We all know the feeling. After payday arrives, we get a major cash infusion and feel able to breathe easy. But a week or so later, all that money’s gone. You can’t even remember where you spent it. Maybe it’s the nights out with friends, the lunches with coworkers, the new clothes for spin class, or getting coffee every day (and sometimes twice a day). The only thing you know for sure is that the sum of money you were paid has dwindled.

The average American is spending $1.33 for every $1 earned. So many people worldwide are in debt from student loans, auto loans, home loans, and credit card spending. In fact, the average American household has $8,700 in credit card debt.

This happens to most people. We want to save money, but we often end up spending more than we expected. This makes it so hard to save enough money for the important big-ticket purchases: cars, vacations, homes, etc. We have our savings priorities, but we often fall short of our real goals.

What’s more, it’s hard to know where to cut our budgets. Or where we even tend to overspend in the first place.

Keeping track of your spendings

In order to stop overspending and to meet your savings goals, you need to keep track of your actual activity. You need be aware of the problem before you can even begin to fix it.

That’s where Spendee comes in.

When it comes down to it, there aren’t many programs or applications that make personal finance simple. But Spendee offers quick and transparent information about your spending and it’s easy to use. Let me walk you through the main features of the app right now.

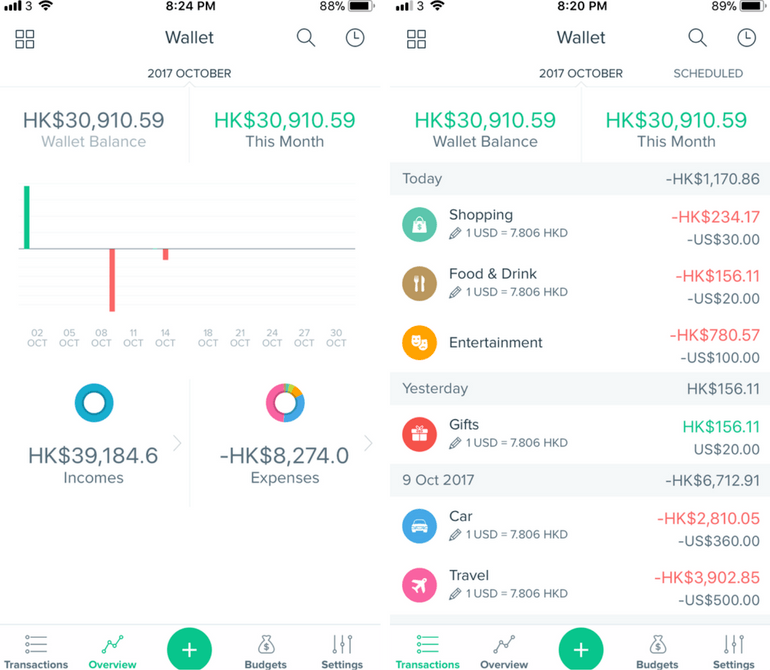

1. See where you spent your money

Spendee gives you a simple but powerful way to view your spending. Graphs and charts track the categories you spent in, how much you spent on average, the number of transactions, biggest expenses, and much more.

This super-valuable tool allows you not only to budget realistically, but to see trends in your spending so you can track down further details if you want. Surprised that you spent $5,400 last week? Well, now that you know, you can go into your recent transactions and see where exactly that money went.

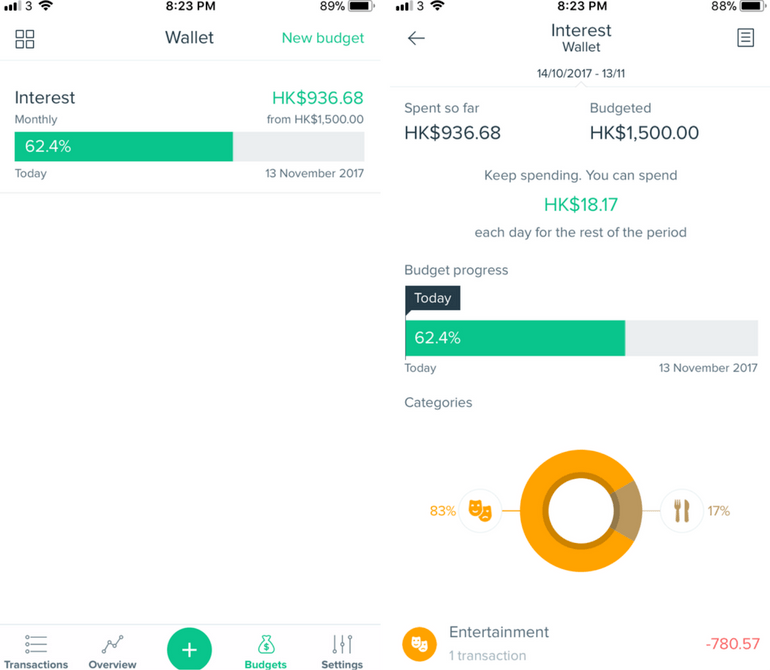

2. Plan your spending with budgets

Individual budgets are a powerful tool to help you stop overspending and start boosting your savings. Spendee lets you set budgets for various categories. This lets you track how much you eat out or spend at the grocery store (one of the most flexible part of anybody’s budget, by the way).

