You probably already know that there are apps you can use not only for entertainment, but for earning extra money or saving some. But, you may not know about these apps, which are some of our favorites. Check out these 10 killer apps you can use to save or make extra money in your spare time.

1. Foap

This is an app that allows you to make money by taking photos. You can charge as much as you like per photo, which means that your money-making opportunities through Foap are virtually limitless. People are always looking for a huge variety of photos, and you may be surprised at how much money you can make with a photo of your cat.

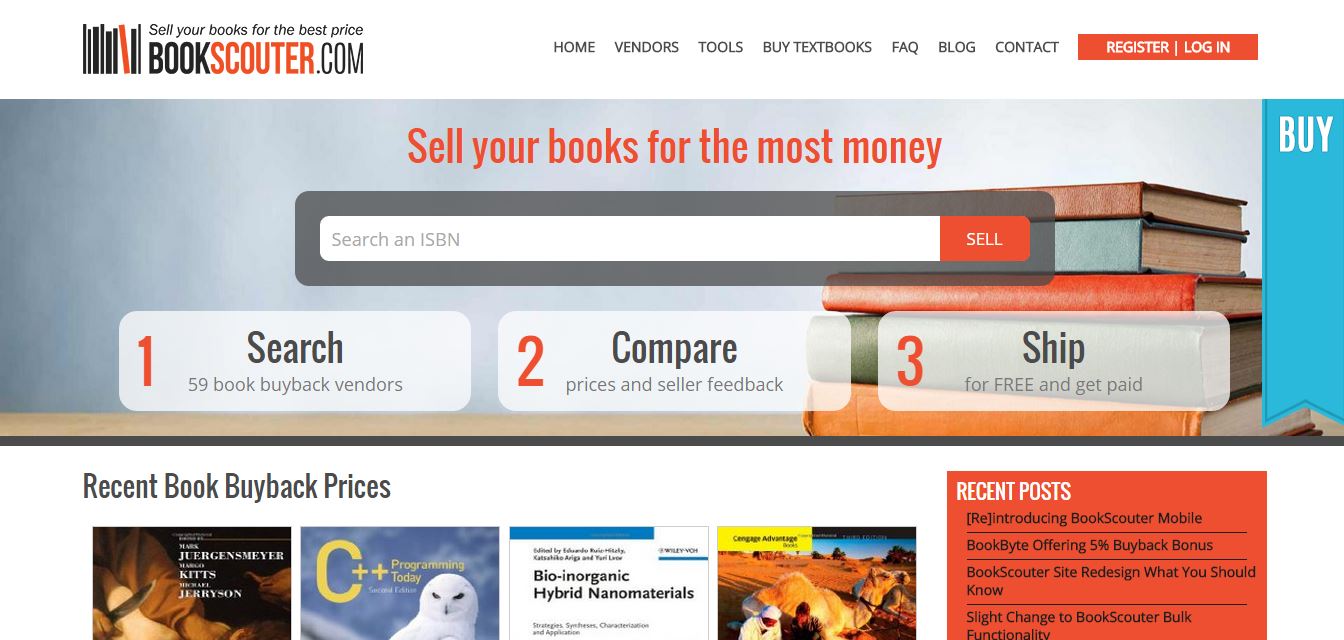

2. Bookscouter

Download links: Web-Based

If you have old books you want to get rid of, use this app to sell them. Scan the barcodes with your smartphone, and Bookscouter will let you see comparisons of payouts from more than 20 book buyback companies. Once you find the best offer, fill out some information about where payments should be sent, and ship the books to the buyback companies.

