When you’re young and money is scarce, saving for retirement is probably the last thing on your mind. You might make the assumption that once you get your dream job you’ll be able to make up for lost time (and money), but the truth is you’ll end up spending more to save less in the long run.

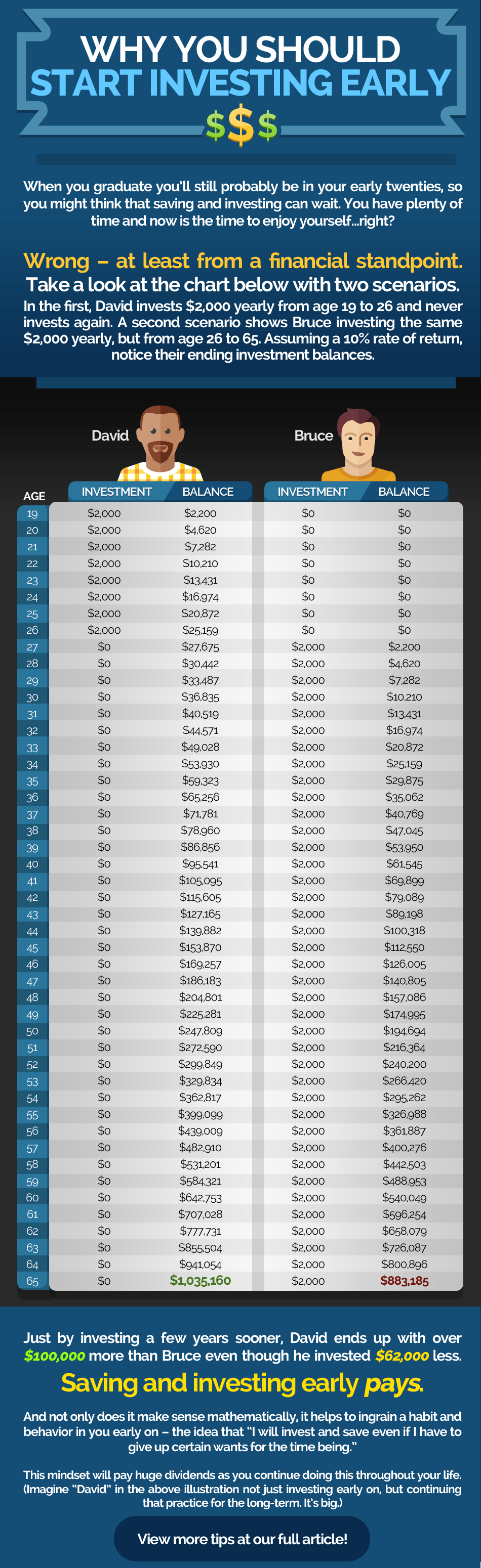

In the accompanying infographic, Certified Public Accountant Micah Fraim illustrates the importance of investing in a savings account from a young age. The infographic clearly demonstrates how sacrificing beer and pizza money during your college years will yield over $100,000 more in returns on investment over the course of a lifetime compared to the savings account of someone who started investing in his late twenties.

Not only does the young investor end up with a seven-digit bankroll by the age of 65, but he also invested much less throughout his lifetime than his late-to-the-game counterpart. In fact, by the time the latter had started investing, our young hero found himself able to sit back and watch the dividends roll in without putting another penny of his own money into the equation.

Also, pay attention to the final message at the bottom of the infographic, explaining that saving early not only builds a strong financial foundation for your life, but it also builds a foundation for the way in which to live your life. If you want to be successful, stay prudent in all areas, and think about the consequences of every decision you make before taking the first step.

Featured photo credit: Why You Should Start Investing Early / Micah Fraim via i.imgur.com