Do you feel like you can no longer cope with the stress of meeting your deadlines? Does the lack of concentration stop you from focusing on your goals? Are you stuck or stressed out? Then put your headphones on. Try using some of the most Zen-friendly websites on offer that really work wonders for keeping your cool in the workplace.

There are so many more sites like this out there, but — for the purposes of this article — I have included 10 of them that I use myself.

1. Do Nothing For 2 Minutes

Yes, that’s exactly what you should do for the next two minutes. Nothing. Just sit comfortably, watch the screen and listen to the sound of waves. Will you be able to sit still without touching the mouse or keyboard? See for yourself. I know I failed the first time I tried it.

2. Calm

Calm.com also challenges you to sit still and quiet your mind. Apart from that, you can benefit from a selection of guided meditations that can last from two minutes to 20, depending on how long you’d like to take a break from your hectic surroundings.

You can choose from the many calming atmospheres that are available — gentle waves, fields, waterfalls. And what’s even better about it is that you can take Calm with you. The iPhone app can be downloaded for free, and there are three options for paid subscriptions if you want to go for Pro Access. Who wouldn’t feel calmer meditating with a view like the one below?

3. SimplyNoise

SimplyNoise uses white, pink and brown noise. You just need to pick a color, slide the knob to the level that’s comfortable for you and enjoy the sound. I’d recommend white and pink noise while you’re at work to keep you alert, focused and productive. White noise uses sound across all frequencies and blocks distractions, making it great for studying and writing. Pink noise uses a mix of high and low frequencies, which is great for reducing your stress while keeping you energized.

4. SimplyRain

SimplyRain belongs to the SimplyNoise website and it simply plays the rain sounds for you. You slide the blue orb to adjust the rain intensity and adjust the volume by sliding the metal knob. Change the storm ambiance by toggling the thunder orb. Based on different algorithms, SimplyRain generates a randomized procedural storm each time you tune in. Both SimplyNoise and SimplyRain apps are also available on iTunes for $0.99 each.

5. Rainy Mood

This one’s my favorite and the one I use most often when I write. On top of the rain, thunder and bird sounds, there’s no audio limit and it plays a YouTube video every day that fits perfectly with the sound of rain. I learned about it when I read how online marketing expert and Overit’s VP of Strategy Lisa Barone writes.

6. Coffitivity

You can’t afford spending every morning at Starbucks? No probs. Bring the coffee shop vibe into your own home, on your own desktop, to get your much needed creativity boost. Coffitivity has a neat and beautiful interface and blends calm and commotion in such a way that makes your creative juices flow. They also link to a super comprehensive study about “Exploring the Effects of Ambient Noise on Creative Cognition.”

7. naturesoundsfor.me

With naturesoundsfor.me you can mix four different sounds, but you have a wide range to choose from: tribal drums, animals, fireworks, heart beat, you name it. The one I created to my own liking is a combo of beach sounds, seagulls, pink noise and kids laughter.

It’s so soothing, yet lively, to listen to the sounds of the ocean’s waves gently crashing on the shore while children giggle in the background. Start creating yours! You can also save it on your computer so you can play it when you’re offline too.

