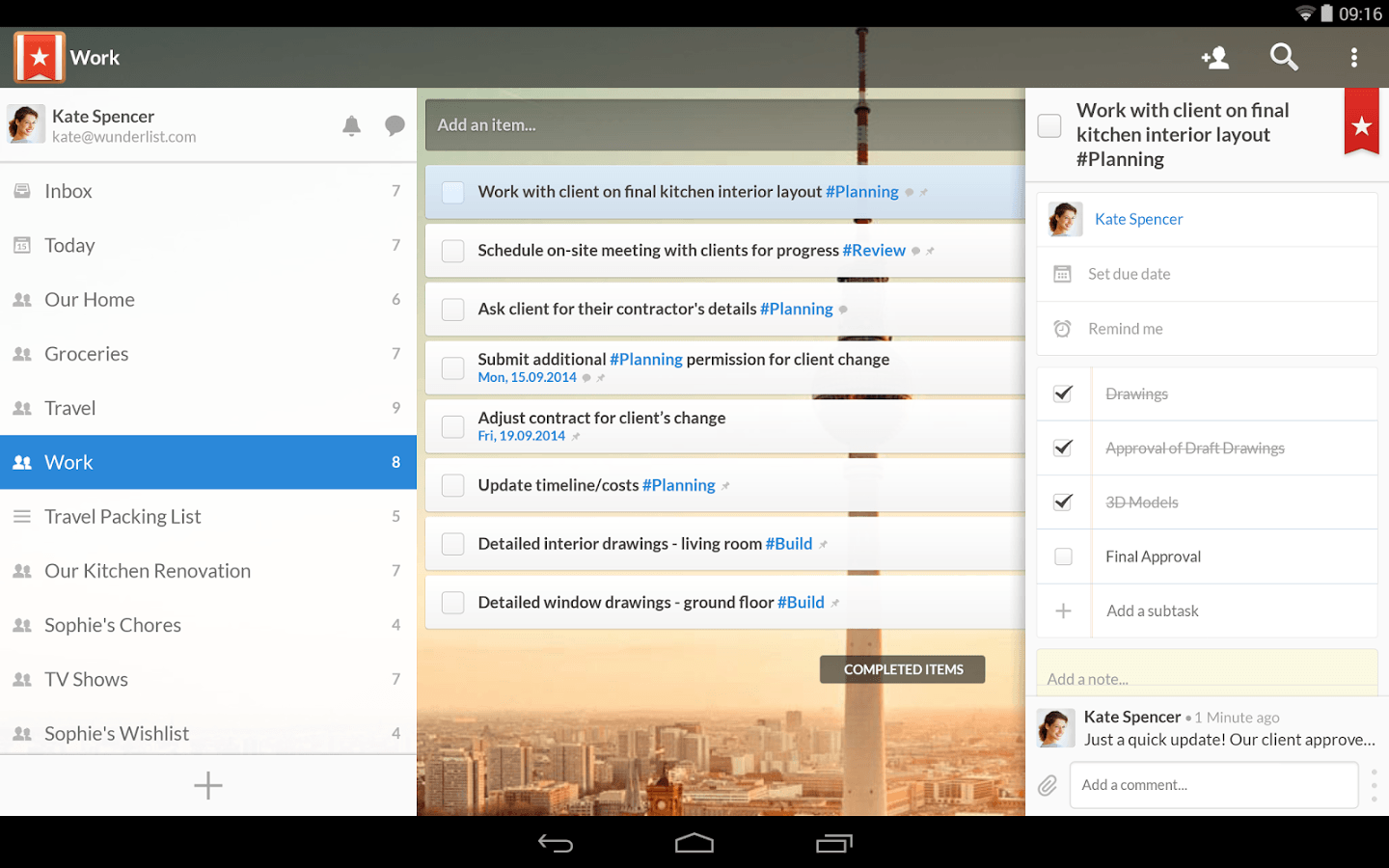

Wunderlist: Clear to-do list with reminders

Are you looking for an app which allows you to create a comprehensive to-do list? Wunderlist might be the answer. It allows you to create different to-do lists and you can even add hashtags on each item of the lists.

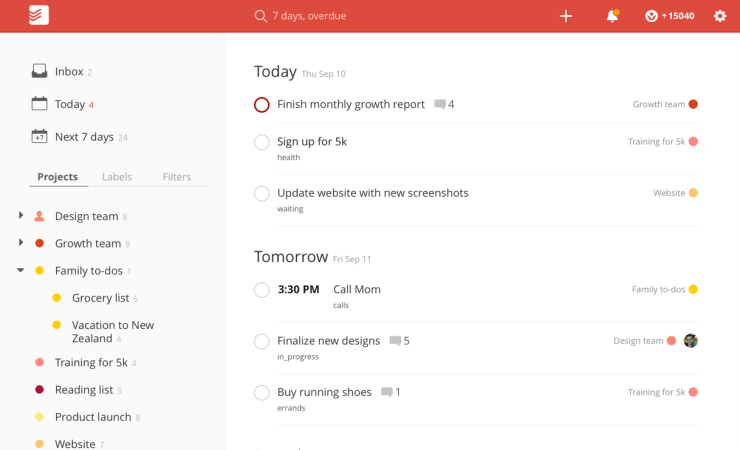

Todoist: Distraction-free to do list

Todoist has a simple and distraction-free design for you to stay focused and motivated. By breaking big tasks into smaller sub-tasks with multi-level, you can organize and review tasks in a better way. You can also easily add due dates using normal language, such as “monday at 2pm”.

