Raising children is arguably one of the most rewarding endeavors that a person can undertake, but it certainly isn’t without its challenges, among which are rising expenses. According to a recently published USDA report, the average cost for a middle income American family to provide for a single child to adulthood is $245,340. That’s right, nearly a quarter of a million dollars, and that doesn’t even include the expense of putting your kid through college!

While the choice to bring a new life into this world goes well beyond purely financial considerations, it can be interesting to put the cost of child rearing into perspective. Here are 25 things that you could do with the money you would save by making the decision to remain child-free.

1. A Quick Trip to Outer Space

For $250k, you can book passage aboard Virgin Galactic’s SpaceShip 2 to sub-orbital space. The flight only lasts 2.5 hours and, of that time, only a grand total of 6 minutes are spent in a weightless environment but hey, once you get back to Earth, you can force all your friends to constantly refer to you as an astronaut and it’s hard to put a pricetag on something like that.

2. An Above Average Home

The median price for a house in the United States is currently hovering around $189,000, so with the money saved by not having a child, you could find your dream home in many parts of the country.

3. Take a 5 Year Sabbatical

Considering that the median household income in the US is around $50,000 a year, you could opt to take a 5 year break from work and finally put pen to paper on that novel you always told people that you wanted to write.

4. A Really Cool Car

Are you into cars? Why not pick up a 2015 Mercedes SLS roadster, which, with its handcrafted 6.3L V-8 engine, is capable of accelerating from 0 to 60 MPH in just 3.6 seconds.

5. Rent a Private Island

Need to get away from it all? $230,000 will buy you a week on your own fully staffed, private island off the coast of Spain.

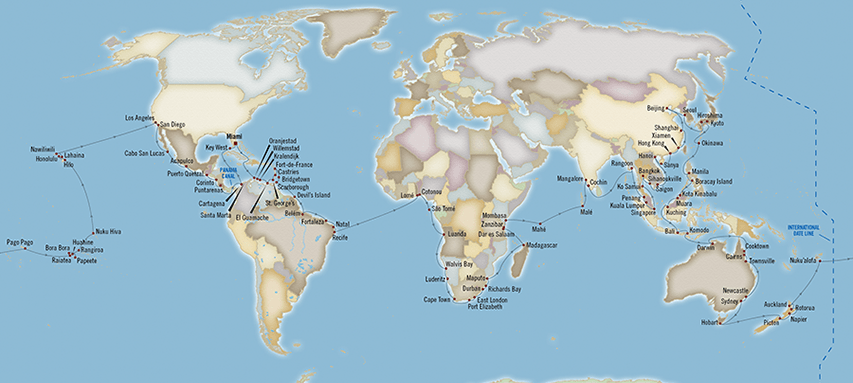

6. Cruise Around the World… Twice

You could book the Owner’s Suite for two 180 day journeys around the world cruise with Oceania Cruises.

7. Four Tons of Custom M&Ms

For the cost of a child, you could buy 8,000 lbs. of everyone’s favorite melt in your mouth candy with a custom image of your face printed on every one.

8. A Big Diamond

You could buy an 8 carat loose diamond to show off to all your friends.

9. A Cargo Ship

$245,000 will buy you your very own used 170′ cargo ship,complete with 11 cabins and 100 metric tons of cargo capacity for that international shipping business you always wanted to start.

10. A Pair of Thoroughbred Racehorses

The average price for a pedigreed racing horse is around $130,000 and is on the rise, so buy soon, while you can still afford them.

11. A Bottle of Bordeaux

Why not pick up a bottle of 1787 CHÂTEAU MARGAUX that was supposedly owned by Thomas Jefferson. Well, unfortunately you can’t because that particular bottle was broken in a dinner-party mishap, but don’t feel bad, its owner collected $225,000 from his insurance company.

