Those of us who’ve survived the four (or more) years it can take to gain our college degrees know that those can represent some of the most trying times of our lives – in no small part due to the lack of money college student hopefuls can experience.

Forget stripping and finding a “Sugar Daddy” to try and survive your college days. Here are 20 unique ways to increase the money in your pocket as a college student:

1. Sell your essays online via Kindle Direct Publishing

There’s a reason you’re researching and writing all those original essays. After you ace your assignment, upload those suckers via a Microsoft Word document (or other file types) directly to Amazon’s KDP website and sell them to others.

2. Donate blood or other body fluids and such for money or gift cards

Although certain FDA rules disallow paying cash for blood, there are ways that capitalists have found to reward blood donators with gift cards or other incentives. Selling sperm, plasma, bone marrow, breast milk, placenta, and even your hair are also options, but don’t think donating eggs is an easy payday.

3. Save by paying cash for medical procedures

Yeah, there a certain visits to the doctor that you might not want to share with your parents. As such, sites like Yempl.com can give you the exact prices that physicians charge for various procedures – like health screenings, etc. – and the discounts they offer people who pay cash.

4. Cut the cable bill costs

Of course you want to keep up with some mind-numbing TV to counteract all that learning, but you don’t want to pay outrageous cable TV costs to do so. Soak up your favorite episodes via Hulu or sites like Choose.tv that allow you to watch international channels online.

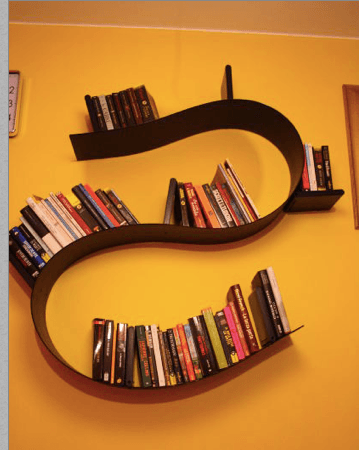

5. Rent textbooks from Amazon

Textbooks can be pretty pricey, but if you rent them through Amazon’s textbook rental service, you can use them only for a semester then ship them back when you’re done.

6. Trade those gift cards for cash using special CoinStar machines

Let’s say you receive a $200 Victoria’s Secret gift card for Christmas, but truth be told, you’d rather have cash for food instead. Use a CoinStar Exchange machine to trade it in for cash, but be warned, you may end up with only $120 or so in greenbacks as a result.

7. Recommend wacky and outrageous products

Use programs like Amazon Associates to promote wildly expensive products on your blog, and take a cut of the fee when they sell.

8. Hawk a video course

Sell your skills via video courses on websites like Udemy.

9. Go crazily creative on YouTube and get ad revenue

If your friends are always laughing at your antics, consider filming them and uploading them to YouTube. Select the option to monetize your videos, and if they go viral, you might make a dent in those student loans!

10. Become a virtual tutor

The best part about being alive in the Information Age is that there are folks willing to pay you to jump on Skype and tutor their kids in all sorts of subjects. Find them on sites like Elance, oDesk, or even Craigslist if you must, but be careful about giving out too much private information.

11. Gain an income for your voice

If you have the kind of voice that belongs on a TV commercial, try your hand at gaining voiceover work in between classes. Set up a gig on Fiverr and see where it goes.

12. Offer local businesses a web presence

Chances are you might know more about social media and websites than the local bakery owner in your college town. If you’re technically inclined, offer to set up their Google Maps listing, social media accounts and even a website – for a fee, of course.

13. Take pics with your phone and make money via apps

Use apps like Gigwalk to score gigs that pay users to take photos of specific things, like end-cap settings in stores.

14. Perform article arbitrage

If you’re savvy and smart enough with details, being a liaison between freelancers and their clients can pay you. For example, you might find one client on Elance willing to pay $175 to have a 500-word article written, and a writer willing to get paid $100 to write the article. By acting as a detail-oriented middleman, you could pocket $75 bucks for the transaction.

15. Make your own app

You don’t even need to know how to code apps in order to have an app created. Use a free app-maker online to get a basic app made. Or, pay small amounts to have a basic app made and submitted to the iTunes App Store and add advertisements to the app. Perhaps you can become the next “Make it Rain” millionaire.

16. Sell your Photoshop skills

If you’re good with that lasso tool on Photoshop, you can probably find a groundswell of clients online and in your real life willing to pay you to pretty up their pics or to create amazing renderings for their graphic design needs.

17. Make niche websites

Take advantage of being a college student in the know – privy to your own 16- to 24-year-old huge focus group. Parlay what’s hot and happening right now, like the corset waist-training craze, for instance, into a site surrounding the topic. Throw up some Google AdSense ads and Amazon product recommendations, and pray the dough will roll in to your coffers.

18. Sing on the street

If you’ve got a velvety smooth falsetto or alto singing voice that gets rave reviews, why not share it with the world – or at least the folks outside your window? Hey, it worked to make R. Kelly famous, when he sang for spare change on the L train’s platforms in his Chicago hometown.

19. Edit videos for others

Instead of plopping your face or voice all over YouTube, consider firing up iMovie or your favorite video editor to help spiffy up the videos of others – for a small or large fee, of course.

20. Sell your social media likes and comments

Yes, in our social-media driven world, people are willing to buy followers, likes and comments. If you’ve attracted quite a following, look for sites that are willing to trade that popularity for money.

Featured photo credit: 20120421-NewYorkCity-ColumbiaUniversityCampus (4MF).JPG By jzlomek via mrg.bz