Whether you are living alone, with a roommate or a significant other, managing household costs should be a priority if you want to be able to get out of debt and live a fairly comfortable life. It’s nice to know that you have some money on your account that can help you cover emergency costs, as well as a little extra saved up for a few important luxuries like travel, home renovations and so on. However, in order to achieve a certain level of financial stability you need to make sure that you are being efficient with your monthly budget, and there are plenty of simple ways to save money without making it seem like you are punishing yourself.

What we will be looking at in this article are money-saving tips that are practical and sustainable, i.e. things that will help you out in the long run and that can become second nature. I’ve managed to drastically improve my budget using these tips – by spending less on basic everyday things, I have actually allowed my family to spend more on some of the finer things in life, and so can you.

1. Stop buying disposable razors and expensive shaving gels

I’ve always admired my old man’s ability to keep his face clean shaven every single day for decades using an old straight razor that his father left him and shaving soap. I on the other hand, have been wasting money on disposable razors and fancy-looking shaving gels until I realized just how much they were costing me.

Yeah, they’re cheap, but you can go through a bunch of them each month. Since a straight razor takes time and skill to use and has to be maintained, a better solution for the busy modern man or woman would be a safety razor or an electrical shaver. Modern electric shavers give a good shave in a third of the time it takes to shave with safety or disposable razors, they work for women as well as men, and you only need to replace the head every few months. You can also whip up a very good shaving cream at home with a minimal investment. Switching to an electric shaver and making your own shaving cream will save you 20-30% depending on how often you shave.

2. Switch to a healthier diet and do some walking

Many people are under the wrong impression that eating healthy costs more than eating junk food. For one, a healthy diet means cutting back on the calories to shed some of the extra pounds, and less food means less money spent. Second, as long as you don’t go full on organic, you’ll find that fruit and vegetables can be quite cheap and filling. You can even buy frozen vegetables in bulk and keep them in the freezer for months.

Eggs are quite cheap as well, and you can get chicken, beef and veal relatively cheap when buying in bulk. As long as you go for a brisk walk, say 60-90 minutes each day, do a few workouts here and there, and eat healthy your health will improve and your medical bills will go down. A healthier lifestyle and smart grocery shopping can save you around 20% and save you a trip to the doctor.

3. Work on your gardening and cooking skills

If you want to take your healthy lifestyle savings to the next level you can grow your own fruit and veggies in the garden or even inside the house, and cook your own food instead of dinning out all the time. There are plenty of fruits and vegetables that don’t take up a lot of space, they give you free and fresh organic ingredients and some, like cherries and almonds, are extremely beautiful when they flower.

You have access to thousands of recipes online and free cooking videos, and you can prepare meals for the next few days and keep them in plastic containers, and bring them to work. Growing your own fruit and vegetables, and cooking more can save you an extra 10% on your grocery bills.

4. Be on the lookout for great bargains, even if you don’t need anything right now

Shopping for something only when you absolutely need it doesn’t leave you with a lot of options. For example, buying a big warm jacket during the winter means you’ll have to pay the full price, while you can buy one in the summer for half price. This is why you should always be on the lookout for great deals when you are running errands around town or going to get some coffee on your lunch break.

Sometimes an exceptional opportunity presents itself, and the money you spend now saves you a lot more down the road. Depending on the discount or special offer involved, hunting for good deals can save you anywhere between 15% and 50% on a variety of items.

5. Educate yourself about hygiene products, clothes and gadgets, so you can buy cost-effective items

To boost your savings even further you need to become a well-informed consumer. A higher price doesn’t necessarily mean better quality, and sometimes all you are paying for beyond a certain point is the privilege to become a walking billboard for a big company. With hygiene products like shampoos, tooth pastes and soaps in particular, there is no noticeable difference between reasonably priced and top of the line products, apart from packaging and marketing.

The more you know about phones, cameras, fashion and other areas, the better you will be able to judge whether a product is worth the price tag or not. By being an informed shopper, on top of looking for bargains, you can save another 5-15% while getting the same quality goods.

6. Try to ditch some of those bad habits

About 18% of American adults are smokers and over a third are obese, and the numbers aren’t quite clear on the number of people who drink regularly. Bad habits like smoking, emotional eating, excessive drinking, impulsive shopping and even excessive coffee consumption can take a big bite out of your budget. It takes a strong will and patience to make a positive lifestyle change, but it really pays off. Not only can ditching bad habits do wonders for your overall mental and physical health, which means spending less on medical bills, but it can help you cut your spending by another 10-30%.

