The internet is a beautifully simple marketplace for people to make money, and get paid for their services. We’ve compiled the five best places for you to make money online, whether you want to start your own business – or just make a little extra on the side.

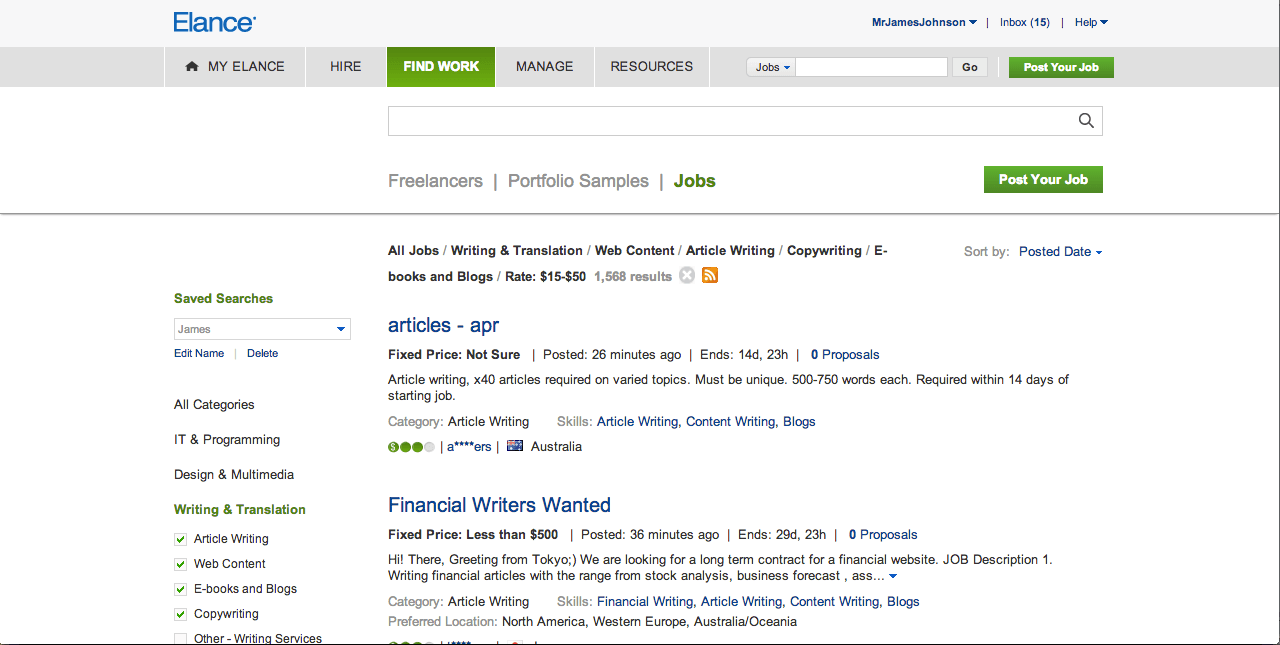

Site 1: Elance

Elance is the Internet’s biggest marketplace for legitimate freelance work. And, it’s my personal favourite of all the websites in this list.

It provides a simple interface that allows you to search for jobs in any kind of niche. From Writing and Translation, to Web Design and Programming.

Basically, people post jobs they want doing on the website, and you submit a proposal for it. It’s that simple.

Regardless of how much money you want to make, the possibilities are endless: there are freelancers on subscribed making $1,000 to $100,000 a year.

Pros: Free service. Simple to use. Easy to manage Tax Documents. Verified, trustworthy jobs.

Cons: Can be slow to become established. Bad Freelancers willing to work for $1-$2 an hour.

Site 2: Fiverr

Fiverr is a long established freelance site where everything costs a $5 minimum. It’s a simple and easy to use website, where you post the services you can provide: and if someone needs them, they’ll pay you to work.

It takes the traditional Freelance way of working and turns it on it’s head. It also ensures you get paid before you complete any work so that you never find yourself ripped off.

There is also scope to earn more than your $5 per job, with different levels for different services, such as: early delivery dates, extra work or ‘bolt-on’s for your services.

Pros: Protected payment before work. No marketing required. Work is on your terms. Quick and Easy to set up.

Cons: Lots of competition for work. Hard to establish a business. Have to do your own accountancy books. Not much scope to build a solid income.

