Collectors are an interesting breed, willing to pay top dollar to own something that few would find value in. Because of some very rich individuals seeking rare objects, you can become fairly rich yourself if you have any collectable pieces in your home you’d be willing to put up for sale. Check out this list of 8 things that might appear to be junk – that can make you rich.

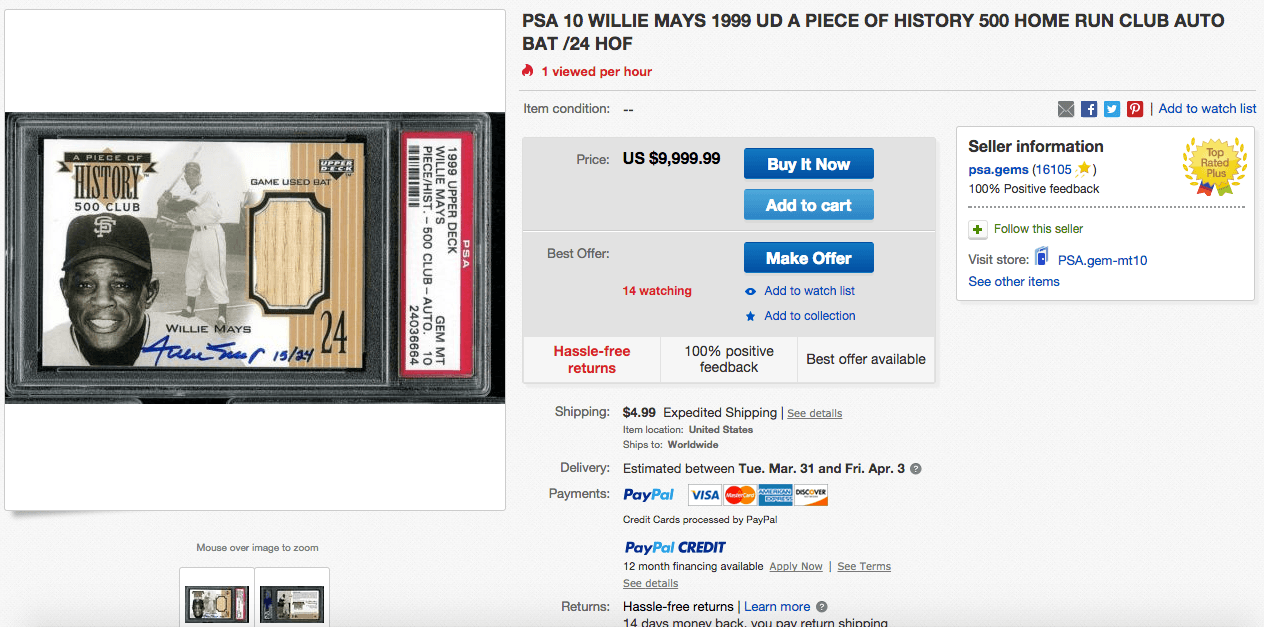

1. Trading cards

Whether they be celebrating sports, games or children’s cartoons, trading cards can reap you some serious dollars. Check out the Willey Mays baseball card above that’s offered for almost $10,000 on eBay. It’s crazy how nutty some collectors will go for a piece of cardboard and you can benefit from that!

