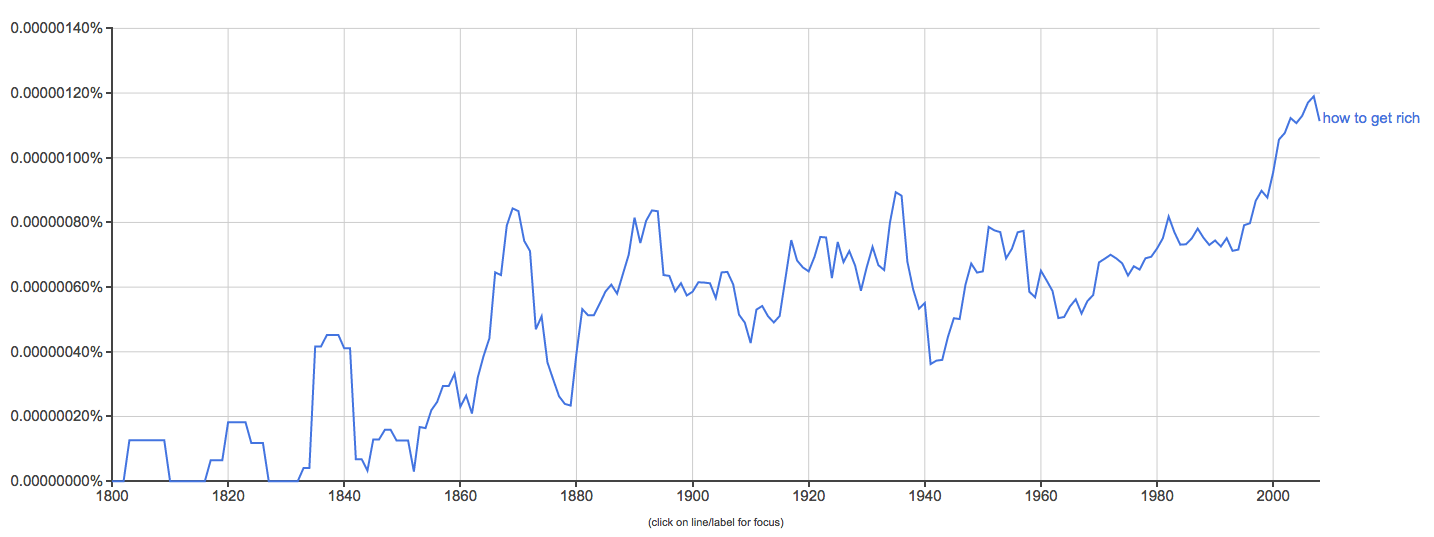

Have you ever asked yourself, “how can I become rich?” Everyone has dreams about winning the lottery and how to become rich overnight. People want to get rich. Just do a search on Google Books and you can see that it’s been a rising trend since the 90s.

Many people are looking for ways to get their first 100K, or ways to invest for a better retirement. Some are trying to succeed as entrepreneurs. People want to have enough money to buy beautiful homes, powerful cars, and great vacations. But not many know how to become rich. How do you become rich?

Being rich is more than about the dollar amount.

Being rich is a state of mind. In a sense, you could be rich but still poor, and vice versa.

You can define “rich” in different ways. There are a lot of people who simply consider it as having a lot of money. For them, rich is equivalent to a being a millionaire.

But rich can also be psychological richness. It is an achievement of being able to live without the worry of money. You don’t necessarily need to own a castle to be considered rich. Everyone can be rich as long as we are able to do what we desire freely and to have the fulfilment in life. The key of it is to live with or even less than what you have. To be “normal” even when you are financially capable to do a lot more.

You might have your own preference on which definition suits you better, but here are some ways on how to get rich. It may help you achieve either (or both) of them.

If you want to become really really rich, make bold moves.

It’s an ambitious goal to become wealthy, and if you’re aiming for that, here are simple ways to get rich.

1. Exploit your skill as a self-employed expert and invest in it.

Make it your goal to do one thing better than anyone: Work on it, train it, learn it, practice, evaluate and refine it. You may find most sports-players or entertainers are millionaires, and that is because they are utilizing their skills fully. If there’s something you’re good at, it is likely you can reap considerable rewards out of it.

It is the same concept of being the top of a particular field. When you are the best at something, you find that opportunities come to you. To become an expert of something, it is crucial to never stop improving. Successful people invest time, energy, and money in improving themselves, and it might just be the most rewarding investment you can ever make.

To get started, figure out what skill you want to cultivate. Make a list of the world’s ten best people at that one thing, and use this list to define criteria and track your own progress toward becoming the best.

If you’re a writer, for example, you might consult the New York Times Bestseller list, and identify the ten successful authors that you admire the most. Learn more about these writers, what they did to be successful, and read some of their work. Invest the time and energy in improving your own craft, by looking at successful past models.

2. Hit $100K, then invest the rest.

Everyone wants to get rich fast. But a goal like this isn’t something you can easily achieve in a short period of time. Instead of thinking of how to get rich fast, aim at saving $100K first.

The small amounts you save daily are powerful. You might only be able to put away $5 or $10 at a time, but each of these investments are your financial foundation.

