The expansion of the internet caused the creation of numerous websites. Some are dedicated to entertainment, others are social networks which help people stay connected and there are those websites which are dedicated to business. Unfortunately, people tend to get lost in this sea of possibilities and lose focus on what is really important.

I am talking about earning money and finding the right way to earn a decent amount to have a less stressful life. In this sea of internet information, there are many websites which serve to give quality information and help people make the right choice when investing their money, with the end goal of becoming rich. If you want to become a financially independent person, you should definitely bookmark the following websites and spend more time gathering information from them.

1. RockStar Finance

This is the perfect website to start off with when gathering information about the world of money. The website was created by J. Money, with the goal of gathering all valuable articles that are helpful to people who want to ensure their financial future. The creator is an experienced blogger who created this website in order to share the best blog articles from a variety of other bloggers who offer interesting insights on money related topics.

The website team reviews more than 200 articles per day and chooses those which are most helpful to publish on the webpage. Beside the vast amount of articles, you can also see information about the net worth of the best finance bloggers. The net worth list is updated every month so you are always up to date with financial figures of successful finance bloggers.

The website also offers a list of a must-read money books. Given all this, this website is the perfect choice for those who want to gather as much advice as possible from the financial world. This web page should definitely be in your bookmark list.

2. I will teach you to be rich

This website was created by a best-selling author of a personal finance book, Ramit Sethi. It offers great insight into the way you should change some things in your life in order to become successful. The creator guarantees free tools on his webpage. All you have to do is subscribe with your email address.

This website offers solutions which will affect many areas of your life because it does not only offer financial tips, but psychological ones as well, because the author also has psychological knowledge, which according to the users of his website, does wonders. His basic tips start off with earning more money with the skills you already possess, finding a dream job and creating the perfect saving system which allows you to spend money on things you love.

Due to the fact that this author was featured in The New York Times, The Wall Street Journal, CNN, PBS and many other well-known networks, you should definitely subscribe to his website and get access to the advice this person has to offer.

3. Finance at Khan Academy

This website provides great video material for numerous areas of financial planning. It covers basic tips on various big life expenses such as getting a house or a car but it also offers tips when it comes to stocks and bonds or compound interest, etc. The tutorial videos are usually under 10 minutes.

This is enough time to cover everything you should know and it is very useful as it takes a very small amount of time, so there are no excuses, no matter how pressed for time you are. If you want to save time and you are a good visual learner, this website is the best choice as the knowledge you can find there will certainly make you more financially educated.

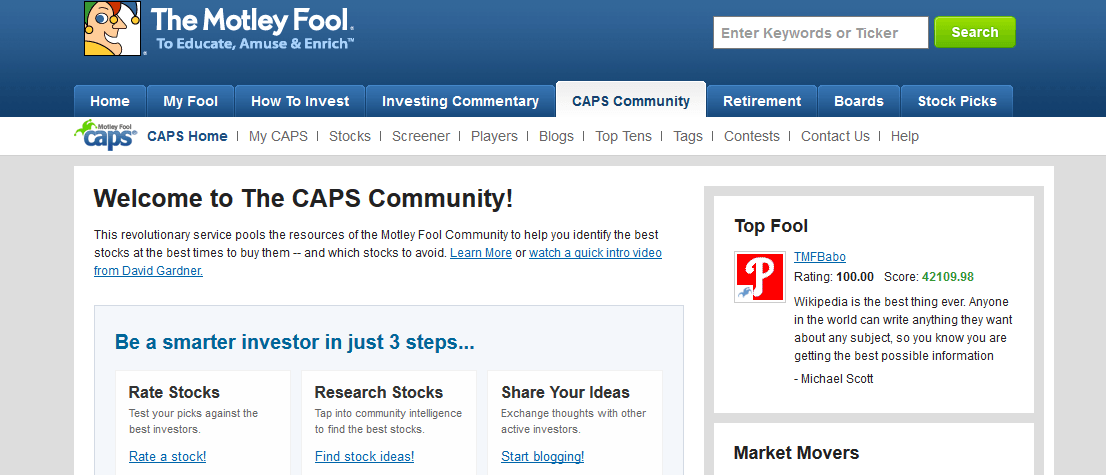

4. The Motley Fool

This website boasts an incredible community of successful investors. A strong community is very useful because you can exchange your thoughts with other people who may be more experienced and have already gone through a financial situation you are currently facing. The website also has free and paid solutions that help many users make the right financial sources.

The newsletter is a fee based service which is very helpful as it servers as your personal advisor. This feature servers to give you an advantage over your competition when it comes to the moment of making the perfect investment at the perfect moment. A very good free tool is called CAPS. This is a community of people who exchange their thoughts and provide good insight into the perfect choice for appropriate stocks.

Using this tool, you will be able to minimize the risk when making an investment. You can also follow some of the most successful investors and follow in their footsteps on becoming a great investor. This website also offers various types of materials ranging from materials for beginners to perfect materials for those who are more experienced. This website should definitely be on your bookmark list if you plan to become a true financial expert.

5. Investopedia

This is a great website for beginners, as it provides all sorts of tips and tutorials important for financial success. Tutorials which are at the user’s disposal vary from personal finance to professional investing tips. Novice investors are to find an abundance of investing guides which provide knowledge that will turn them into true professionals.

One of the reasons for using this website is that it has a stock simulator. This feature alone makes this site a must in your bookmark list. The stock simulator gives all beginner-level investors a place where they can practice investing in order to get ready for the real deal. By using the simulator, you can evaluate your progress and focus on some mistakes you are making.

Another feature that welcomes inexperienced people to the financial world is the included financial dictionary which is full of various financial terms. Everything on this website is focused on helping people who are new to the investment business but it also gives more than enough material for those who are experienced financial experts.

To sum up, these websites are perfect for people who want to get more financial education and improve their financial status. Whether you are starting an online business or simply looking into making the right investment, these website will greatly improve the financial concepts you currently have. The best way to learn about finance is by combining useful information from all of these websites. Do not focus on a single one as the amount of information is much greater when it is coming from several different sources.