When you hear the words “boarding school,” visions of Hogwarts or rich yet emotionally neglected children may come to mind. But what are America’s most expensive boarding schools really like—and more importantly, how much do they cost?

Well, it’s time to seriously look into launching an enterprise that will transform you into a millionaire, because you’ll find hefty tuition fees—along with amazing opportunities for your children to learn new and exciting lessons—on this list of 25 of America’s most expensive boarding schools.

1. Walnut Hill School for the Arts

The boarding tuition expense for the 2014–2015 school year is $53,000 for this private boarding high school, according to the Walnut Hill School for the Arts website. Nestled in Natick, Massachusetts, students aren’t far away from bustling Boston as they choose to study subjects such as visual arts, media arts (covering writing and film) or theater, dance and music.

2. San Domenico School

The San Domenico School is situated within the scenic hills of Marin County, California, and their total 9th- through 12th-grade tuition totals can range up to $54,800 per year. The school’s Virtuoso Program boasts an impressive list of universities that certain students of the boarding school have gone on to attend – as well as quality Marin Symphony guests.

3. The Webb Schools

The boarding student tuition for these schools—which are separated into one for only boys and another for all girls—are $53,575 for the 2014–2015 school year. If you’ve got a budding paleontologist on your hands, the Webb Schools have their accredited Raymond M. Alf Museum of Paleontology directly on their campus.

4. Blair Academy

While the name might remind us of a main character from the 1980s sitcom The Facts of Life, the annual fee for Blair Academy could turn smiles serious for those considering sending their children to the location in Blairstown, New Jersey. The boarding student costs for the 2014–2015 academic year that covers tuition, room and board is $53,600. The dorm life includes social activities like trips to the movies and holiday parties—not to mention dining services that are replete with “Blair Angus” burgers, Texas toast and a “protein zone” menu for post-athletic student endeavors.

5. Suffield Academy

Tuition for boarding students at Suffield Academy is $52,300 for the 2014–2015 academic year, but you’d better add the cost of an Apple laptop onto those fees, which is a requirement for students. Located in Suffield, Connecticut—just 17 miles north of Hartford—this school features a 20,000–volume library, a new lifestyle yoga/Pilates center named The Balance Barn, and a plethora of outdoor fields for soccer, football, softball and more.

6. Brandon Hall School

The Atlanta-based Brandon Hall School is a college preparatory boarding school that is rumored to cost $62,300 per year, and requires students to complete the application process for at least two colleges in order to graduate. This process of creating practical methods of going on to higher education is why the school boasts 100% of its students going on to attend college, so prepare to study up on cashing out your annuity in order to help your kids make the grade for this high-cost institution.

7. Brooks School

Boarding students in this North Andover, Massachusetts, school may face a tuition cost of $53,420; however, with 10 dormitories, a long list of extracurricular activities and plenty of “Afternoon Programs” in the bucolic location above Lake Cochichewick, it could be well worth the fee.

8. Cushing Academy

The 2014–2015 tuition and fee costs for Cushing Academy boarding students is $53,700—and this private school has been praised for providing 21st century leadership skills—as well as a bunch of different dorm activities (like pizza parties and powwows) that help students bond.

9. Williston Northampton School

The 2014–2015 academic year tuition for an upper school boarding student is $52,900 for the Williston Northampton School located in Easthampton, Massachusetts. The family-like environment features a merit scholar legacy program for alumni family members that meet certain stipulations and standards.

10. Hebron Academy

Students who live in the United States or Canada will pay a 2014–2015 boarding tuition of $53,900—while international counterparts outside those areas pay $56,900 to call Hebron Academy their boarding school home. With a top-class athletic center, ice-skating arena and extensive trails, this top tier school is located in Hebron, Maine.

11. The White Mountain School

The boarding tuition for the 2014–2015 academic year is $52,000 for the White Mountain School, which is perfect for those who love the picturesque and rugged countryside of Bethlehem, New Hampshire. The lessons taught in the academy’s sustainability study teach students about life from the cradle to the grave.

12. Holderness School

You’ve probably heard of Upward Bound; well, the Holderness School has a special program called Artward Bound that allows students to express themselves through all measure of artistic endeavors. The charge for tuition, room and board for this Plymouth, New Hampshire-based school for the 2014–2015 academic year is $54,100.

13. Portsmouth Abbey School

This Rhode Island school for 9th to 12th graders has a boarding tuition for the 2014–2015 academic year of $52,730. Founded in 1926 by a Benedictine monk, the Portsmouth Abbey School sits on an idyllic 525–acre campus close to the beautiful shores near Newport. With a wide range of sports and visual arts programs, the institution includes community service internships as well.

14. New Hampton School

Boarding tuition and fees for the 2014–2015 school year for New Hampton School are $53,700. The New Hampton, New Hampshire-located school offers a special international exchange program whereby a handful of students, along with a couple of faculty advisors, travel to China.

