Clipping coupons is such a chore, but it doesn’t have to be anymore. Much like everything else in life there is an app for that. Now you can view, save, and use coupons all from your mobile device. Leave the hassle out of using coupons and utilize the following apps (and maybe a few extra hacks) to save yourself some cash:

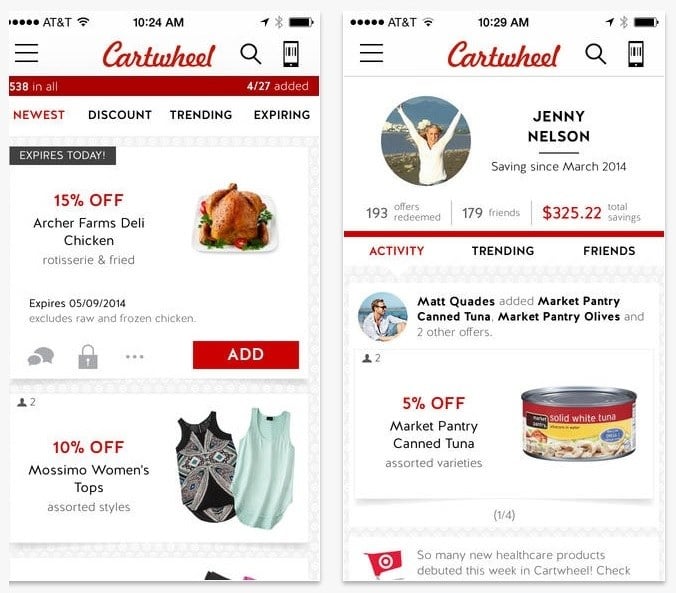

Cartwheel by Target (Free)

Target’s newest app is great for frequent shoppers. You can view all of the latest deals and sales in the app, save up to ten coupons onto your account, and use all of your coupons at once at the register with a simple scan of a bar code provided in the app.

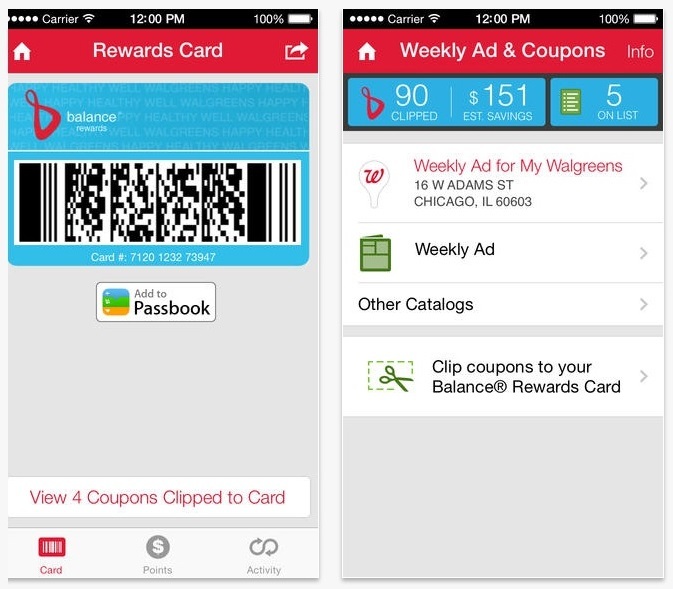

Walgreens App (Free)

The Walgreens app offers in-app coupons, a bar code you can scan at the register, as well as many more features. It’s easier now than ever to keep up with the weekly deals. This app requires the user to have a Walgreens card to function. This app even allows the user to refill their prescriptions, so you can save time and money all at once.

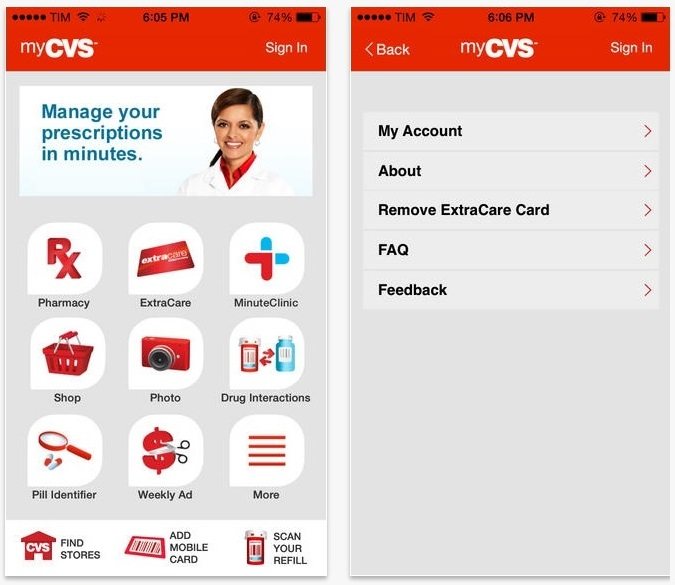

CVS App (Free)

Much like the Walgreens app, the CVS app allows users to view and use coupons. The CVS app differs from Walgreens, however, because it allows you to actually order products directly from your phone much like an online store. This app requires the users to have a CVS card to use, but if you’re a frequent customer of CVS this is definitely a great investment.

