It is the holiday season, and we are all (already) overwhelmed with shopping for our loved ones. With not much time left in shopping season, getting the perfect gift can be both stressful and expensive.

Don’t fret. I’ve compiled a list of 8 cashback shopping sites for every kind of shopper. If you are anything like me, you like to save money whenever possible. So, below is a list of cash back shopping sites that will help ease the stress of holiday shopping, and save you money for years to come. Hack shopping this Holiday Season, and visit these websites for cash back. Happy shopping, my friends!

1. Active Junky

A Cashback Shopping Site for The Outdoorsy

If you love to climb, hike, ski, bike, and/or participate in any outdoor sports, then I’ve got an online shopping jackpot for you. Active Junky features cashback deals on major brands like Northface, Patagonia, Under Armor, Spy, Moosejaw, Nike, Teva, Cabela’s, and many more. You can even use their cashback shopping deals on websites like BackCountry.com & The Clymb–where you can save up to 70% off before cashback savings. One of the other nice things about Active Junky are their interactive Gear Guides and User Reviews. If you’re an outdoorsy person, you can’t afford to ignore Active Junky!

2. UPromise

Cashback Shopping for College Education

If you are a college student, why not get cash back towards college for your holiday and everyday online shopping. Here’s how, with Sallie Mae’s UPromise:

3. SWAGBucks

Search, Watch & Shop for Cashback

SWAGBucks is cashback shopping on steroids. At SWAGBucks, you can earn “digital currency” (SWAGBucks) through a myriad of ways, including:

- Searching The Web (via SWAGBucks)

- Completing Surveys

- Shopping in the SWAGBucks Shop

- Voting in Daily Polls

- Playing Games (yes, games)

- Watching Videos

- Inviting Friends To Join

- Completing Special Offers

SWAGBucks can then be converted at varying dollar values on your favorite online stores.

4. Coupon Cactus

Coupons & Cashback

One thing I like about websites like Coupon Cactus is that they offer more than one tool to save. This website features coupons (primarily from large companies), AND cashback offers on your purchase. Like most cashback shopping sites, Coupon Cactus gets paid a commission for every order you place and shares part of it with you. They are currently offering $3, just for signing up.

5. Lyoness

A Global Cashback Shopping Site

With merchants in over 45 countries, Lyoness is one of the most global cashback shopping sites online and features cashback deals from large companies and small companies. Their easy-to-use filtering system allows you to search by Location, Shopping Category, and even Cashback Type (Cashback Card, Gift Cards, Online Shopping, Mobile Gift Card, Gift Card Point of Sale).

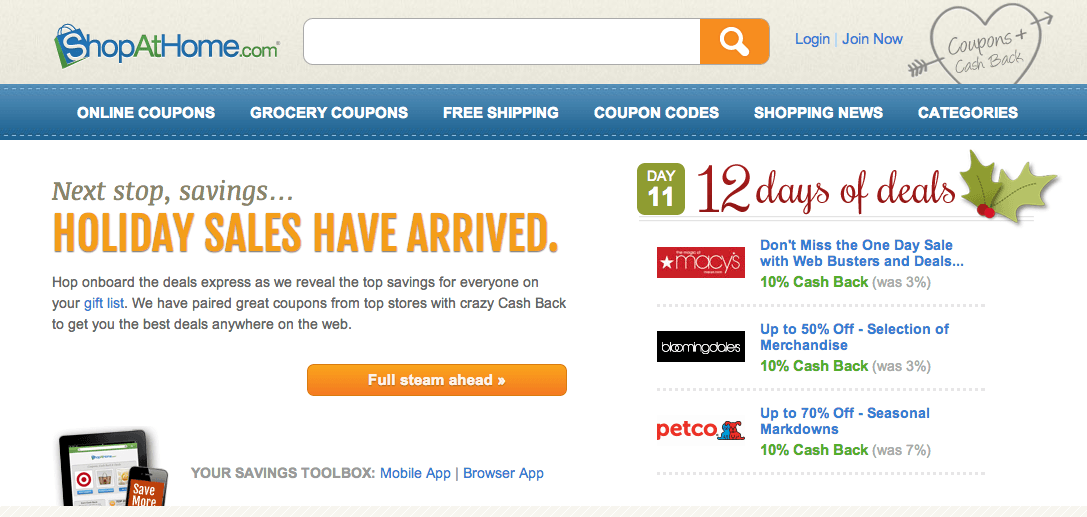

6. Shop At Home

For The Stay-At-Home Folks

4,500,000+ Facebook fans will tell you, “Shop At Home” is a great site. What I love about Shop At Home is their focus on technology. Shop At Home has an app that features Mobile-Only deals + 100,000 coupons codes and exclusive cashback deals. You can download the app off their “About Page”.

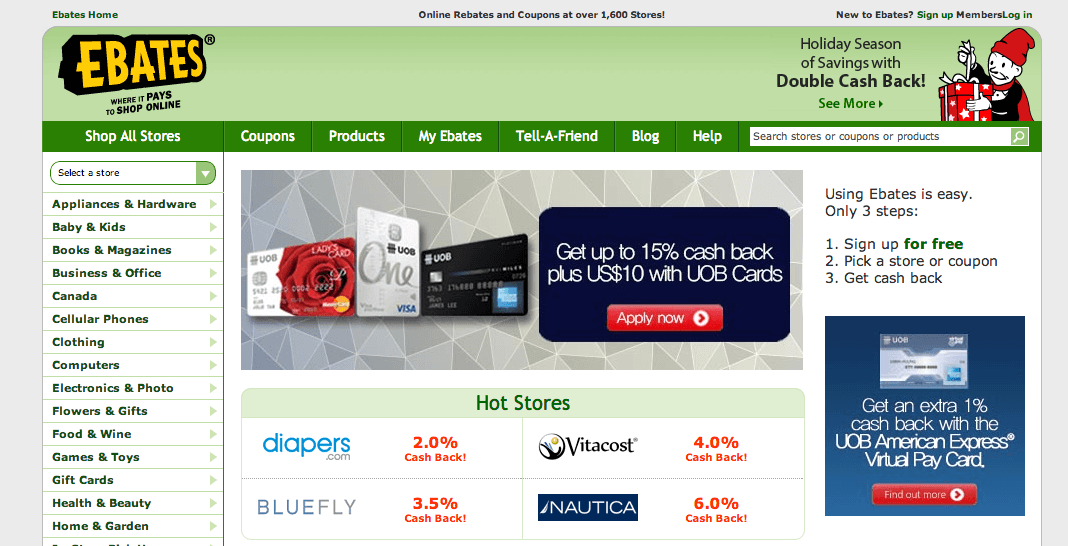

7. eBates

“The Walmart” of Cashback Shopping Sites

While eBates may be “the Walmart” of cashback shopping sites, its sheer size enables them to feature some of the larger cashback offers that you will find online–i.e. deals currently featured range from 4% cash back to 45% back.

Are you a cashback shopping site, or do you know of any sites that I’ve missed? Comment (below) with your favorite websites for affordable shopping and cashback deals.