The bright visuals (with percentages) give you an immediate sense of how much you’ve already spent and what you have left. So if you’ve spent 80% of your food budget by the 10th of the month, it might be time to cut back!

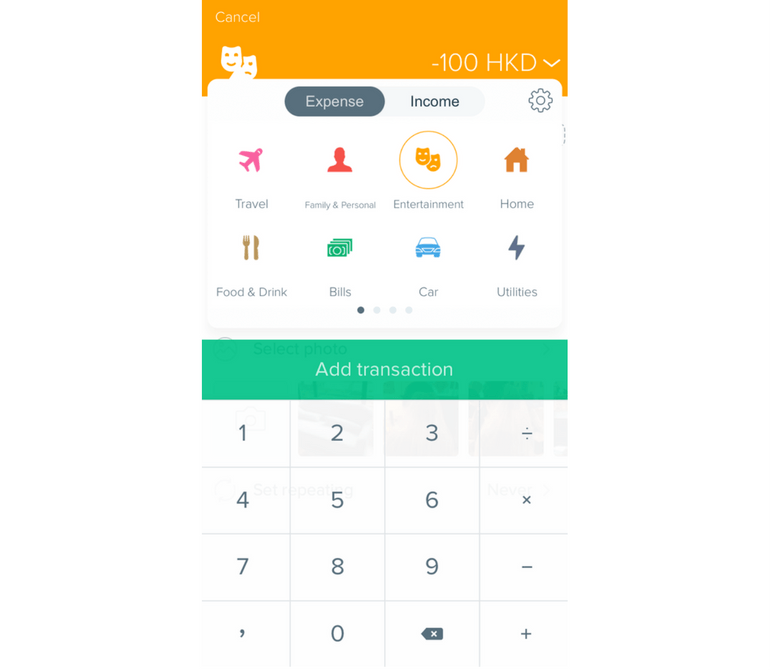

3. Create different wallets for different spending purposes

In what’s call the “envelope method,” Spendee Premium lets you set aside the money that you already have for specific purposes. (Note: This is not an option with the basic, free version of the app.)

This isn’t so different from regular budgeting, but many people swear by this method. Why? It allows you to divide up your sources of money, which in turn makes it psychologically more challenging to overspend. You can’t spend what you don’t have, and if you restrict yourself to money in a particular wallet, you can’t mess up.

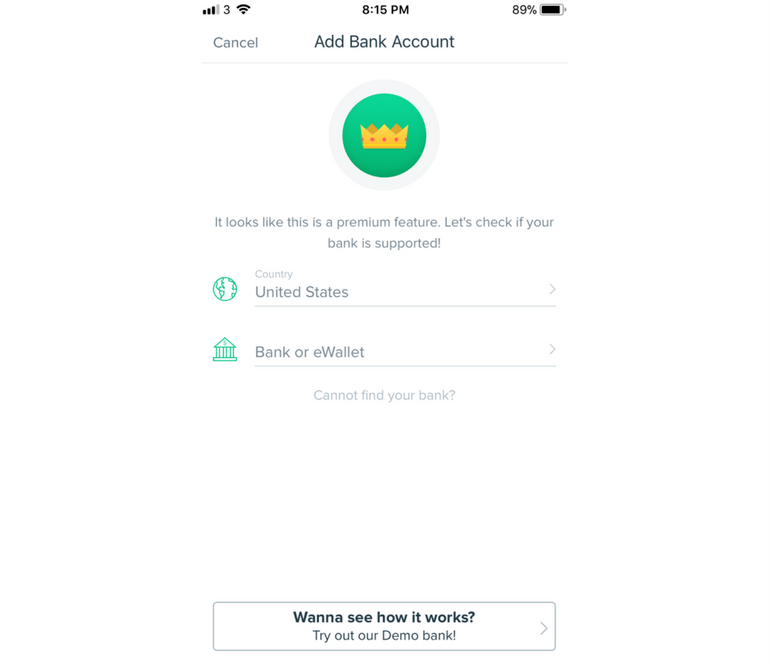

4. Sync your Spendee account with your online bank account

With Spendee Premium, you can always keep track of your money. Your transactions will automatically update when you sync Spendee with your online bank account.

Simply select your bank and enter in your credentials. All of your transactions will get automatically imported and categorized. Seeing your spending activity couldn’t be easier if you tried.

Take control of your finances

The sooner the better! If you find yourself wanting to rein in spending, or just to save better for mid- to longer-term goals, it’s important to have and use the right tools.

Install Spendee Here

If you love the free version, consider trying out the Premium version if the features interest you!