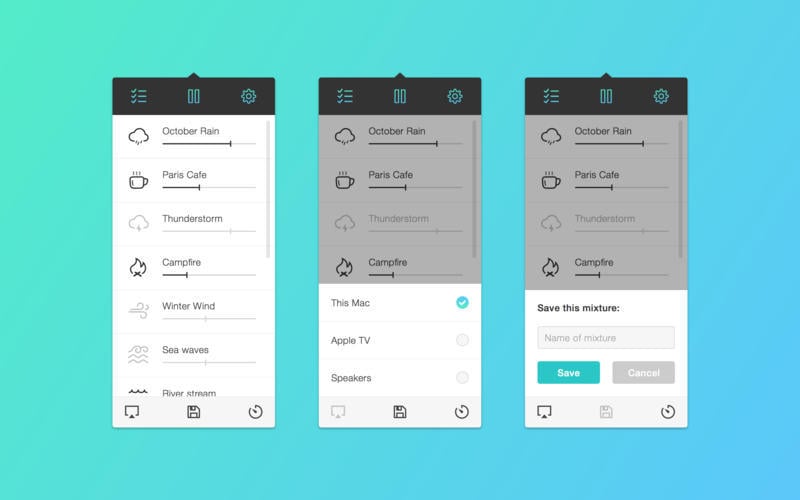

Noizio: Ambient background sounds

Perhaps sometimes the noise of surroundings is the reason why you find it difficult to focus on your work. Here’s the solution: creating an ambient background sounds to find your comfort. You can even mix the sounds on your own.

Best time management tricks

Apart from the tools, there are also a number of tips that can make us much more productive.

Spend The First 90 Minutes On The Most Important Task

As our brain are most active in the morning, we should spend the first 90 minutes of the day on the most important task so that we can finish it efficiently. Stop doing trivial matters like scrolling the to-do list or checking emails in the morning. You would miss the golden time of getting things done.

Have A Timesheet To Keep Track Of What You Have Done

A timesheet is the simplest and perhaps the best tool to have a clear picture of what you have done in each time slot.

By dividing your day into different time slots and filling in what you have done, you can compare the reality and the expectation. Did you finish your task as expected? Or did you spend too much time on it? And why? You might also see how much you have improved on your efficiency day by day.

Create A Stop-doing List

Instead of a to-do list, which most people have, a world-class productive person should have a stop-doing list.

You might find yourself spending too much time on things that don’t really matter. That’s probably the key to manage your time in a better way and become more efficient. Stop scrolling social media at work and quit doing all those meaningless things. These might be the items you would write on your list.

Set Time Limit

Work expands itself if we allocate more time to a task. That’s what the Pakinson’s law about. In other words, as Cyril Northcote Parkinson writes,

If you give yourself a week to complete a one day task, then (psychologically speaking) the task will increase in complexity and become more daunting so as to fill that week.

So set time limit. If you can finish a task within an hour, then next time, try to finish it with 50 minutes. By allocating less time to a task, you would gradually figure out the actual time needed for you to finish it without wasting any time.

Identify Your Peak Hours And Schedule The Most Important Tasks For Those Hours

Everyone has different working patterns. What’s important is to identify your own peak hours.

Our brain has limited attention span and it varies among people. So it’s important to organize your day around your body’s natural rhythms. Try to schedule your most important task for this period and work on minor tasks during your non-peak times. For example, arrange an appointment with a client during your peak hours and check emails during your non-peak times.

And Here Are The Don’ts:

Make Checking Email The First Thing To Do At Work

Checking email seems to be the vert first thing you have to do at work. But that’s not the case.

It is not the most important thing at work and it gives you an illusion that you’re achieving something. Think about it: what have you achieved actually after marking all emails read? Probably you have something more important to work on.

Multitask And Think That Would Make You More Efficient

Some people believe multitasking do work. But expert tells us that it brings harm to our brain: [1]

In fact, multitasking was found to increase the production of cortisol, a stress hormone, as well as adrenaline, which can overstimulate the brain and cause “mental fog”.

Put simply, the more information you have to handle, the less time you have to give it the thought it deserves. When you enter a “mental fog”, you start making poor decisions or responding irrationally. So don’t try to do research for an article and write it at the same time. This probably takes you a longer time.

Not Taking Breaks

Taking breaks is not a waste of time. In fact, it boosts our productivity.

As we know our brain has a limited attention span, there is no use in working for consecutively for a long period. After an hour or two, we begin to lose focus. That’s the time for you to take a little short break and give your brain some fresh air to recharge. Have a cup of tea or grab some snacks to eat. The valuable down-time enables you to think creatively and work effectively.

It is fair for everyone. Regardless of age, gender, occupation, and anything, everyone has 24 hours a day. But why some people can do that much within just a single day? The key is time management. With suitable tools and smart tricks, you can maximize your productivity and succeed in whatever your goal is.