The Internet has opened up a wide range of possibilities on what can be done remotely. In fact, the way in which the Internet has taken over many functions makes us wonder how we got by before the Internet became popular. Paying for goods & services, sending, and transferring money is one of the many things that the Internet has made possible.

The rise of smartphones has also pushed the limits of mobile banking as more people find fewer reasons to go to the bank for financial transactions. Most banks have apps that you can use for your banking needs right there on your mobile device. However, the transaction costs of some of such apps might not make much sense. This post seeks to provide you with information on some other ways that you can transfer money online with ease, speed, and lesser transaction costs.

1. PayPal

PayPal is probably the oldest way to send and transfer money online. PayPal is designed to take the hassle out of the need to enter in your financial information every time you need to make a transaction. Apart from the fear that your financial details could end up in the hand of cyber criminals, typing out series of credit card numbers might get tiring on the small screen of most Smartphones.

PayPal allows you to send/transfer money simply with your email address. PayPal is accepted in most online stores; hence, you only need to input your PayPal email address at checkout. If you receive funds into your PayPal account, you can also withdraw the funds into your bank account. PayPal also provides PayPal MasterCard that you can use in stores.

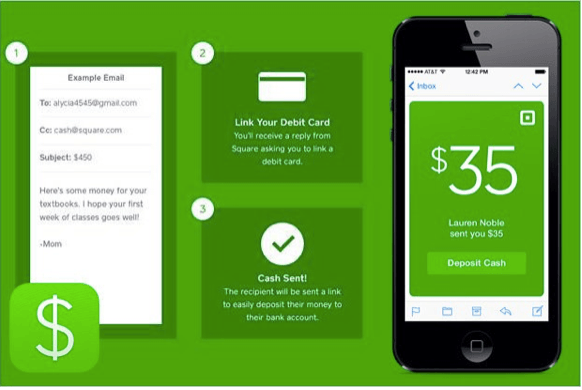

2. Square

Square Cash is relatively younger in the online payments industry; it has gained significant traction and the firm had its IPO last month. Square seeks to become a peer-to-peer payment service that allows you to send money to people’s debit card directly. Square’s appeal lies in the fact that it supports iOS, Android, and Windows Phone—there’s also a dedicated Square Cash Web app.

Square is also business-centric. Square Cash for Business is designed to help small business owners receive payments without credit card readers. The new $Cashtag allows people to pay directly from their debit cards, and it allows the businesses to receive the money into their accounts. Square is still in its growth stage, but the platform might become a major online payment platform once it signs up enough users.

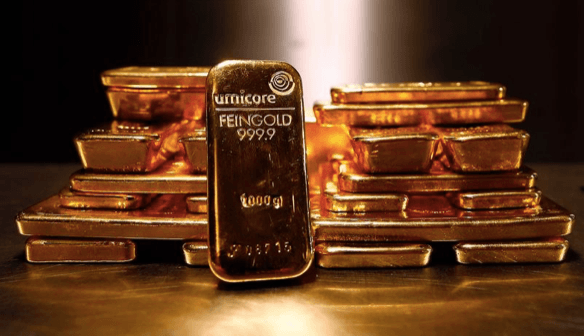

3. BitGold

BitGold is an online payment solution that looks to the past to solve the problems of the present time in order to avoid problems in the future. BitGold allows you to buy physical gold, which you can then leave in your account as a store of value because gold tends to keep its value longer than other asset classes. You can also transfer gold online to other BitGold users with minimal fees. It is a great alternatives to regular online money transfer services. You can use the gold to pay for online transactions through a Prepaid MasterCard that you’ll be issued. You can use the card anywhere that the major credit cards are accepted. You can also use the prepaid card to withdraw local currency via ATMs.

BitGold is still young and it might not offer the perfect peer-to-peer payment system because its user base is still growing. However, the fact that you get to keep your funds in gold bullion ensures that you enjoy all the benefit of the stability in gold prices without having to worry about safety deposit boxes for gold bars. If you’d rather keep the physical gold, you can request BitGold to send you the gold in your account as physical gold cubes or gold bars.

4. Bitcoin

If the idea of sending, transferring, or receiving money without a paper trail interests you, Bitcoin might be your best bet for sending money online. Bitcoin is completely decentralized, anonymous, fast and cheap. You’ll need some computer skills if you want to go the hardcore way of mining bitcoin, but you can easily fund your bitcoin wallet by purchasing bitcoin from one of the many merchants in town.

Bitcoin tries to keep its value insulated from the manipulation of fiscal and monetary authorities—the move should ensure a fair distribution of wealth that gives everybody a fair chance to earn money. However, Bitcoin is not immune from volatility caused by events in the news. If you choose to keep your money in bitcoin, you should be ready to deal with the wild swings in its market value.

Featured photo credit: Universal Studios Florida by Theme Park Tourist via Flcikr via flickr.com