Ever find yourself stuck on the endless merry-go-round of choices, where making even the tiniest pick feels like a Herculean task?

You might be wrestling with choosing between sushi or a burger for lunch, or stuck in the rabbit hole of online reviews for a new laptop, unable to click the “buy” button.

This is the all-too-common battle with analysis paralysis. It’s that annoying little glitch in our brains that makes us overthink our decisions to the point where we just don’t make them at all.

We lose time, we miss out, and let’s be honest, it’s exhausting.

Fear not, though, because we’re about to dive into the nitty-gritty of analysis paralysis. We’ll dissect why we freeze up, how it jams up the gears of our day-to-day life, and the big one: how to snap out of it.

Get ready to arm yourself with four battle-tested strategies that’ll help you break free from the decision deadlock and stride forward with confidence.

Table of Contents

What is Analysis Paralysis Actually?

Analysis paralysis is when your brain gets so bogged down by choices and information that you can’t make a move. It’s like being a deer in headlights, except it’s your decision-making skills that are frozen, not just your legs.

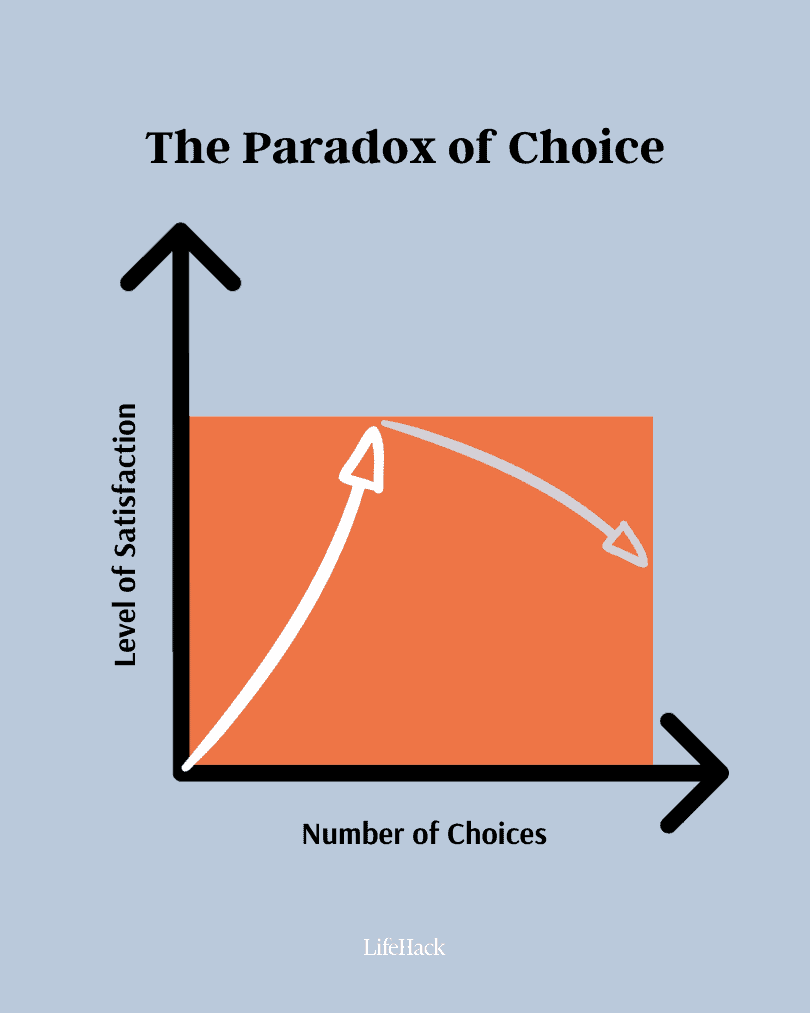

Psychologist Barry Schwartz hit the nail on the head with what he calls “The Paradox of Choice.”[1]

Sure, it’s great to have options—like 31 flavors of ice cream—but when you’ve got a gazillion choices staring you in the face, it’s like your brain throws up its hands and says, “I’m out!” This whole too-much-of-a-good-thing can make us anxious, indecisive, and oddly enough, pretty darn unhappy.

And then there’s this idea of “perfection paralysis,”[2] which is when you’re so bent on finding the flawless pick that you end up picking nothing at all.

It’s like wanting to take the perfect jump shot and ending up holding the ball so long that the buzzer sounds the end of the game.

Let’s take a page from history. Winston Churchill, the British bulldog himself, knew a thing or two about tough calls.

