I’m going to show you a super easy, step-by-step process for ensuring that you never pay more than half price for any new book (even if it’s an absolute best-seller that everyone is trying to buy) or product.

I’m not talking about wasting hours scouring discount and deal sites for great prices either. Amazon already does a great job of offering low prices across a range of items so getting a good price is a given.

Fortunately, with only a tiny bit of extra effort you will be able to squeeze far more out of your shopping budget. Here’s how you do it.

1. Getting Started

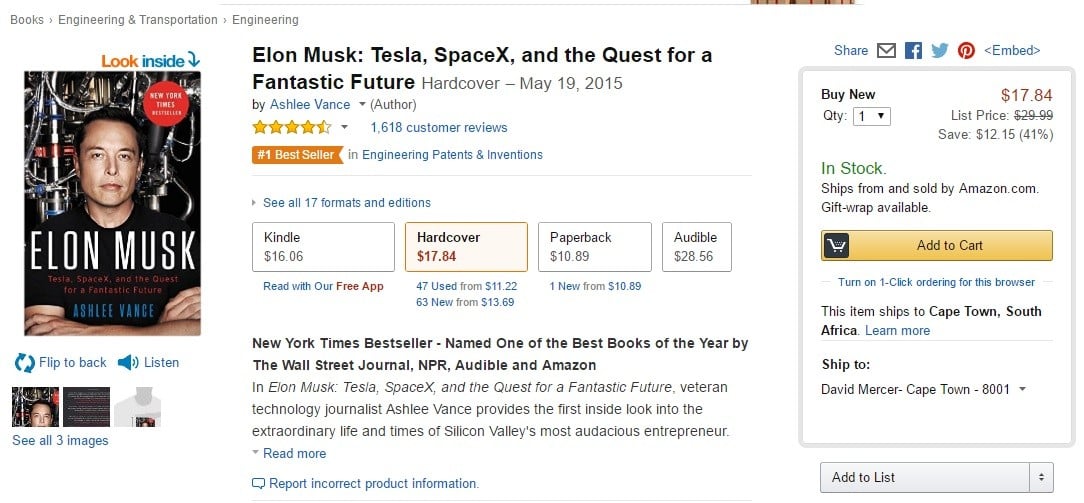

We’ve all shopped on Amazon, right? Here’s a typical buying page for a really popular best-seller by Elon Musk:

There are a couple of important things to notice about this page that will help you save more cash in the coming steps:

- The List Price is $29.99 but we can buy it now for $17.84

- It is also available New from $13.69

- It is available Used from $11.22

So, right here, right now we can buy a $30 book for about $14. That’s a little under half price already. So far so good.

2. Price Tracking & Alerts

The Amazon marketplace is extremely fluid and volatile. Prices for products can change on an hourly basis, as Amazon competes with other sellers to offer the best prices. This is where we can gain a bit of extra advantage over other shoppers.

Instead of spending time checking back each day to see what the new price is, we can use an accurate price tracking service that will notify us of price drops (and increases – these will be important later on) in virtual real-time.

Set up a price alert watchlist of all the items you want to buy for both price drops and increases.

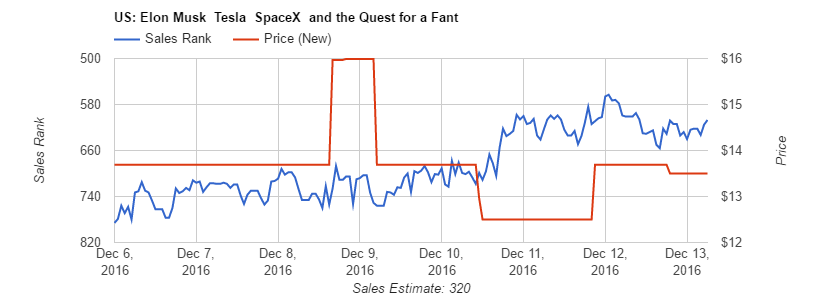

Here’s a screenshot of the sales and price changes for the aforementioned book using RankTracer – an extremely accurate tracking service that updates hourly so you are never more than a few minutes behind the latest price changes:

Chart showing hourly sales & price changes Amazon book (Tesla, SpaceX …). Courtesy of RankTracer – Amazon Sales & Price Tracker