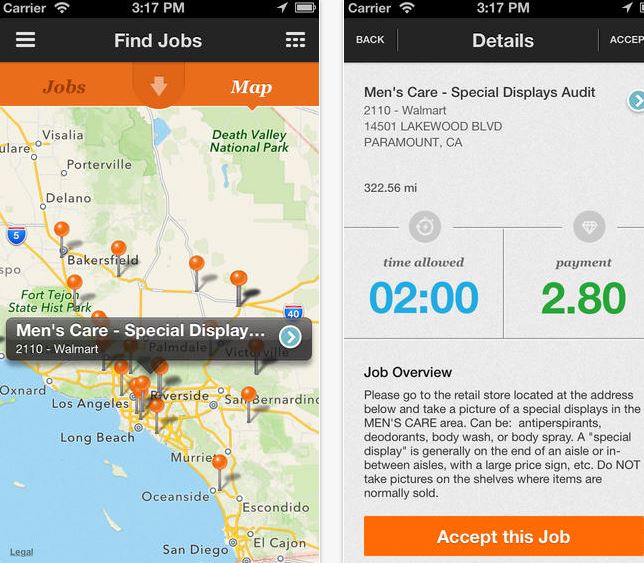

3. Fieldagent

This is a great app that can help you earn money. From the main navigation window you can locate jobs through the “Jobs List” or through the ”Map View.” Select a job to see additional details and accept it. Once a job has been selected, you will have two hours to complete the task. Be sure you’re near the objective before you start the task.

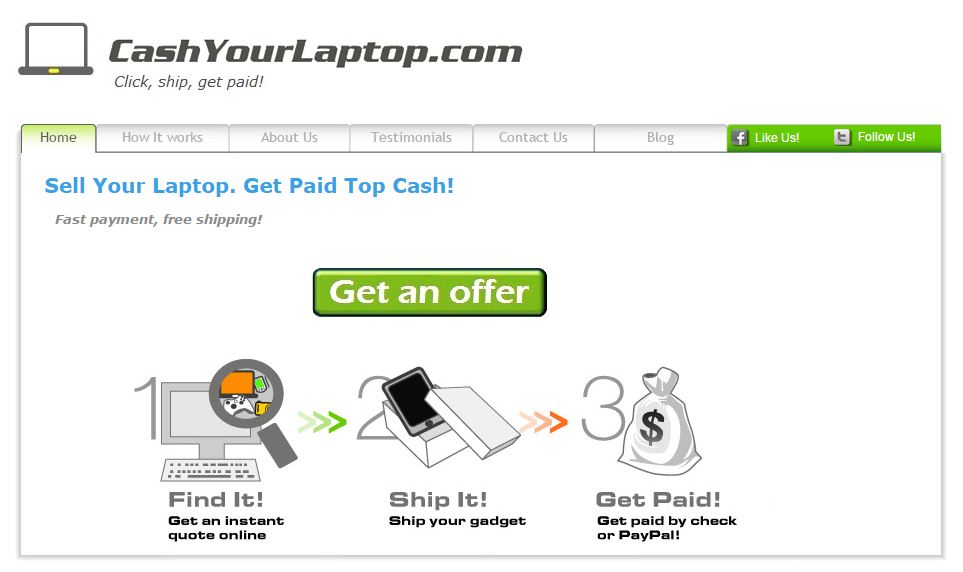

4. Cash For Laptop

Download links: Web-Based

You can make extra money by selling your old laptop, and this app will let you do it. Simply select the type of device you wish to sell, add a description of the device, pack it up and ship it (free of charge), and get paid with a cheque or Paypal.