In the thick of World War II, he faced a real do-or-die moment. He wanted to win, but perfection was out of reach. He had to move forward, imperfectly.

Churchill once said something that boils down to this: aiming for perfection is a fast track to getting zilch done. “Paralysis,” he called it, because hunting for perfection can mean you never take a shot.

“The maxim ‘Nothing avails but perfection’ may be spelled shorter: ‘Paralysis.'”

This whole analysis paralysis mess is rooted in our internal wiring—good old anxiety. It’s fear that’s the real culprit here. Fear of goofing up, fear of regret, you name it. And that fear can be a real stick in the spokes of our decision-making bicycle.

The Cost of Analysis Paralysis

When you’re caught in the quicksand of analysis paralysis, it’s not just your decisions that suffer—your whole ability to get things done takes a hit.

Decision Dithering

You know that feeling when your computer’s spinning wheel of doom appears because it can’t handle your twenty open tabs? That’s your brain on analysis paralysis.

You’ve got so much data swirling around that making a decision feels impossible. And while you’re spinning your wheels, the clock’s ticking, deadlines are dancing by, and stress is piling up.

Before you know it, you’ve missed the boat on opportunities that could’ve been great, if only you’d jumped in time.

Not only do you fall behind, but you also start to question your ability to choose anything at all, which just stirs the pot of indecisiveness even more. It’s like when you’re at a buffet with a hundred dishes—you end up grabbing a little of this and that, only to sit down with a plate that’s kinda meh.

Studies[3] tell us that too many choices don’t make us happy; they make us anxious and even less satisfied with whatever we end up picking. It’s a classic case of too much of a good thing being, well, bad.

Mental Gridlock

Then there’s the brain drain. Overthinking clogs up your mental pipes like hair in a shower drain.[4]

Your brain has this thing called working memory—it’s like your mental notepad, but it can only hold so many notes. When you flood it with info, it’s like scribbling too many words on a tiny Post-it note until you can’t read any of it. [5]

This mental overload messes with your ability to nail those tasks that need your brain firing on all cylinders. You end up with a performance that’s as lackluster as a dim flashlight.

And here’s the kicker: the more you stress about it, the more you overload your brain. It’s like a hamster wheel of unproductiveness.[6]

Time and Dough Down the Drain

Now, let’s talk about the cold, hard cash and ticking time.

Imagine you’re painting a room. You could spend days looking at color swatches, but that room isn’t going to paint itself.

While you’re agonizing over eggshell versus ivory, you could’ve painted the room twice. That’s time and money you’re never getting back.

And if that wasn’t enough, the longer you take to decide on the color, the longer you’re living with walls that might as well be a canvas for scribbles.

Pouring too much time and resources into chewing over your choices can mean your project costs balloon, and profits deflate like a sad birthday balloon the day after the party.

What’s worse, all the dawdling means that whatever problem you’re trying to fix just keeps festering, like a leaky faucet you never get around to fixing.

So, how do we stop the madness, put the brakes on the analysis express, and get back to being productive?

How to Break Out of Analysis Paralysis

Being stuck in analysis paralysis is more like getting your sleeve snagged on a fence than being trapped in quicksand. You can free yourself, and I’m going to show you how.

1. Timebox Your Decision

Slap a timer on that decision. Why? Because nothing lights a fire under you like a countdown. It cuts through the noise and gets you to the heart of what you need to decide.

When you’ve got a deadline, suddenly, all the fluff falls away, and what you need to focus on becomes crystal clear.

When you set a deadline, be smart about it. Don’t give yourself so much time that you’re tempted to kick the can down the road.

On the flip side, don’t set it for five minutes from now and then panic when time’s up. Think about what you’re trying to decide, and give yourself a time frame that nudges you out of comfort but still feels doable.

Let’s say you’re looking at a decision that feels about as complex as a jigsaw puzzle. You wouldn’t give yourself a year to figure it out, right? Maybe you decide, “Okay, by Friday, I’ll have this piece of the puzzle in place.” That’s your deadline.

The bonus is, deadlines are like kryptonite to decision fatigue. That’s the brain-drain you get when you’re bouncing from one choice to another like a pinball.

If you’ve got a whole day of decisions, cap each one with its own deadline. Then you can move on, and your brain gets a breather. It’s like saying, “Brain, you’ve done enough heavy lifting for now; go take a nap.”

Treat your decision like a hot potato — hold it long enough to make an informed toss, but don’t let it burn your hands.