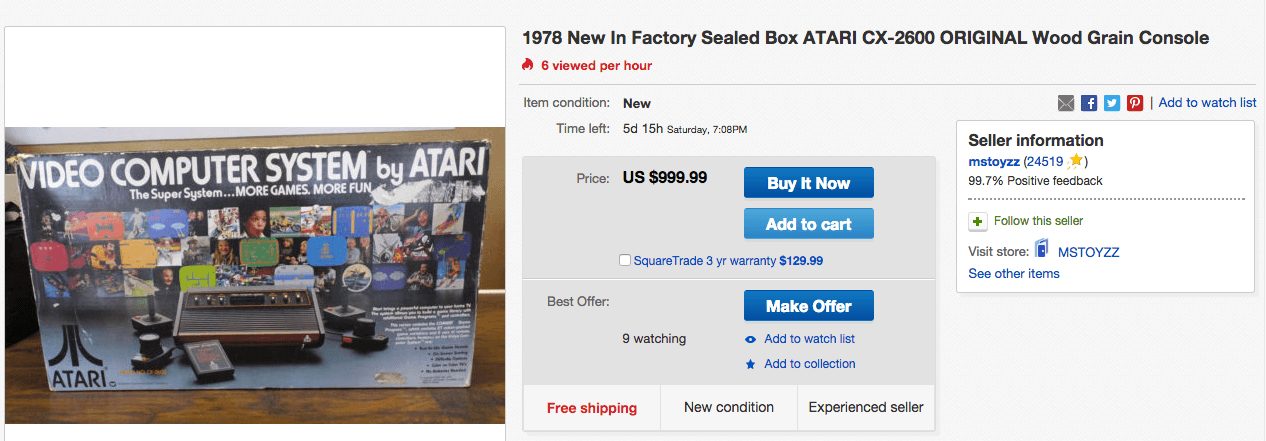

2. Vintage tech

What means “outdated” to you may mean “vintage” to a collector. If you have any particularly old technology, do a quick eBay search before tossing it out. Maybe you’ll become rich quick with almost no effort required.

3. Video games

If you didn’t cash out and sell your video games to a retailer for store credit after you finished them, you might find that some of the older ones have turned into major cash cows. There’s a huge after-market for Nintendo games in particular, since they stop production on their titles fairly quickly after release. Who knows, maybe you’ll end up finding one of the most valuable video games in the world among your collection and sell it for tens of thousands of dollars! Even if you don’t, you could still make a pretty penny off of some of the unplayed video games stored in your basement.

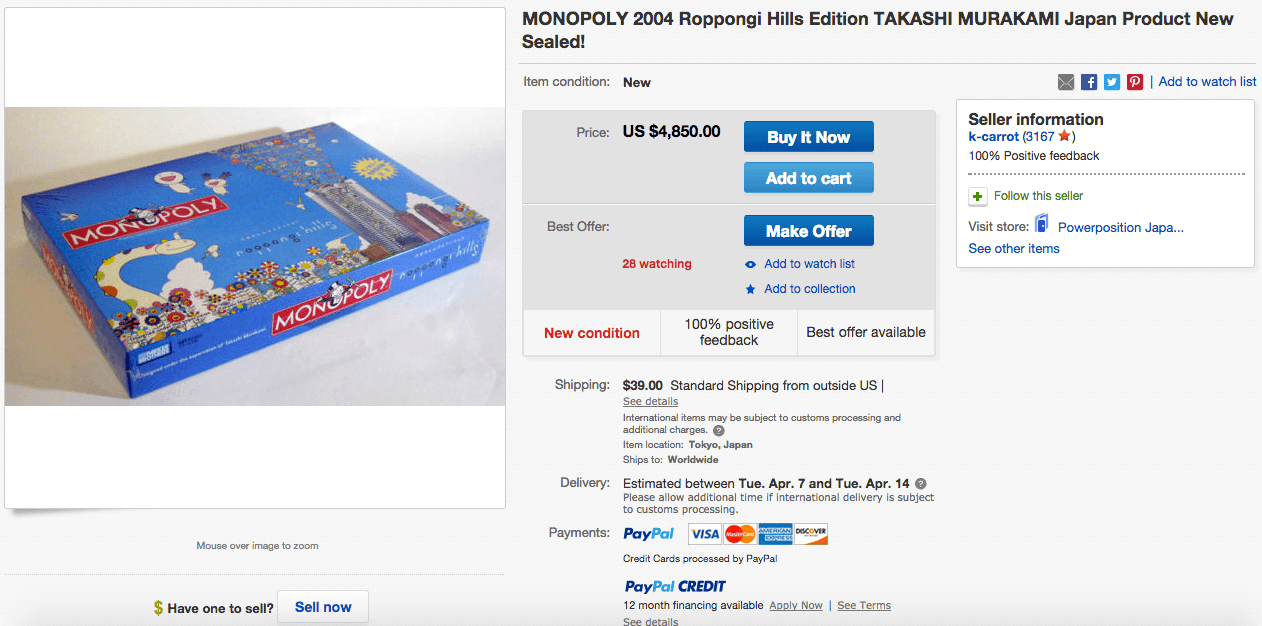

4. Traditional games

Considering the endless variations of Monopoly, there are bound to be collectors who would be willing to make you rich in exchange for unique editions they missed out on – that you might have in your possession. Check out the eBay listing above asking for almost five grand for an example of just how much people will spend on a basic board game.

