Do you love Groupon? It is useful in lots of different ways; you can try out new activities in your area, make holidays cheaper, and discover new hobbies. But did you know that there are ways to get even more savings from Groupon?

Check out 10 tips to help you save money with Groupon.

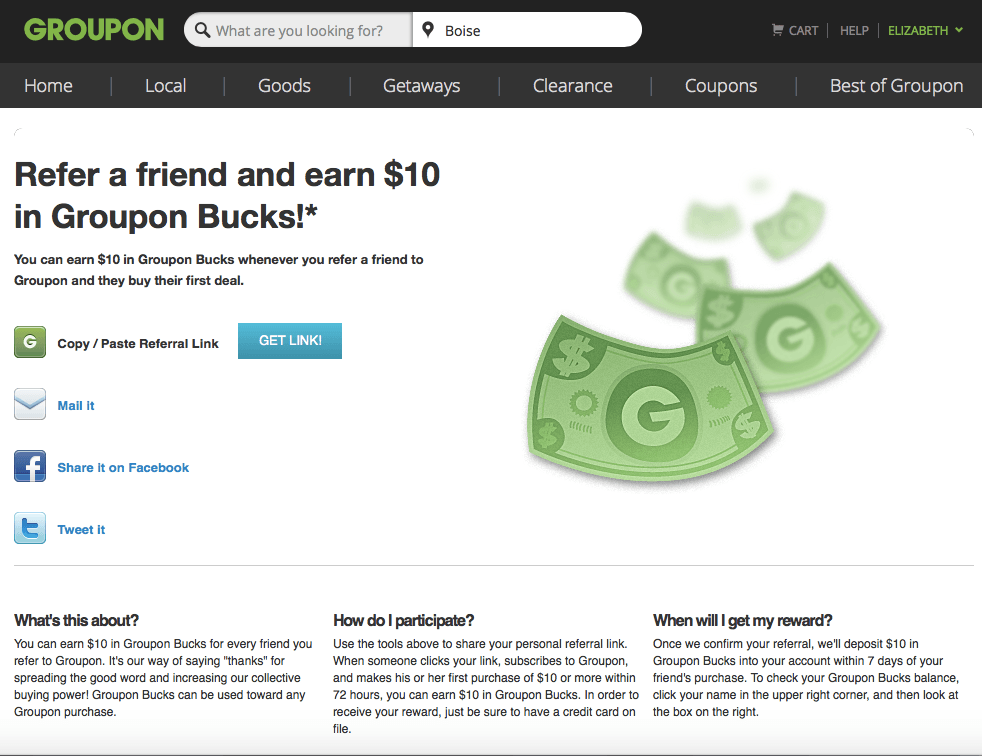

1. Refer Your Friends

If you have any friends who love deals too, recommend they join Groupon!

For every friend you refer, you will get $10 in Groupon bucks when they make their first purchase. All you have to do is sign in and click on your name in the top corner, then click “refer a friend” from the drop-down menu. A quick and simple way to make your purchases on Groupon even cheaper!

2. Check For Extra Charges

One of the most expensive parts of Groupon is the hidden extras, such as shipping fees and the gas you need to get there. Watch out for the hidden fees before you purchase so you know exactly how much you are paying and what for.

Another great way to make the extra fees cheaper is to wait until holidays, such as Easter and Valentine’s day, when Groupon offers extra discounts.