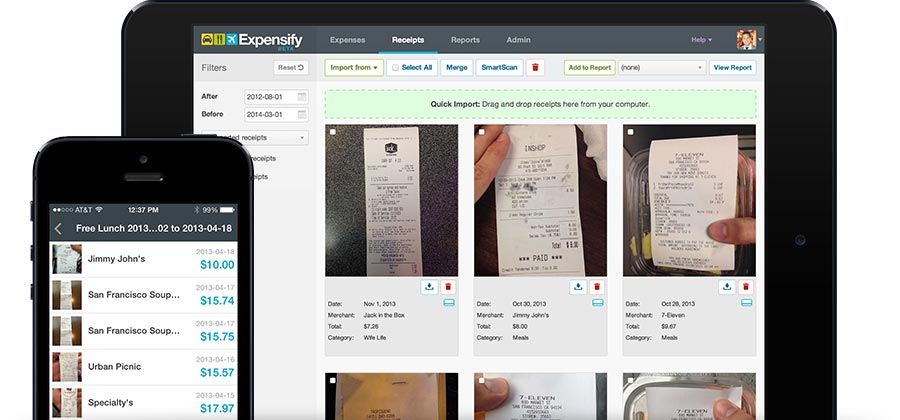

5. Expensify

If you are having problems with your expense reports, you can save time and money by using Expensify. This app lets you capture receipts, track time and mileage, track business travel, create expense reports, and more. Using this app will allow you to get these things done quickly, so you can spend more time actually making money.

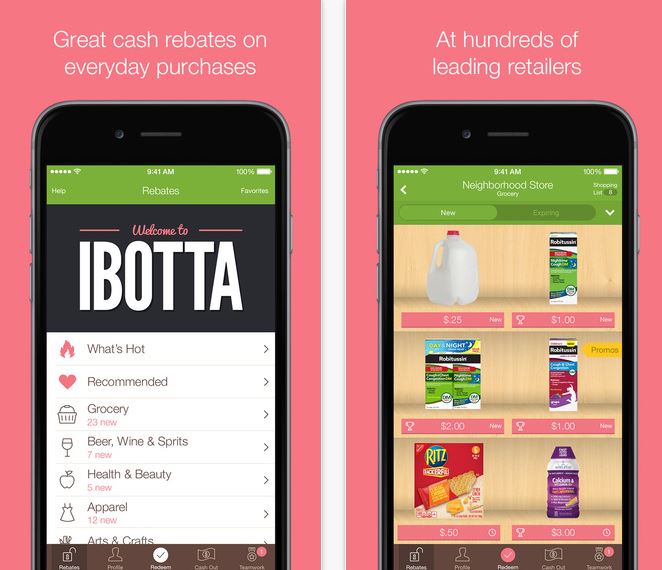

6. Ibotta

Take photos of your receipts and receive rebates using this app. Sign up for a free account, download the mobile app, and click on “Rebates”. Here you will find loads of great offers. Rebates will vary depending on the product and the promotion.