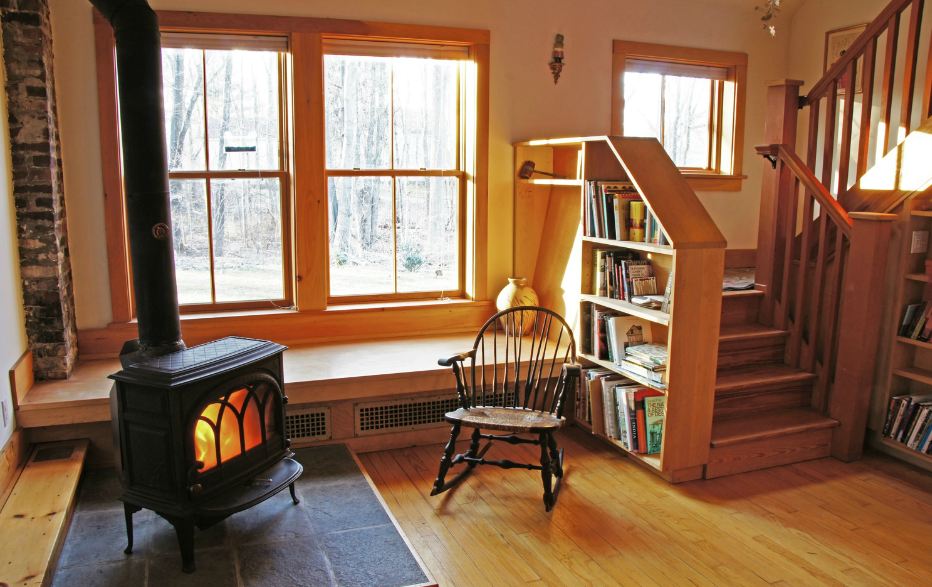

7. Consider switching to a wood-burning stove

The heating bill is usually one of the biggest hit to everyone’s budget. When winter comes you don’t have much of a choice than to keep the house warm by any means available. However, even though some DIY insulation solutions can help you keep the place warmer, a wood-burning stove is a very cheap heating solutions and will last for decadences. Getting quality firewood will keep the fire going for a long time and isn’t expensive, but will require some work to chop up and store properly. A stove will require an initial investment, but will quickly pay for itself, as it keeps you warm winter after winter, and will save you up to 20% on your heating bill.

8. Don’t walk around the house in a t-shirt and shorts during the winter

You can save on your heating during the coldest months even further if you dress for the season. Most people like to feel warm and cozy, but if you want to walk around the home wearing as little clothes as possible, like you do in the summer, then you will need to heat the home up to summertime temperatures, which is not very energy efficient. A simple solution is to wear warm socks and slippers, and layered clothing, so that you can keep the temperature a bit lower and still stay warm enough. This can cut another 3-5% from your bills.

9. Learn to limit your water usage during everyday tasks like showers and dish washing

I like to imagine that I am in a dessert environment and that water is very precious and the supply limited – an idea I got from a summer vacation where we had to make do a set amount of water each week. You’d be surprised at how much you’ll save on your water bill if you start turning it off while you brush your teeth or soap up during a shower, use a low flow to quickly rinse the dishes and turning it off until you’ve applied detergent and scrubbed them off and so on. You can also get more efficient shower heads and faucets. This can save you a nice 5-8% on your bills, depending how many people you have in your household.

10. Hit the library

Buying books can be expensive, while joining a library costs very little. However, not a lot of people spend plenty of money on books, but they do sometimes need a quiet place to work or do some research, and while coffee shops are a good option, they tend to be pricey. Public libraries offer a calm workspace which doesn’t cost you anything, and as an added bonus, those few hours you spend at the library are a few hours during which you are not actively using electricity at home, so you save a tiny bit on your energy bill as well. Depending on how much time you spend at the library, you can save some 5-10% on coffee shop bills.

All in all, following these simple and effective cost-cutting measures will allow you to shave a fifth or fourth off your monthly spending. This money can go towards paying off your debt, straight into an emergency fund or into a savings account.

Featured photo credit: Kitchen via shutterstock.com