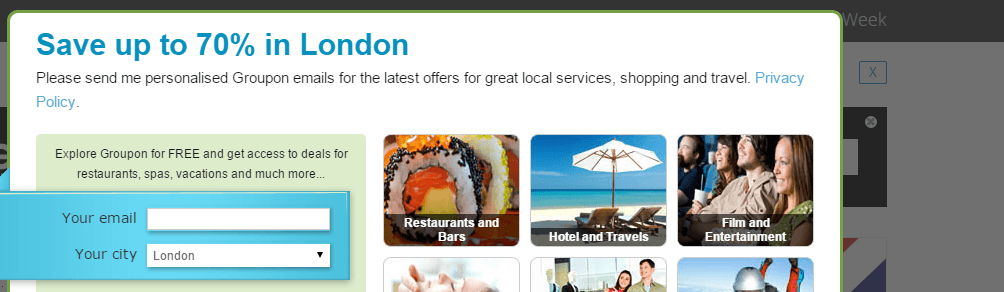

3. Subscribe For The Best Savings

Instead of checking the site whenever you remember, subscribe so that you are alerted to all of the best deals. Often you will see many more offers that are perfectly suited to you. Another useful tip is to subscribe to any cities you plan to travel to in the near future to help make your trip even cheaper!

4. Get Social With Groupon

If you tweet about your personal favorite Groupon purchases, Groupon will personalize your offers so they are more suited to your own interests. This is a great way to filter out the offers you are less interested in and replace them with improved offers.

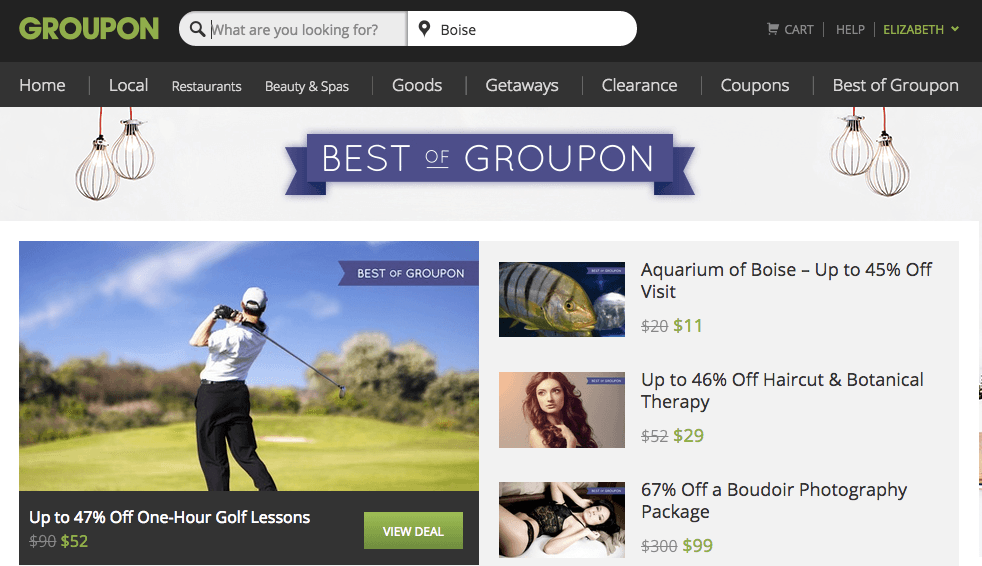

5. Only Search Through the ‘Best Of Groupon’

To save some serious money, only search through the ‘Best Of Groupon.’ This part of the site offers the best deals – normally 50% or even more. This is one of the easiest ways to save money on Groupon.

6. Read The Fine Print

With every Groupon deal, there is a section called the ‘Fine Print’. Instead of being pages long, there is just a brief description of everything you need to know – including parts that may ruin the deal. For instance, some offers are only available if you haven’t already used them in the last month – handy to know before you buy!