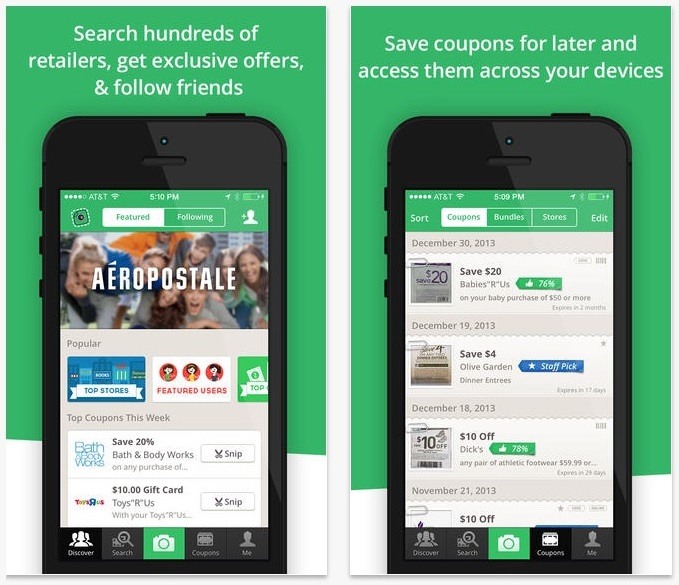

SnipSnap (Free)

Do you struggle with keeping up with all of your paper coupons? If so, SnipSnap is the app for you. With this app you can take pictures of your coupons, which scans it into the program for you to organize and use. There is also an option to search and find useful coupons directly on the app. SnipSnap is the way to go if you’re looking for a better way to organize and use your coupons before they expire.

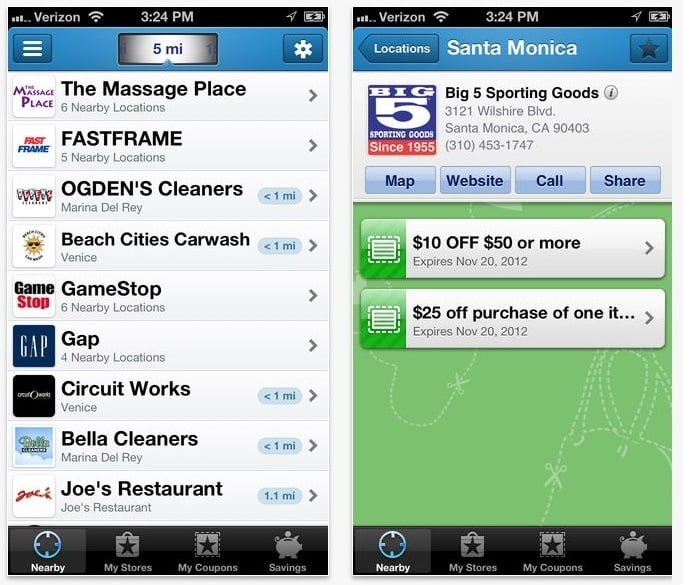

Yowza (Free)

Why limit the savings to just grocery stores? With Yowza you can save on a wide variety of items, including food, clothes, entertainment, car repair, and more. Yowza is location based, as well, so the app can send you notifications when a nearby store releases a new deal.

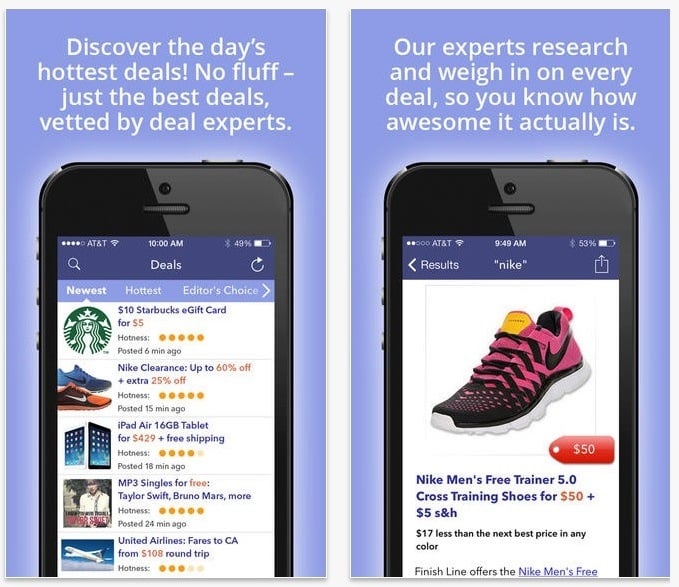

Dealnews (Free)

Do you work better with lists? Dealnews brings you the top 300 best deals in your area which is great if you’re unsure of what kind of savings you’re looking for. You can save on a wide range of products without being overwhelmed with too many deals. Dealnews updates every day so you’ll have a fresh list of the top 300 deals daily.