2. Make a List, Check It Twice

Consider what you’re after and what’s non-negotiable. It’s like hunting for that new pad.

What’s the big win for you? Room for the kids to play, or slashing that commute to a brisk walk?

Break it down with the Superstructure Method, a simple way to stack your needs:

- Must-Haves: These are your deal-breakers. If an option doesn’t have this, it’s out. Like a life jacket on a boat, you wouldn’t go without.

- Should-Haves: These are your strong preferences. Not essentials, but they weigh heavy on the scales.

- Good-to-Haves: These are your cherries on top. Miss them, and the sundae still tastes sweet, but snag them, and you’ve got the full flavor.

Let’s say you’re after that family-friendly apartment. Your must-haves are clear: enough bedrooms, safe for the baby, no stairs to navigate a stroller. Anything missing that list doesn’t even get a second glance.

Now, put your choices against this checklist. Score them. It’s like a game show where only the highest scores move on to the next round.

This isn’t just us talking; it’s tried and true. At LifeHack, it’s how we roll. Tool selection, partnership vetting, design picking — we line them up against our must-haves, should-haves, and good-to-haves. It’s our secret sauce for calling the shots without getting twisted up in knots.

3. Tip the Scales

Sometimes the list you’ve made is too close to call. That’s when you weigh the good against the bad with a clear head.

Lay out the pros and cons side by side. It’s like comparing apples and oranges by their tang and sweetness, not just color and shape. Look at what each option brings to the table and what it might swipe off it.

Stay focused on what packs a punch. A single pro can knock out a list of cons if it’s heavy enough. Likewise, one con can sour the whole deal if it’s a deal-breaker. It’s about impact, not just tally.

If you’ve boiled it down to two choices that are neck and neck, and you’re caught in a loop, don’t sweat it. If they’re that close, either will likely serve you well. And if this doesn’t ease your mind, the next step is ready to break the tie.

4. Good Enough Is Good Enough

If you’re waiting for the stars to align for that perfect choice, you’ll be waiting forever. Perfection is a myth. It’s about making a call and rolling with it.

We’ve all been there – thinking, “What if there’s something better?”

But here’s the thing, doing something is better than doing nothing. Our editor learned this the hard way. She’d fuss over decisions big and small, like picking the right tool or strategy. My advice? If you’ve done your homework, trust your work. Make the call.

Got two options that seem equally good? It’s a coin toss. Really, don’t sweat it.

What counts is making a move that’s in line with what you want and what you need. It’s okay if it’s not the crown jewel of decisions. Every choice has its ups and downs. It’s better to choose and learn than to stand still and stew.

And hey, if you goof up, it’s not the end of the world. It’s a chance to learn, to grow. A growth mindset is your buddy here. It tells you that tripping up isn’t failing – it’s part of the journey.

Remember, good enough gets the job done. Perfect just keeps you parked.

Final Thoughts

Analysis paralysis is when you get so stuck in your head, weighing this and that, you end up going nowhere. It’s like you’ve got your foot on the brake and the gas at the same time.

But you can beat it. You can get your gears shifting smoothly again. How? By knowing what you want, laying down a deadline, and ditching that sneaky need for everything to be just right.

If you find yourself spinning in circles, caught in the analysis trap, keep it simple. What’s your target? What’s non-negotiable? When does this need to get done? Nail these down, and you’re halfway home.

You’ve got to step off the ledge of deliberation and dive into doing. Take that leap. Because at the end of the day, the magic happens when you’re moving, not when you’re mulling it over.

Make those choices, take the steps, and remember – it’s not about the flawless victory; it’s about playing the game.

Reference

| [1] | ^ | Barry Schwartz: The paradox of choice |

| [2] | ^ | Lon Roberts: Analysis Paralysis A Case of Terminological Inexactitude |

| [3] | ^ | Procedia Economics and Finance: Application of Paralysis Analysis Syndrome in Customer Decision Making |

| [4] | ^ | Mayo Clinic Health System: Cognitive overload: When processing information becomes a problem |

| [5] | ^ | Sweller, J. (2011). Cognitive Load Theory. (P. Ayres, S. Kalyuga, S. (Online Service), & L. (Online Service), Eds.) (1.). New York, NY : Springer New York. |

| [6] | ^ | J Exp Psychol Learn Mem Cogn.: Does Overloading Cognitive Resources Mimic the Impact of Anxiety on Temporal Cognition? |