What I learned about finances from The Godfather is you give The Godfather the money he wants and you get to keep your knee caps. That seems like a fair trade. Joy Mali, of The Washington Times and Dumb Little Man, shares more financial and credit advice from The Godfather and other classic movies:

There are three main reasons many of us watch movies:

- We watch movies to be entertained.

- We also watch movies to become aware of social and economic issues.

- We watch movies to be informed and educated.

“Films are subjective-what you like, what you don’t like,” says director Christopher Nolan. “But the thing for me that is absolutely unifying is the idea that every time I go to the cinema and pay my money and sit down and watch a film go up on-screen, I want to feel that the people who made that film think it’s the best movie in the world, that they poured everything into it and they really love it. Whether or not I agree with what they’ve done, I want that effort there-I want that sincerity. And when you don’t feel it, that’s the only time I feel like I’m wasting my time at the movies.”

Movies can help educate us on how to manage our finances and credit health. Here are six movies that not only provide lessons about money, but may also give you tips to improve your credit rating:

Wall Street (1987): “The point is, ladies and gentleman, that greed, for lack of a better word, is good. Greed is right, greed works. Greed clarifies, cuts through, and captures the essence of the evolutionary spirit.

Greed, in all of its forms; greed for life, for money, for love, knowledge has marked the upward surge of mankind. And greed, you mark my words, will not only save Teldar Paper, but that other malfunctioning corporation called the USA. Thank you very much.” – Gordon Gekko

This quote by actor Michael Douglas, playing the infamous Gordon Gekko, speaks boldly about how greed drives our country. This impassioned speech gives a nod to how important it is that we want more and more, to the point of greed. Because we want to have the ability to purchase more, we open up credit accounts that allow us to buy what we want now and pay for the items later.

These payments are tracked on our credit histories. Even the United States government goes into debt to pay for the things the country needs today and makes payments on these credit accounts.

Shawshank Redemption (1994): “Get busy living or get busy dying.” – Andy Dufresne

This award-winning film about a wrongly imprisoned New England banker sends the message that viewers might want to plan for the future, especially in these current times of economic crisis.

Maintaining stable employment, working to pay off debts, building an emergency savings fund, and checking credit history to make sure everything is in order are four things every consumer can do to help plan for the uncertain future.

This character understands if you are not living, then you are dying. In financial terms, we could view this statement as: if you are not saving then you are wasting.

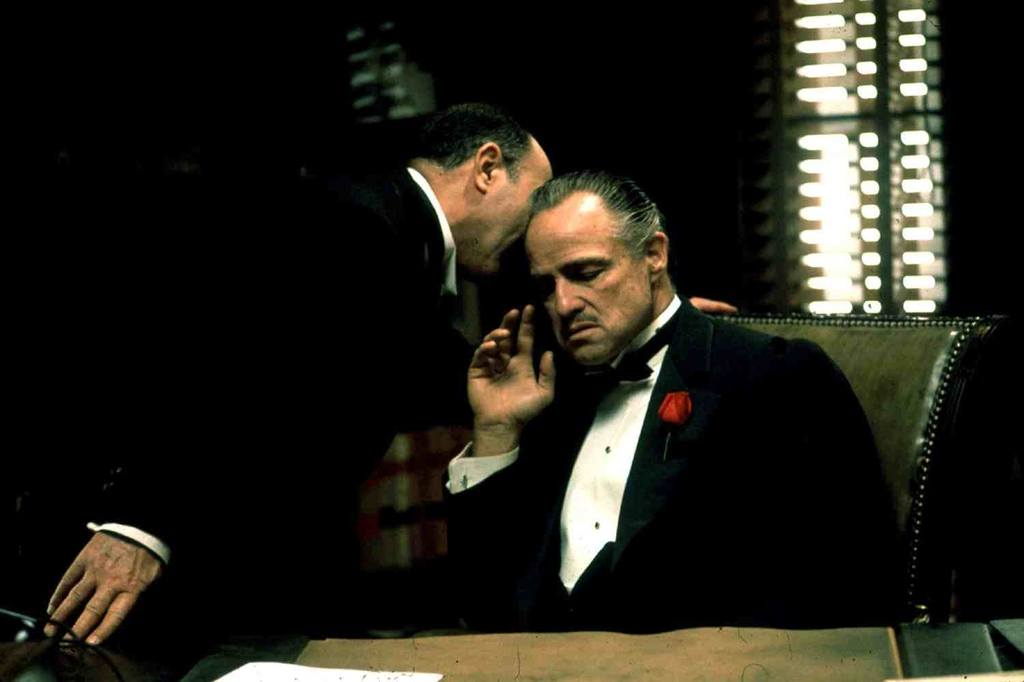

The Godfather (1972): “I’m going to make him an offer he can’t refuse.” – Vito Corleone

This timeless trilogy provides a viewpoint on money that indicates how everything has a price to be paid. Corleone is not speaking directly about monetary value when he states the above, but the statement is applicable to finances.