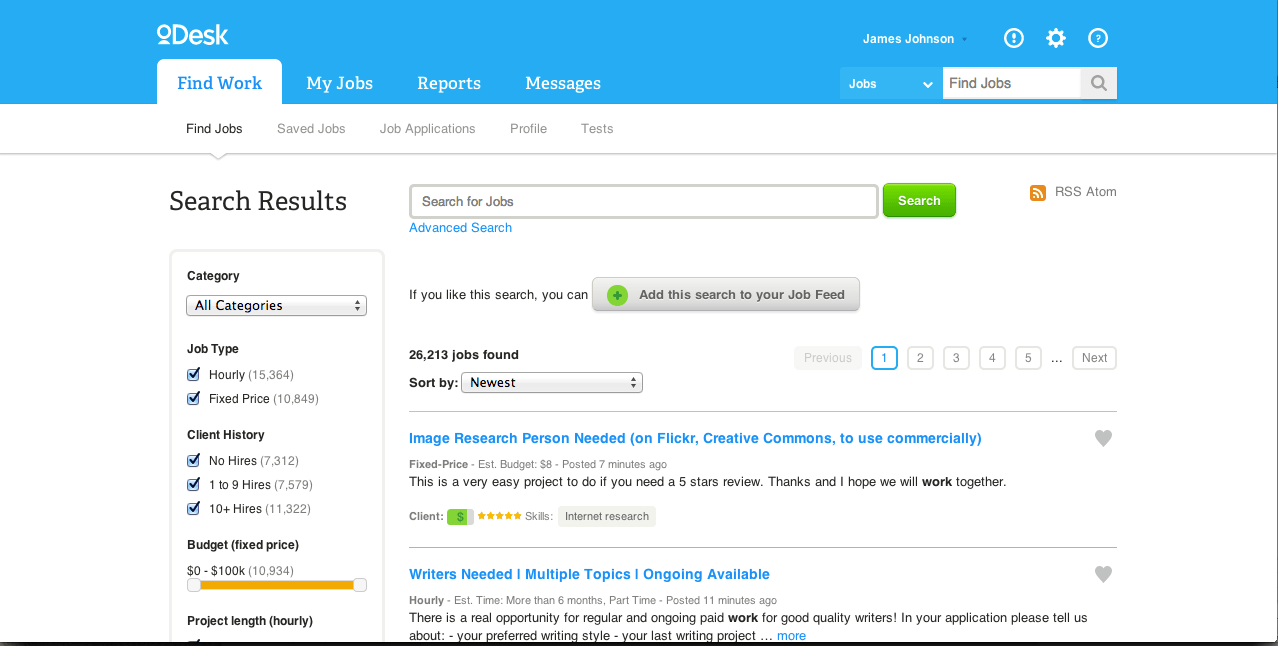

Site 3: oDesk

oDesk is somewhat of a sister company to eLance, that helps freelancers find work in a wide range of areas. Out of the two sites, it’s down to your personal preference: but the oDesk’s design and Payment tracker app set it apart from the competition.

This is a great website to get started on as a beginner as the average prices for jobs is lower, and it’s much easier to establish yourself as an up and coming freelancer.

Pros: Good design. Simple set up. Great for beginners. Easy to use interface.

Cons: Prices can be too low if you’re looking to build a big business.