15. Wilbraham & Monson Academy

Wilbraham, Massachusetts, is the stomping grounds of the aptly named Wilbraham & Monson Academy, whose 2014–2015 tuition for upper school boarding students is $52,985. Little details make the school special, such as the “family meals” that the students have each week with other students in the dormitories in order to foster stronger relationships and learn how to serve one another.

16. George School

George School boarding students tuition and fee amounts for the 2014–2015 academic year are $53,600—an amount that will also cover room and board. Although Quakers located in Newtown, Pennsylvania, founded the school, “GS” doesn’t seek to convert children to a path of Quakerism. Instead the focus remains on fun art activities, academics and athletics—all married with a sense of understanding.

17. The Thacher School

The 125–year–old Thacher School is located in gorgeous Ojai, California; however, students get the choice to take an entire year to study elsewhere, either in the United States or overseas. The boarding tuition and fees for the 2014–2015 school year are $53,500.

18. Deerfield Academy

The total tuition costs for the 2014–2015 school year of $54,580 that boarding students pay for Deerfield Academy covers a wide range of items, such as academics, room and board—as well as lab equipment use, art supplies and lots of the weekend campus perks. Perhaps the biggest bonus of attending this school is that certain alumni go on to attend Ivy League schools such as Harvard and Yale.

19. The Masters School

Expect to shell out $55,050 for boarding costs, tuition and special event fees for the 2014–2015 school year for this Dobbs Ferry, New York, academy that houses boarding students from all over the world as well as those closer to home. Placed within 96 acres and woods that have a vantage point above the Hudson River, The Masters School is an ideal environment for learning.

20. Sandy Spring Friends School

The Sandy Spring Friends School sounds like the perfect place to meet new acquaintances and academic ideals, and for tuition costs of $54,600 for 7–day boarding of students from grades 9 through 12, plenty of opportunities for bonding arise in this school that focuses on outdoor learning and athleticism in Sandy Spring, Maryland.

21. Tabor Academy

The Tabor Academy boarding students pay $53,375 for tuition and fees during the 2014–2015 school year to learn a variety of subjects, including up close and personal marine biology studies conducted during two-week-long winter breaks in the Caribbean. Beyond that, the Marion, Massachusetts “School by the Sea” focuses on language arts, athletics and a great measure of subject areas to keep interest from waning.

22. Mercersburg Academy

Count notable actors such as Jimmy Stewart and Benicio del Toro—both Oscar winners—among the illustrious former students of Mercersburg Academy in Mercersburg, Pennsylvania. And while you’re counting, plan for tuition, room and board costs of $52,700 for the 2014–2015 school year for this 300–acre campus that prides itself on birthing students that go on to attend highly competitive colleges.

23. Oregon Episcopal School

At the Oregon Episcopal School in scenic Portland, Oregon, tuition for the 2014–2015 school year is $53,498 for boarding students in the 9th through 12th grades. The combination of small class sizes and an emphasis on global exchange programs along with college prep instructions makes this a valuable place to pick up values and educational skills.

24. The Winchendon School

The Winchendon School costs $54,080 for boarding tuition and fees for the 2014–2015 school year, and for that cost, “The Winch” provides its attendees with a big education in digital literacy, top-notch athletics, arts and college-prep classes at the New England boarding school.

25. St. George’s School

Rounding out the list is St. George’s School, another Newport, Rhode Island-helmed boarding school that costs $54,100 for the 2014–2015 academic year for boarding students. “Because the journey matters,” reads the tagline of this Episcopal school by the sea that allows more than half a dozen students to travel the Atlantic shoreline on board Geronimo, a large marine research vessel. Perhaps the pledge to act with truthfulness and honor in the student’s honor code is what draws parents the most to this learning facility—along with all the additional academic and spiritual offerings.

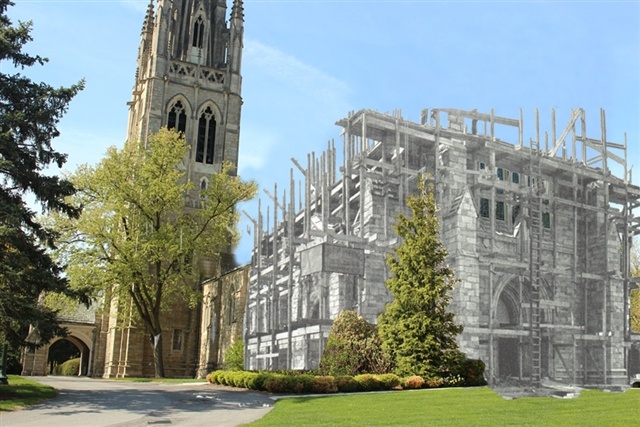

Featured photo credit: Suffield via media.cdn.whipplehill.net