Every financial action we make comes with a price. If we cannot refuse the offer to open up certain credit accounts, we must also take the responsibility for paying off the debts we incur.

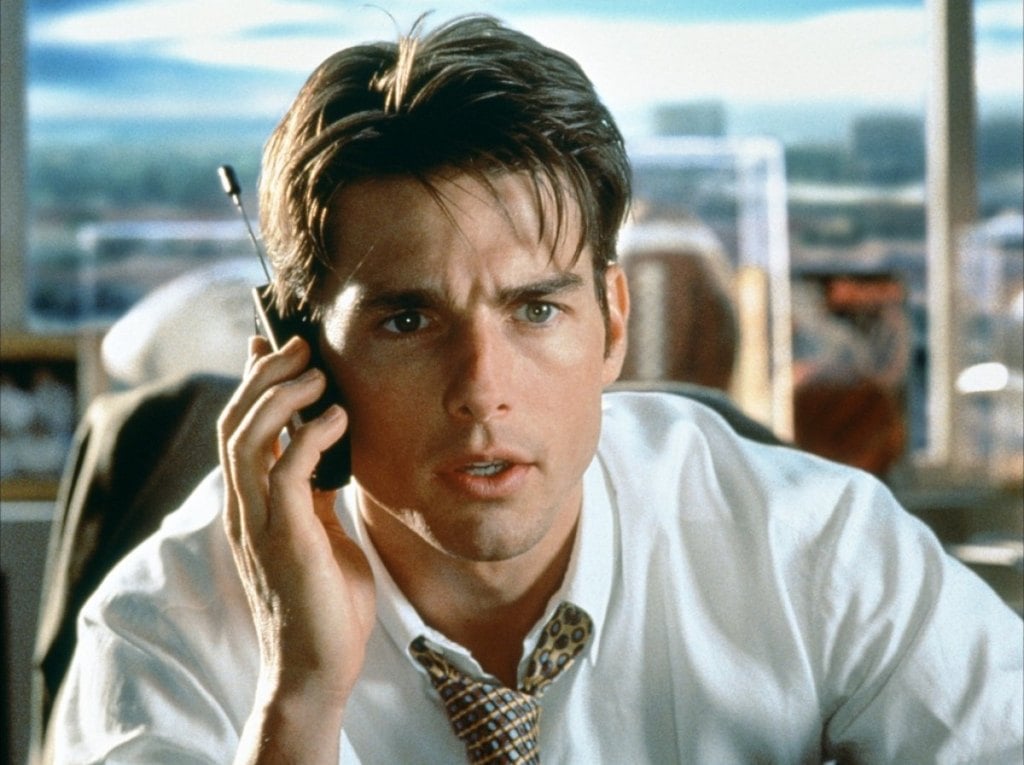

Jerry Maguire (1996): “Show me the money!” – Rod Tidwell

Athlete, Tidwell, makes this statement to his sports agent, Maguire, to motivate him to make more lucrative endorsement deals and contract agreements for him. Tidwell knows his worth, and he will not settle for less pay than his expertise and celebrity can command.

To take a page from Tidwell’s book, you can ask for the salary you deserve and show confidence that you will get it.

Field of Dreams (1989): “If you build it, he will come.” – Shoeless Joe Jackson

When you make sound financial decisions and monitor your credit, you can build a positive financial standing that can result in creditors offering to extend you credit.

Lenders tend to reward consumers with positive credit standings with even more credit lines. These are the consumers who can write their own loans, with favorable terms.

Boiler Room (2000): “And there is no such thing as a no sale call. A sale is made on every call you make. Either you sell the client some stock or he sells you a reason he can’t. Either way a sale is made, the only question is who is gonna close? You or him? Now be relentless, that’s it, I’m done.” – Jim Young

There are winners and losers in every aspect of life. In the world of money, the employee who enters the boss’ office with a well prepared request for a raise may come out the winner. This employee may know his or her worth and is willing to negotiate for a higher salary.

If the employee is less prepared, or full of self doubt, the discussion could very easily turn into a declination of the raise request. Those who climb the financial ladder to increased salaries are relentless in their pursuit of higher pay.

Joy Mali is a staff writer on The Washington Times and Examiner. Her work is also published on Lifehack, Yahoo and other mainstream sites. She likes to share interesting tips to help people manage their personal finances & credit.

Greed Is Good! How Financial Advice From Gordon Gekko and Vito Corleone Can Teach You About Credit Management | Dumb Little Man