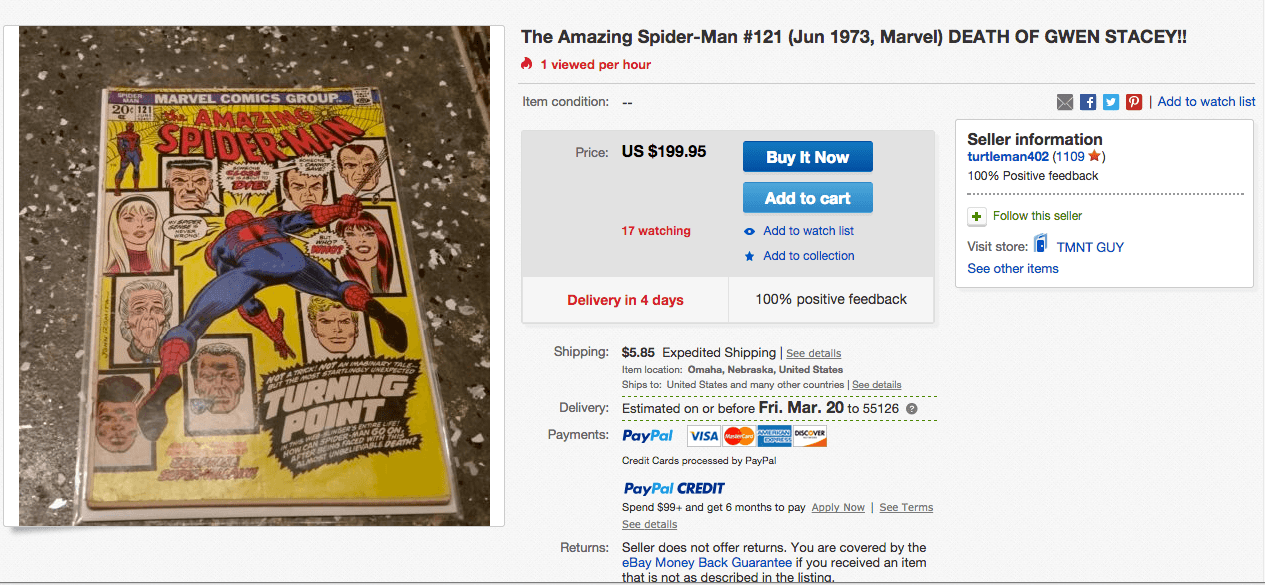

5. Old comics

Comic books were seen as disposable for a long time, which is why there are so few first-print editions left of original titles about iconic characters like Batman, Superman and Spider-Man. If you have comics, especially ones from the 70s and earlier, you could be in for a big pay day.