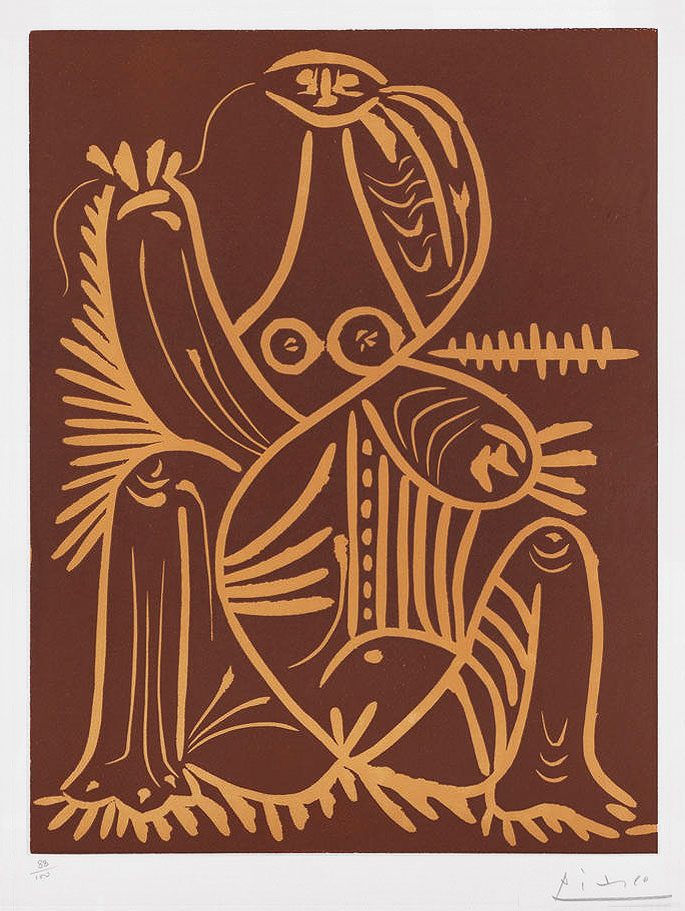

12. Line Your Walls with Picasso Linocuts

You can buy 5 hand-signed color linocuts (a design cut into a linoleum surface) by the venerable Pablo Picasso.

13. Go to Disney World Every Day for The Next 11 Years

Instead of having a kid, you could embrace your own inner-child and spend over 4,000 straight days at the Magic Kingdom.

14. Spend 10 Nights in the Bridge Suite at Atlantis

At $25,000/night, the enormous luxury suite that bridges the two towers of the Atlantis Resort in the Bahamas is one of the most expensive hotels on the planet.

15. Put a 100+ Inch TV in Every Room

At around $50k a pop, you can put five Panasonic 103″ high definition televisions all over your house.

16. Rent an Apartment in Manhattan

Love big city living? The average rent for an apartment in Manhattan is around $4,000/month, which would allow you to live there for a little over 5 years for the cost of raising a single child.

17. Attend the Super Bowl in Style

At most stadiums, box suites can be reserved for the Super Bowl that accommodate 20+ of your closest friends and offer full food service and an open bar so you can enjoy the big game in style.

18. Eat a Lot of Steak

Embrace your inner caveman by ordering over 10,500 seven ounce Private Reserve Fillet Mignons from Omaha Steaks, their finest cut of beef.

19. Buy Enough Gas To Drive Around The Earth 66 Times

At an average cost of $3.50/gallon, you could buy enough fuel to drive over 1.6 million miles.

20. Drink Some Water Out Of A Very Fancy Bottle

Feeling parched? Why not quench your thirst with a few bottles of the world’s most expensive water, Acqua di Cristallo Tributo a Modigliani. At just $60,000 a 750ml bottle, you can afford to drink about four of them.

21. Get Married A Bunch of Times

Why should your wedding day be a once-in-a-lifetime experience? Enjoy eight average-cost weddings for the same price as one wedding night mistake.

22. Go Back To School

The average cost of college tuition is around $30k/year, allowing you to pursue one of those fancy 8 year degrees.

23. Enjoy Ten Servings of the World’s Most Expensive Dessert

Indulge your sweet tooth with ten servings of the decadent Frrrozen “Haute” Chocolate from Serendipity 3 in New York City.

24. Get Your Own Billboard

Buy advertising space on a billboard in Atlanta and run your ad for over seven and a half years. Tell the world how much money you saved by not having children.

25. Fill Your Yard With Children Made of Bronze

For the cost of raising a flesh and blood child, you can own almost a hundred bronze replicas.

Do you plan to have children? Think they’re worth the pricetag? Let us know in the comments.

Featured photo credit: Cash / 401(K) 2012 via flic.kr