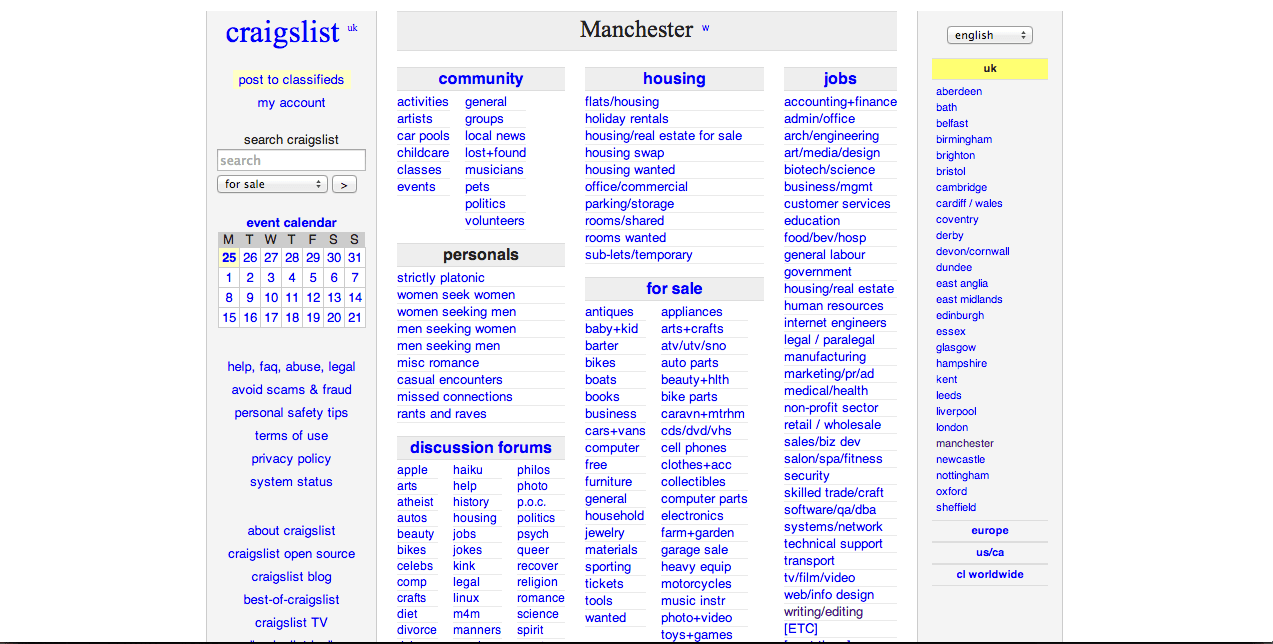

Site 4: Craigslist

Craigslist isn’t a site you’d think synonymous with Freelance Work – but it’s actually a hub of jobs and work to apply for.

It’s a simple and easy to way to start to build a portfolio and make some money in the process. The normal client can vary between local businesses, college students and someone looking to get work done as quickly as possible.

Air on the side of caution though, as sometimes you can find yourself chasing money for work you’ve done.

Pros: Easy to get started. Low pressure environment. Constant stream of new jobs. Easy money.

Cons: Not always reputable clients.

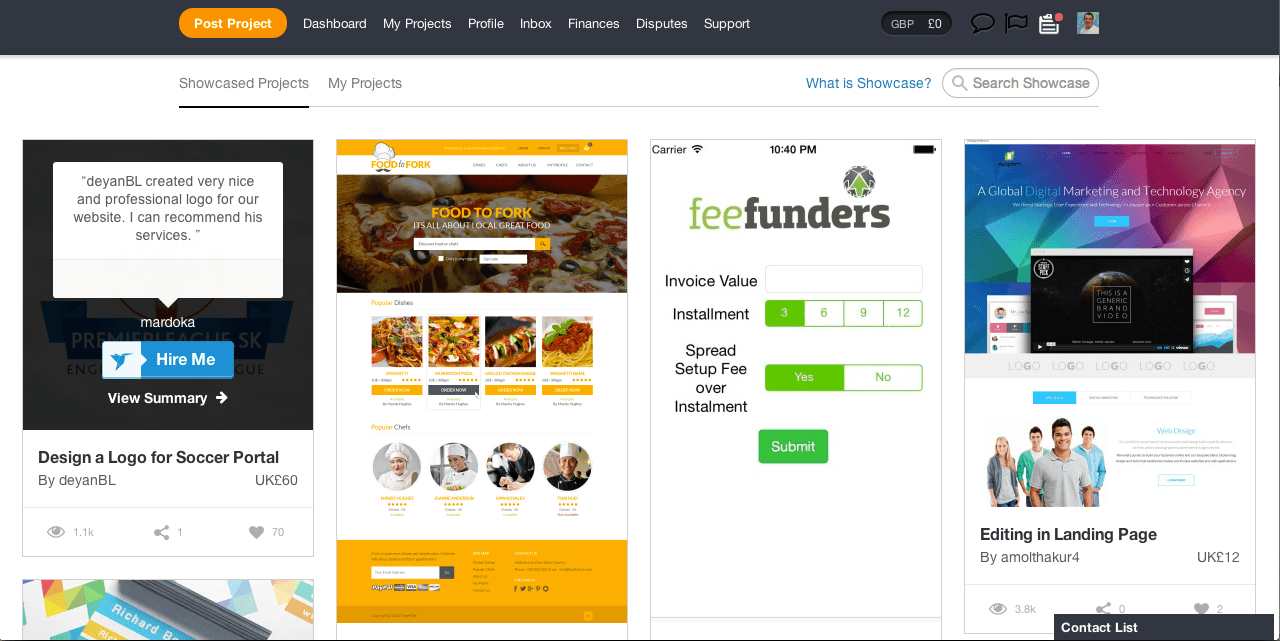

Site 5: Freelancer

Freelancer is a ‘gameified’ version of the sites eLance and oDesk mentioned earlier. You have the ability to ‘level up’ by earning experience points from the projects you complete and the milestones you hit. There are no shortage of jobs on these sites and everything is channelled depending on your skills and abilities.

Freelancer doesn’t have a free option that is as flexible as it’s competitors, and you find yourself paying to take tests and complete certain tasks.

This plays into the hands of people posting projects, as it shows you’re committed and established, but it doesn’t really help you if you’re just getting started.

Pros: Fun and easy to use interface. Interactive spin on normal freelancing. More reliable jobs than any other source.

Cons: Paying for tests and membership makes it hard to access for low-budget new starters.

Featured photo credit: Sanjay Kalyan via flickr.com