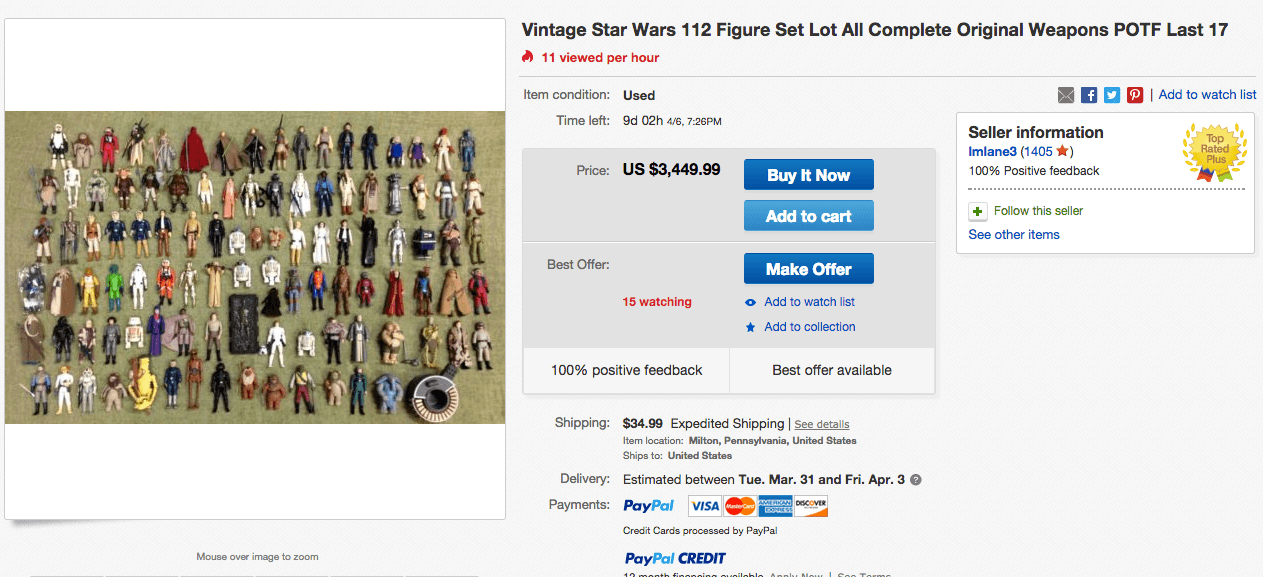

6. Old toys

Yet another type of product from the lucrative after-market of children’s entertainment that can make you rich! People desperately want some kind of tangible representation of their childhood, or an item that demonstrates just how much they love a certain TV show or movie or book series. Those action figures in the old toy box could make you very rich with a little luck.

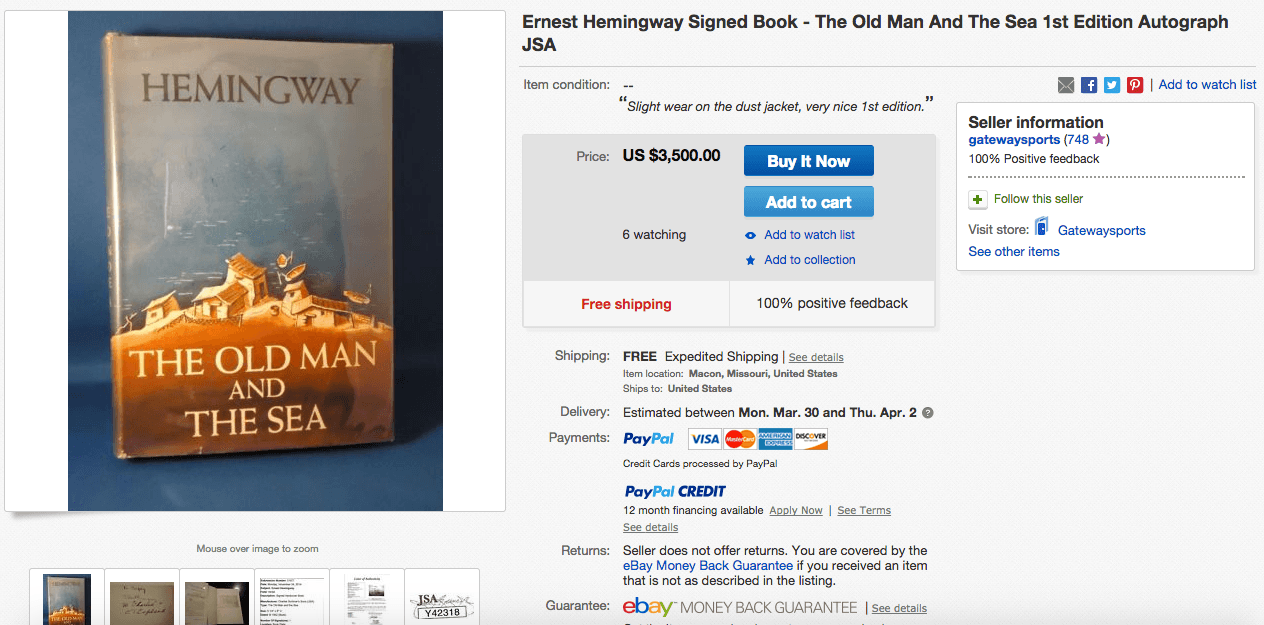

7. Signed copies of things

Signatures from famous people, especially those who are dead or otherwise indisposed, hold a lot of value. If you’ve held on to the inherited objects family has passed on to you (even though you may not recognize any value it) you may get lucky and become rich. It’s possible for example, that an old book in your possession was signed by a famous author. A hunt around your bookshelf will answer that question for you.

8. Collectibles

People, for whatever reason, collect a lot of different trinkets that are worth nothing to us but worth some serious cash to the right collector. Look in your home for anything that you know people like to seek out. They could be coins, buttons, patches, stamps or any number of other things that appeal to those who like to build complete collections. Just about anything at all collectible could potentially make you rich. Just rummage around your house or your apartment and you might just stumble upon something innocuous that will end up changing your life.

Featured photo credit: Rare video game peripherals/Generic Brand Productions via flickr.com