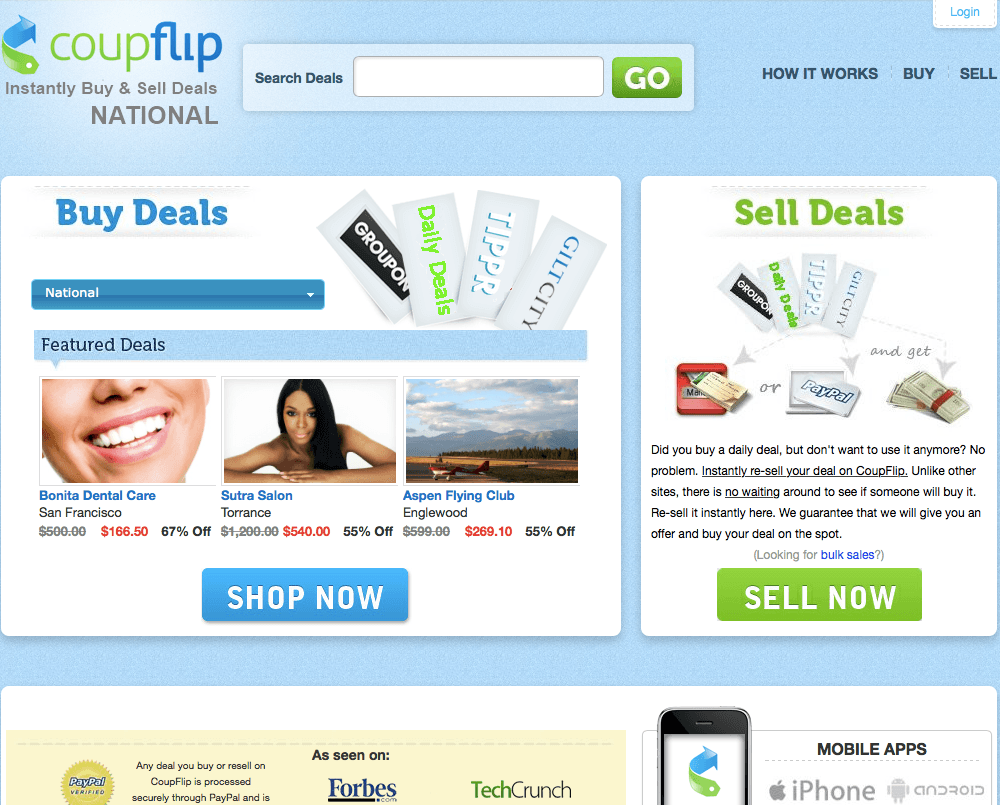

7. Sell Your Unused Vouchers

Often there are offers so good on Groupon that you don’t want to miss out – only to regret your purchase an hour later. If you make an inpulse buy that you later regret, you can always sell your voucher on CoupFlip, a website were people can sell great coupons and vouchers.

8. Know What You Are Looking For

Do you want to take a short vacation, make a day trip, or buy something for your home? It is useful to have an idea of what you want before you look on Groupon, as the deals can be different every day. That way, you can make sure you get exactly what you want!

9. Check Out Groupon Online

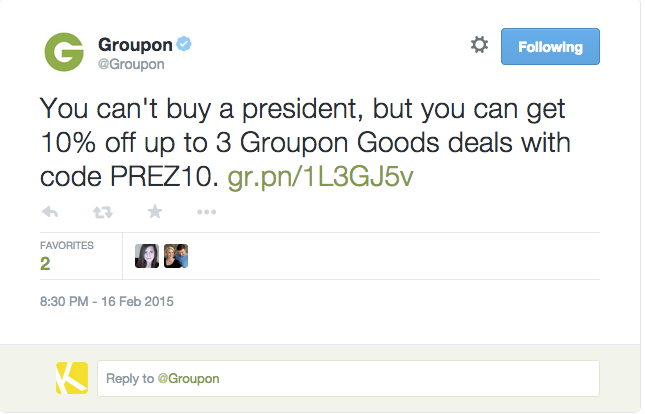

Another handy way to keep up with the best deals on Groupon is by following them on Twitter. Here, they frequently showcase new deals and offers – and if you want, you can even tweet them with suggestions of offers you’d like to see in the future.

10. Get Groupon For Your Mobile

The free Groupon app is a nifty way to win as many savings as possible, even when you’re on the go. The app uses your location, so you only ever get deals that are in the area you are currently in. It’s a great way to filter out deals that you’re not interested in so you can focus on the useful deals!