3. Be an inventor and consider it as an opportunity to serve.

Stop thinking about getting rich fast and start thinking about serving a lot of people. If you think about what people need, or things that could improve society, your insights will have more impact. Not only that, you could be the first to produce a trending product in the future.

When you start to serve a lot of people, the effect of word of mouth is magnified – not to mention, you’ll have much more helpful feedback to improve what you do.

Having the patent of a popular invention could be the fast-lane ticket to prosper. Just look at Snapchat.

It would definitely be challenging, but consider it to be a way of serving, to benefit those who actually need your invention. No business is successful without the support of the public. Rather than squeezing every single dollar out of your customers, show them you are actually working to make them better.

4. Join a start-up and get stock.

Using the same potential consideration of start-up in the above points, owning stocks of one or more start-up companies could be a valuable investment if the company thrives and either floats or is sold to a larger enterprise.

Only a small minority of start-ups succeed in realizing large capital gains, so the odds are not good. However, you can use your judgment to see which business idea and which management team are likely to succeed. Early employees in Apple, Google, and Microsoft became millionaires on this basis.

5. Develop property.

Buying, developing and selling property has always been a major way for people to accumulate capital.

Borrowing could be a key element in this method. Say you borrow $200,000 and put in $50,000 of your own to buy a property for $250,000. Then you develop the property and sell it for $400,000. The property has increased in value by 60% but your $50,000 has now grown fourfold to $200,000. You have to select the right properties in the right areas and develop them wisely.

You are at risk from booms and busts in the property market. However, in the long term this remains a proven way to accumulate wealth.

6. Build a portfolio of stocks and shares.

If you can make steady investments in stocks over a long period, choose wisely and reinvest the dividends then you can build a large store of wealth. Of course stocks can go either way and many small investors lose heart when their portfolio plunges.

But over the long-term, equities are as good an investment as property and much more liquid. Stock market crashes represent great buying opportunities for those with cash and strong nerves.

7. Start your own business and eventually sell it

More and more startup have seen success with great return in recent years. If you can find a new approach towards a specific corner of the market and build a business that addresses that need, then you have a potential of success in it.

It literally can be anything: a cleaning business, a food delivery service, or a blog. It will probably take years of very hard work to build up the enterprise. All entrepreneurs will have to endure great risk and stress. But if you can pull it off, the potential rewards are huge. This is how many of the seriously wealthy people did it.

If you want to become wealthier and live a better life, build simple habits.

If you’re aiming for a stable life with enough money to support a living, start with the everyday things you can do.

8. Find a job in the right vehicle.

Choose a job of your interest – do what you love and love what you do. No one succeeds in doing what they hate.

You might have to start at the bottom and work your way up. But chances are, if you love what you do, it’s easier to make that happen. You’ll actually enjoy the process of getting to the top.

Earn the experience through different levels of work and when you feel like you have gained all that you can from it, consider moving on in other companies would widen your horizon on different business cultures. Putting more experiences in various positions would make you a more valuable asset for companies and making you a better option for higher rank duties.

Consider how the rich are able to get in with the right companies, where there are plenty of opportunities for growth. Seek places where you can grow your skill and and are able to multiply your monthly income many times over

9. Cut your expenses.

The biggest problem in some people’s path of getting rich is that they always spend more than what they earn. Living below your means will be the easiest to get rich.

Consistently track your progress on how much you’re spending. Use an app or simply an Excel spreadsheet to make sure you always know how much money you have what where it’s going. This gives you a proper place to review and refine what does and doesn’t make sense in terms of your spending.

Start cutting the unnecessary spendings in your life. Do what you can to reduce your bills: make sure you turn off the lights, plan meals to save at the grocery store, and be disciplined about eating in. Focus your life with only the necessities and in no time you will be saving a lot more than what you previously did.

10. Save it in your bank.

Set savings goals and routines to support those goals. Figure out ways that work for you in saving money, and refine what doesn’t.

Many banks have the option of creating separate savings accounts, as well as automatic withdrawals. By setting up these automatic transfers, you save passively and have to make an effort not to save.

Another thing you can try is to increase the amount of savings by 1% in every interval you wish. At first, it will be an insignificant change, but as time passes, you will notice a big difference.

Give yourself a reason and motivation to save as well. It is always important to plan for the future and saving for retirement could be a great point to persuade yourself to stay away from excessive spending.

11. Make investments wisely

Investment is much more than pure luck. One investment mistake could tear away a large chunk of your assets. So make sure whenever you are making decisions on investments, whether on properties or stock, think twice. It will be better for you to consider opinions from professionals and experts.

To give you some ideas, legendary investor Warren Buffett suggested to put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund, so that if the market crash, you will still be fine by cashing the 10% rather than selling the stock with a bad price.

Getting Rich the Wise Way

There are a lot more important things in life than accumulating wealth. Who wants to end up rich, unloved, lonely, and in poor health? However, if you can enjoy a balanced life and at the same time become rich, why not do so?

Taking combinations from the above suggestions may not guarantee you a prosperous future, but it will surely eliminate a lot of financial troubles in your life. With one step at a time, maybe you will also become the one you dreamed of.

Featured photo credit: Sharon McCutcheon via unsplash.com