The summer travel season is almost underway, with many individuals finalizing ideas for destinations they want to go to. By this time, many individuals are beginning to look into flights now that dates are becoming solidified and graduations are finalized. However, the trouble with booking flights isn’t finding the best times or destinations, but it lies in finding a flight for the best price. Flight costs fluctuate and the amazing deal you thought you scored on Monday could be nothing compared to Tuesday’s deal. Today, we will discuss six tips to finding amazing flight deals.

1. Timing is everything.

Timing is one of the biggest aspects of finding the cheapest airfare to what ever location you are intending on traveling to. There isn’t a special equation or formula to find out the best date; however, there is a combination of aspects that can lead to the best price. Preferably, you should look to book flights between 20 days and a month before your intended departure. If you are going abroad, three months is the optimal time to look for the best flight deals. When booking, Tuesdays are the key days to look into actually booking your flight and Wednesdays are key departure days. On Tuesdays, airlines refresh their prices and reductions are usually added.

2. Think outside of the engine.

Search engines are a great way to get a great idea of where your budget should be when purchasing plane tickets. However, they should not be your only option when looking for flight options. Many times, airline search engines connect with certain airlines to ensure that their flights are highlighted more than others. Additionally, in many cases, airlines like Southwest, an airline that is known to offer well discounted flights, aren’t included in the search engine. When you do check out search engines, look into websites like Skyscanner, Hipmunk, and Student Universe.

3. Be flexible.

Flexibility is the key to getting the most optimal deals with air flights. As mentioned before, air flight prices fluctuate, and being able to have a variety of date choices will open you up to a cheaper ticket a day or two before what you were intending. In addition to flexibility with dates and times, you’ll open the possibilities to even greater deals through flexibility in the departure and arrival airports you’ll be flying through. If no adverse situations arise, flying in one airport and going home through enough works because it allows you to make a deal package, taking a bit of one airport or airline’s price and that of another.

4. Is the deal worth It?

You might find that an airline is offering flights at ridiculously low rates. However, as the saying goes, if something is too good to be true, then chances are it possibly is. Most of the time, airlines that have super low ticket prices, make up for the low cost through high baggage fees and baggage policies with tons of loopholes. In the end, this traps the consumer into more money being spent that wasn’t outlined directly. It’s highly recommended to read the fine print when booking with airlines that are quite inexpensive. If you have a question about a certain fee or baggage specifications, ask but continue to be cautious. Inexpensive airlines with truthful rates and policies may still be unreliable with accurate takeoff times, putting you at risk or arriving to your destination late.

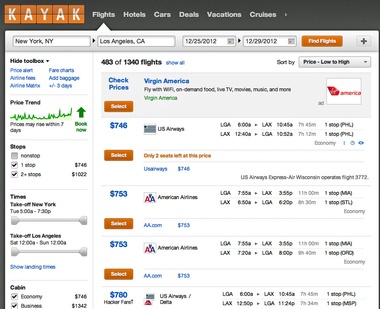

5. Discover pricing trends.

Despite the fact that airline plane prices can be unpredictable, you can make use of pricing calendars and other services that offer pricing trends as a way of getting a better idea of how pricing increases and decreases with certain airlines. Some services, including Bing and Kayak offer a feature that signals to you if it’s fine to wait to purchase the airline ticket or if you should purchase now before another significant increase to the flight cost. Use a mixture of services, discover a trend, and come up with your best prediction of whether or not to buy and when. Making use of email notifications for airline prices, using services like Farecompare, can allow you to get great airline steals as well.

6. Become a frequent flyer.

Lastly, a great way to get the cheapest flight tickets is to look into joining the frequent flyer program through some airlines. In addition, looking into credit card rewards that offer an array of options to transfer points to airfare costs, you might also find that some credit cards offer great deals when you book in their exclusive airplane booking portal for credit card owners. Cards like the Chase Sapphire Preferred as well as special credit cards through each specific airline, like Southwest or Delta, are where you’ll find the biggest bang for your buck.Let us know in the comments below what inside scoop you have to finding the cheapest airline tickets.

Featured photo credit: BHM Pics via bhmpics.com