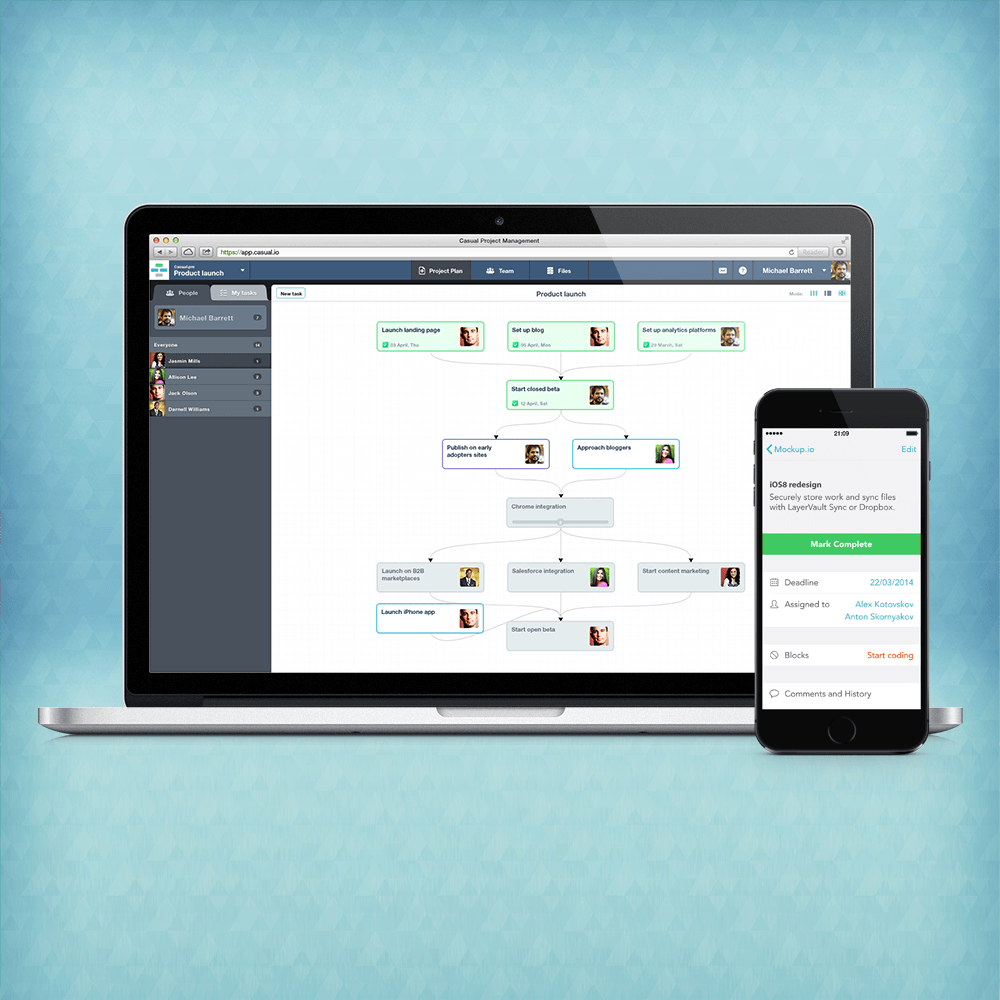

7. Casual

Download links: Web-Based

You might be surprised, but the project management app Casual saves a great amount of money by helping reduce fails with deadlines and problems with the team. Casual helps handle tasks and projects in a new way: plan your tasks just by drawing them as flowcharts. Amazing feature is that Casual helps visualize dependencies between tasks. Become much more productive by using it.

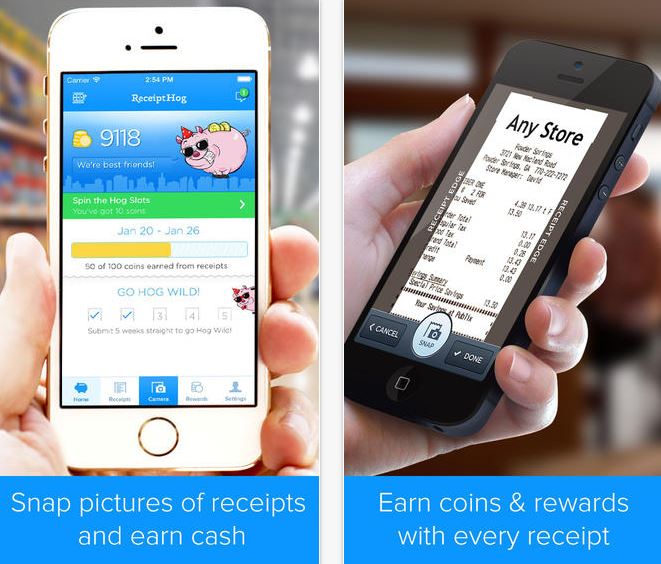

8. Receipt Hog

This is a lot like Ibotta, because you can take photos of receipts and get rewards points for Paypal or Amazon gift cards. Unlike Ibotta, you don’t have to shop at specific stores. You can shop anywhere, and still earn points. But, it is slower to cash out than it is with Ibotta.