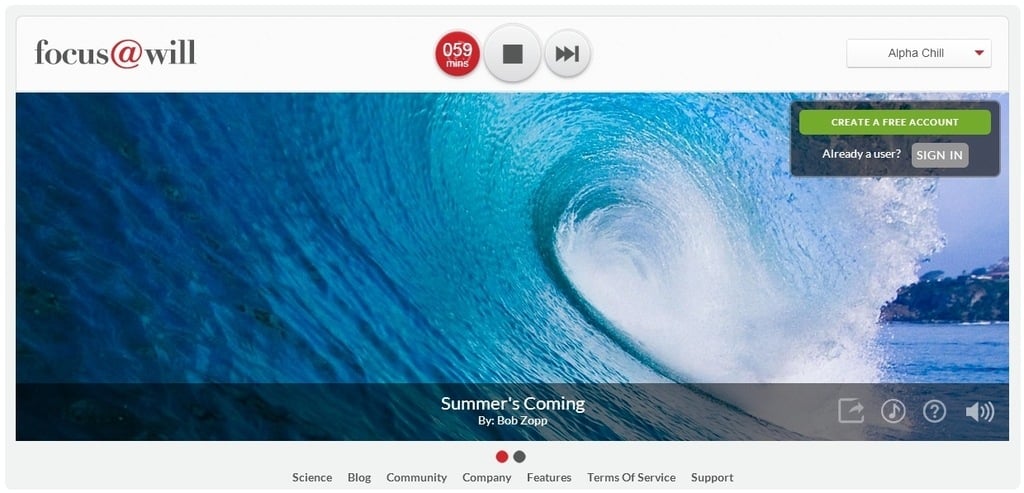

8. Focus@Will

Focus@Will is fantastic! It uses phase-sequenced instrumental music that increases your attention span up to 400 percent when reading, writing, or studying. Apart from that, it extends the standard 20- to 30-minute productivity cycle to approximately 100 minutes.

The music stream (Alpha Chill works for me) engages your background attention to such an extent that it doesn’t interfere with your conscious focal attention on the task you work on. As for the costs, you can choose from three different account types: Guest, Personal and Pro.

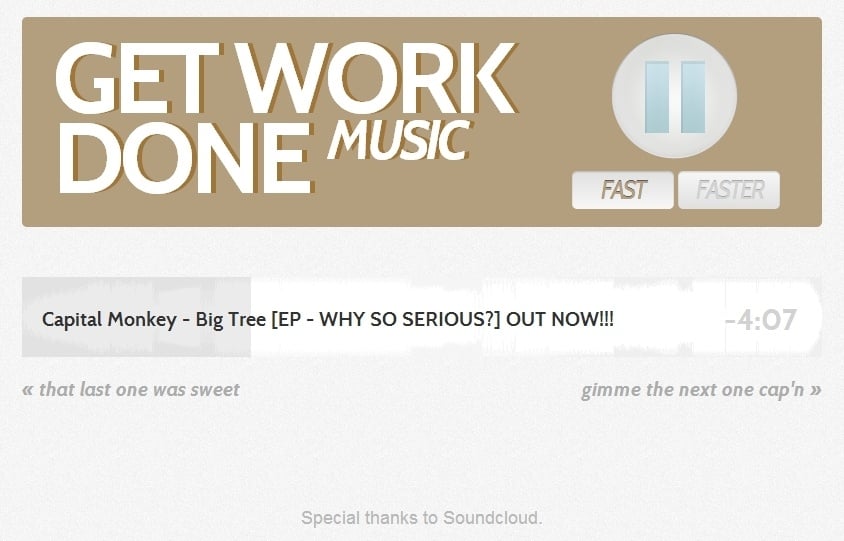

9. Get Work Done Music

Get Work Done Music simply plays upbeat, instrumental tunes from Soundcloud. It’s pretty straightforward to use with very few controls — just the play/pause button, Fast and Faster, and “gimme the next one cap’n” to switch to the next song.

10. Teamviz

Last, but not least, Teamviz is the icing on the cake among the tools that help you stay on schedule as you prioritize your tasks and approach them one by one. There’s no music, but this is probably one of the best productivity tools out there.

Formerly known as PomodoroApp, this free downloadable app, which is basically a timer, allows you to break your working routine in 30-minute chunks. You work for 25 minutes then take a 5-minute break. What you choose to do during that break is important. Stay away from email and social media. I for one meditate. That’s when Calm.com or donothingfor2minutes.com, for instance, come in handy.

As I worked on this post I used Coffitivity and Focus@Will simultaneously. The music volume was set just above the ambient noise level of Coffitivity.

Try to have as much variation as possible and notice what puts you best in the zone. Measure the effects and share what worked for you with your friends — and in the comments below.