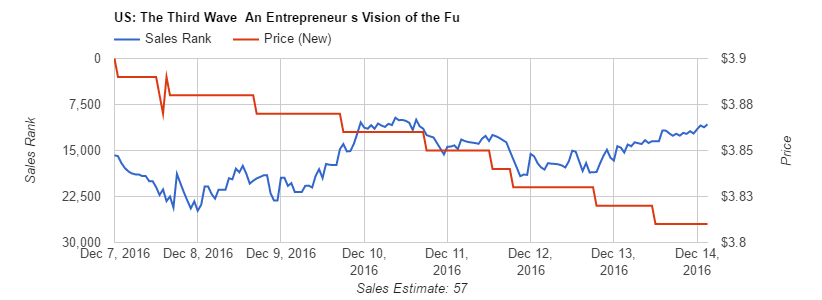

Not all products have the same pricing profile, however. It’s important to note that some items swing wildly from day to day, or even hour to hour. Here’s a price chart showing changes for a popular entrepreneurship book entitled ‘The Third Wave‘:

Chart showing hourly sales & price changes for Amazon book (The Third Wave). Courtesy of RankTracer – Amazon Sales & Price Tracker

As you can see, that is a bit more volatile, and prone to changing price more often, and in this instance becoming consistently cheaper. Each product will, of course, be different. The important thing here is to know when the price drops and when it increases. Once you know that, we can take the next step – buying low.

3. Buy Low

Looking at the charts above you can see that there are better (and worse) times to buy than others. But, with your price alerts coming in via email, you’ll be able to buy the items you want at the best possible prices.

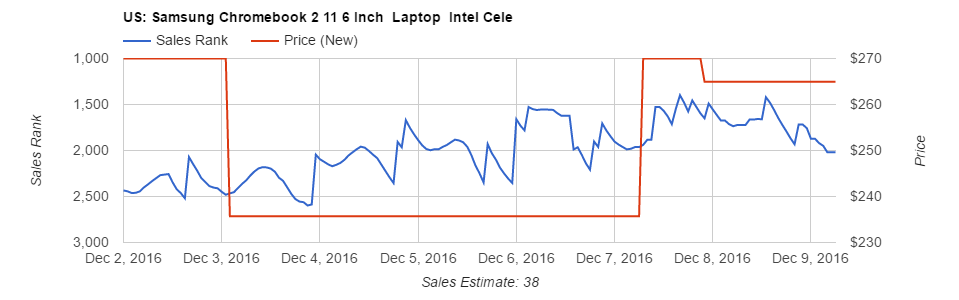

I was thinking of buying a new notebook recently, so I tracked a few to see their prices over time. Here’s one for the Samsung Chromebook:

Clearly buying any time between December 3rd and December 7th would have been ideal, as it would have resulted in an additional saving (on top of the best price you might find shopping on a random day) of just under $250.

So we can save money by buying low. Great.

Unfortunately, buying low is where most people stop going. After all, doing things like this will mean you save plenty of cash on the Christmas shopping. But, if you really want to ensure you pay less there’s one more step to take.

4. Sell High

Once you’ve finished reading your book (or no longer need the item purchased), it’s time to sell it back via Amazon.

Becoming an Amazon seller is quick and easy, and you can get started over at Amazon’s Seller Central website. If you are going to sell less than 40 items, then it is completely free to sign up – although there are small charges per item sold. Selling more than 40 items will require a paid plan that should cost about $39.99 per month, although you can explore the different types of seller accounts at their pricing page.[1]

With your seller account set up, it is now possible to re-list the products you bought – most likely listing them in Used condition.

At this point our price tracking comes in handy because it can tell us when prices are high so we can sneak in with a slightly lower offer in order to radically improve the chances of making a sale.

Take a look at the original screenshot of the Elon Musk book sales page and notice that there were used copies being sold from $11.22. Given that we could have purchased it for $13.69 (according to RankTracer’s price data), and we can sell it back for $11.22, we have effectively bought it brand new for the grand total price of $2.47.

Take into account other costs, like Amazon charges, and you are probably still going to get away with paying less than $4. For a book listed at $29.99, that works out to less than 15% of the list price.

You can squeeze as little or as much out of this process by waiting for the lowest low prices and selling at the highest high prices. But, on average, spending between 10% and 30% of the asking price should make anyone very happy.

This trick works for any product that can be sold used. Obviously, consumables like food and drink probably won’t fetch a reasonable price in used condition. Simply watch your price alerts, wait for the right time to buy and sell, and start saving money big time.

I’d love to hear how much money this saves you in the long run. Drop a comment here and share your huge savings stories to make the rest of us jealous.

Featured photo credit: Roderick Eime via flickr.com

Reference

| [1] | ^ | Pricing page: https://services.amazon.com/selling/pricing.htm |