Technology provides access to just about everything we can imagine — but that instant gratification is a double-edged sword. When it comes time to buckle down and get to work, it can be difficult to stay distraction-free and keep our minds from wandering.

According to one study, our minds wander 47 percent of the time. Combine this with noise and other distractions around the office, and it should come as no surprise that the average office worker is disrupted every 11 minutes.

Luckily, there are several online resources that can help you silence the chatter, eliminate distractions, boost productivity, and stay focused at work.

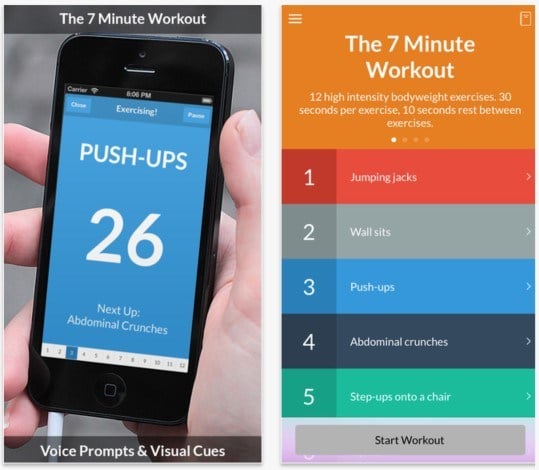

Start the Day off Right with 7-Minute Workout

Exercise is good not only for your physical health, but also for your memory and ability to focus. For many of us, hitting the gym in the morning before work isn’t possible. With the 7-Minute Workout app for iPhone and iPad, you can get your heart pumping in just a few minutes, track your activity, and set goals. The basic version of the app is free to download, but you can pay to upgrade and access various other features, including alternate workouts.

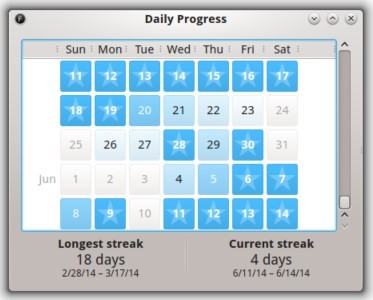

Avoid Internet Browsing with SelfControl

Whether it’s Facebook, a blog, or email, we all have our online Kryptonite that distracts us from getting any work done. SelfControl, a free, open-source OS X app, can fix this. With SelfControl, you can set a timer and block selected websites and mail servers, which is great for when you are on a deadline. Set a timer for four hours and you won’t be able to access your “blacklisted” sites — even if you restart your computer.

Focus Booster

Master the Pomodoro Technique with Focus Booster

The Pomodoro Technique is a time-management method that breaks down work into intervals of 25 minutes, followed by five-minute breaks. This is believed to improve concentration and mental agility. The Focus Booster app is based on this technique, helping you manage your time and dedicate specific time increments to projects. After a free 15-day trial, Focus Booster costs $2.99 per month or $29.99 per year.

Write Without Distractions with FocusWriter

When you are on a deadline and falling prey to writer’s block, even the battery icon and clock on your toolbar can prevent you from focusing on the page. FocusWriter is like a full-screen Microsoft Word, eliminating all distractions. You can look at only the page on which you are working. Available for both Windows and Mac, FocusWriter is free to download.

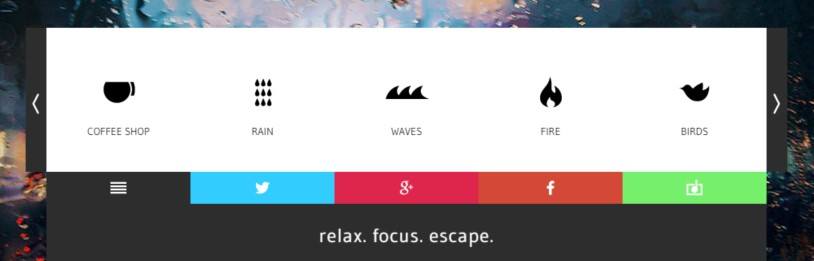

Relax to Ambient Sounds with Soundrown

Silence isn’t always conducive to productivity. While breakroom chatter or a silent office may work for some, others require the fine balance between sound and noise. With Soundrown, you can choose the type of ambient sound that best helps you focus and boost your productivity. Currently, the free-to-use website offers 10 different options that range from Coffee Shop to White Noise.

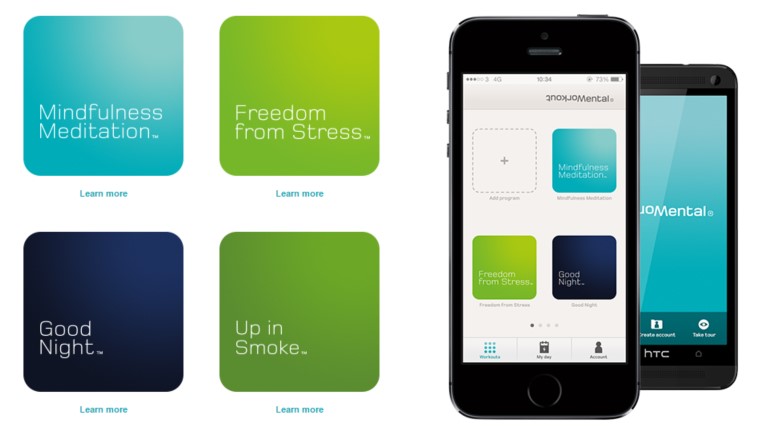

Find Your Center with Mental Workout

Sometimes, we need to embrace our inner hippie and meditate. Meditation can increase your ability to concentrate by helping you relax, de-stress, and clear your mind. For new practitioners, meditation can be harder than it looks. The Mental Workout app, which was designed by a meditation teacher and psychotherapist, offers an eight-week guided meditation program for beginners. It also has more advanced options for experienced practitioners. Along with inspirational talks and body scans, the app is well worth the $1.99 download fee.

Conclusion

Beyond using apps that help you focus, set yourself up for success by using the right tools. Make sure your computer is running efficiently and that you are regularly backing up your files. You may also consider investing in a good set of headphones when you need to drown out office noise. Lastly, don’t forget to ensure that your Internet connection is fast enough for your productivity needs. Videos that take too long to buffer and delayed website load times can quickly distract you from the task at hand.

By staying focused at work and using apps to boost your productivity, you can get more accomplished in less time. Start by trying some of these tools at your place of employment to see which ones work best for you.