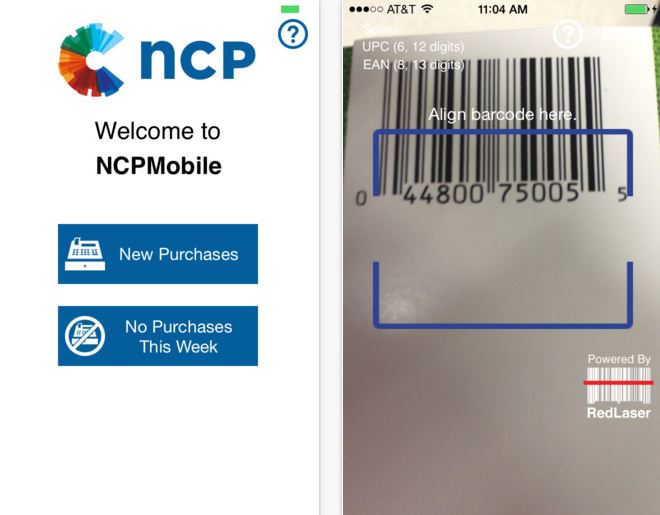

9. Ncponline

Earn rewards points as a panelist for Ncponline. Scan your purchases, and send the data in to get points. You may also be contacted occasionally for opinions. You can make money through this app, and it only takes an hour each week. You get points for every interaction, and when you have enough points, you can cash them in for rewards.

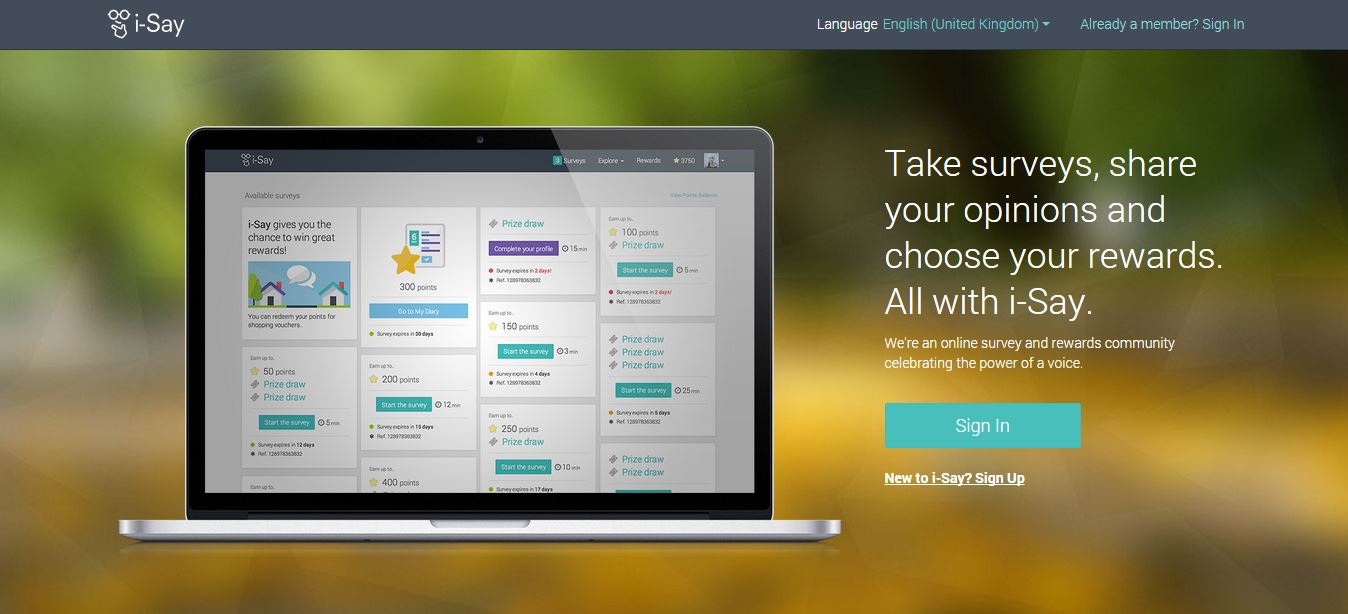

10. i-Say Mobile

Download links: Web-Based

When you need a survey app, this is definitely the one to choose. It is from the Ipsos company, which does much of the polling during presidential races. If you have some free time, you can make money completing surveys. Or, you can collect points, and redeem them for gift cards from Amazon, iTunes, etc., or cash them in through Paypal.

Featured photo credit: Woman Using a Smart Phone via shutterstock.com