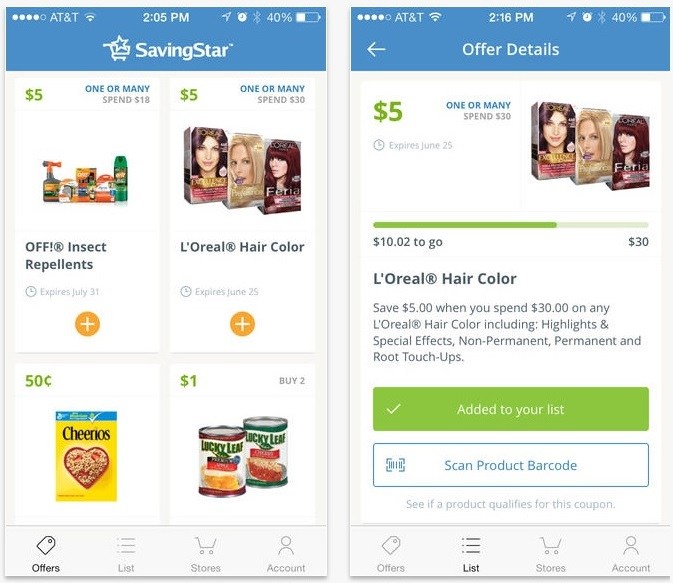

SavingStar (Free)

SavingStar is great if you are the type of person to use a lot of in-store savings cards. With this app you can send your coupons directly to your savings cards. SavingStar is a coupon app specifically for groceries that allows you to clip and use coupons straight from the app.

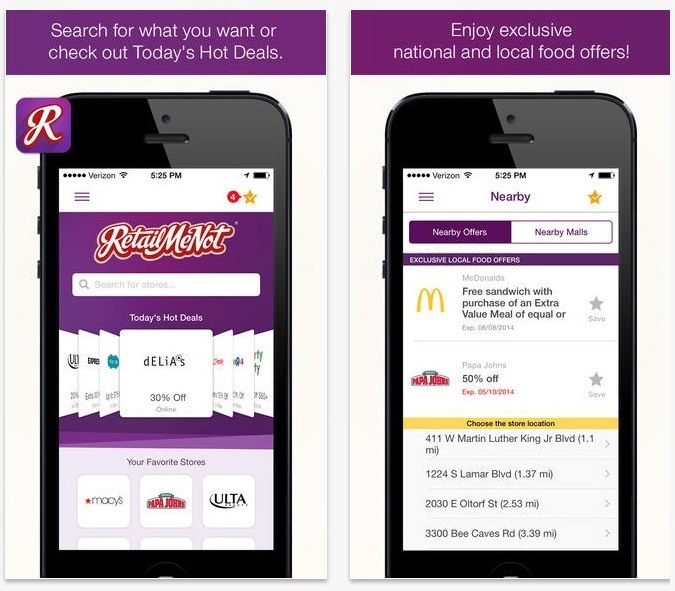

RetailMeNot (Free)

Do you like to shop from specific restaurants and stores? Retail Me Not has got your back! You can browse deals from all of your favorite individual shops and bookmark any deals you would like to use in the future. This app is great for people who shop in a wide variety of stores and knows which ones they like best.

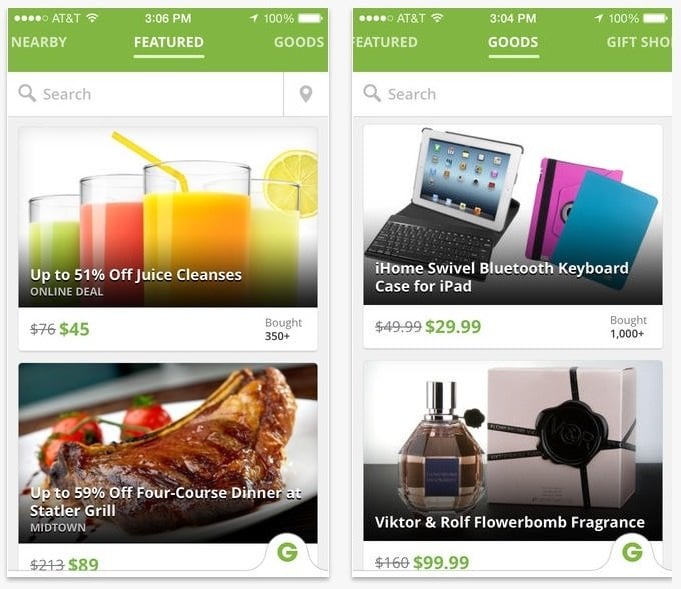

Groupon (Free)

And, of course, there is always Groupon! This app is focused on what deals are in your local area including items and services up between 20 and 70 percent off. You can instantly use any of the coupons in the app and participate in Groupon Giveaways.With Groupon you’ll never have to print another coupon again.

Featured photo credit: Matt McGee via flickr.com