It’s a popular complaint among young adults these days that their schools never taught them personal finances. How to balance a check book, how to do taxes, and the value of money. Since its less and less likely for schools to change their curriculum, that means it is up to parents to teach their kids how money works. Here are a collection of books to help teach your kids about money.

1. Lemonade in Winter: A Book About Two Kids Counting Money by Emily Jenkins

One of the earliest experiences a child has in becoming an entrepreneur is opening a lemonade stand. In this book, two kids open a lemonade stand in the middle of winter. It teaches some basic math and entrepreneurship and it also teaches kids that something may not be a good idea even if it sounds like one. If there is anything kids should learn early, it’s how to deal with disappointment so they can bounce back and try again.

2. Bunny Money (Max and Ruby) by Rosemary Wells

Learning how to budget money is an important skill to learn. In Bunny Money, Max and Ruby have saved up $100 to buy gifts for their grandparents. Unfortunately, some things happen and they have to spend some of it. It’s a great book to teach kids how to budget and save money. There are also some math skills involved and it teaches kids that emergencies can drain your wallet unexpectedly. It’s some life lessons definitely worth learning.

3. Joseph Had a Little Overcoat by Simms Taback

What happens when a kid breaks something? They immediately ask for another one! In Simms Taback’s Joseph Had a Little Overcoat, a child can see a story that shows the value of re-using things. In the story, Joseph’s overcoat is really nice but it starts to get worn. Joseph continuously re-uses the material from the coat to make other items until it becomes a cloth button. The book is great for teaching kids how to be frugal and the importance of re-using things. Until they grow up and get a good job, they may end up having to find creative uses for things they thought were ruined.

4. Annie’s Adventures (The Sisters 8) by Lauren Baratz-Logsted

The jungle of nonsense that is adult finances is tough enough to get a hold of even if you know what you’re doing. In Annie’s Adventures (The Sisters 8), Annie is put in charge of her parents finances. She has to figure out how to write checks, pay the bills, and balance a budget. It’s a delightfully lighthearted adventure that puts a fun spin on the basics of adult finance management. There are even elements of entrepreneurship and frugality. It’s a really great choice and it’s especially great for girls.

5. The Lemonade War by Jacqueline Davies

The Lemonade War is a humorous and fun adventure about two siblings who open two lemonade stands. They use some simple ideas to take their lemonade war to ridiculous heights and it’s a truly fun read for kids. The book teaches entrepreneurship, money management skills, how to implement ideas to challenge the competition, and other business-oriented lessons that are essential for tomorrow’s business leaders.

6. Junior’s Adventures: The Boxed Set by Dave Ramsey

Okay so this is actually a series of books rather than a single one but all of the books revolve around a central premise. In these books, Junior learns the value of working, saving money, spending money, and the pleasure of giving to others. They teach selflessness and how intelligent money decisions can allow you to have nicer things. Kids definitely need to learn the value of the dollar and this is a good series of books to do it!

7. One Hen: How One Small Loan Made a Big Difference by Katie Smith Milway

One thing that no one really learns before graduation high school is how to manage a loan. Or what you need a loan for. In this story, a boy from Ghana named Kojo takes out a loan and uses it to start a farm to feed and provide for his family. It’s based on true events and it’s a heart warming story of a boy who learns the value of money, how loans work, and how to start a business with very little.

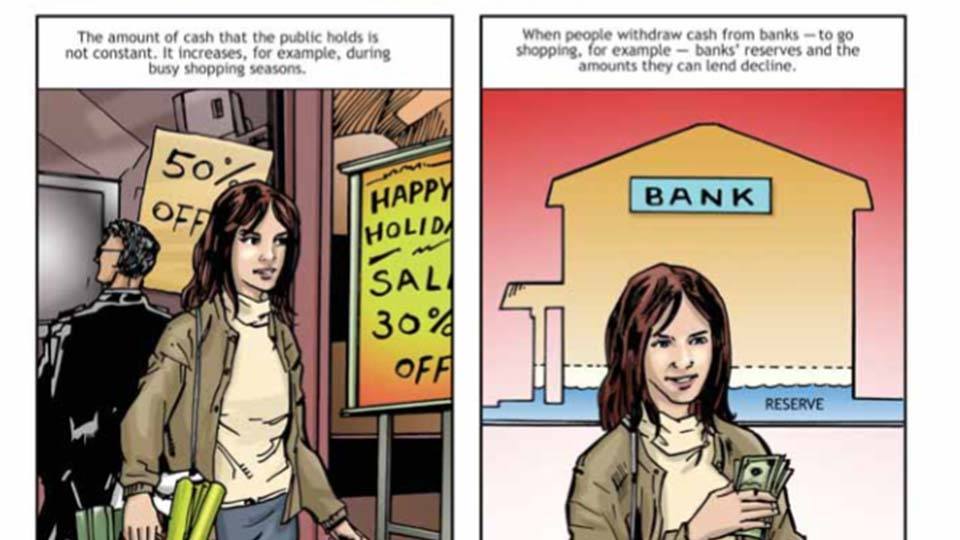

8. The Federal Reserve comics by The Federal Reserve

Yes friends, this is a real thing. The Federal Reserve has a host of comics that illustrate lessons about money. It is a comic and the situations are a little more mature than these other ones so we recommend either reading these to your kids or waiting until they’re old enough to understand them. The link above goes to the search page where you can download the PDFs of each comic for free.

Wrap up

There are a whole bunch of children’s books out there that teach a great number of things. A lot of them will come through personal experience or through school. However, money management is something that rests almost solely on parents. It’s tough to do but with books like these you can teach your child the value of a dollar and the value of work.

Featured photo credit: Indiana Public Media via indianapublicmedia.org