Want to make money online? Becoming a YouTuber could be a good choice.

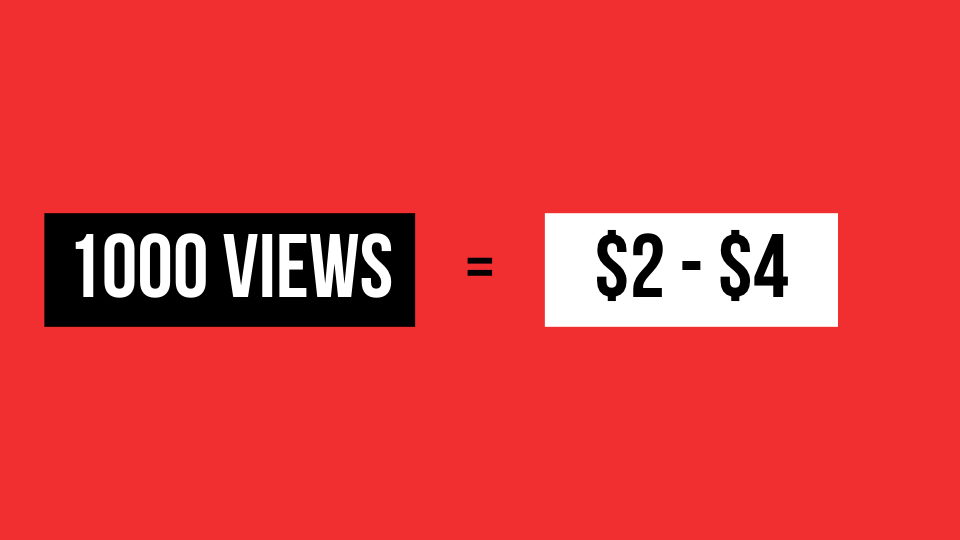

YouTube gets more than one billion unique users a month: that’s a huge audience.[1] Many people are already making money there: YouTube boasts one million creators in its YouTube Partner Program alone. With every 1,000 views, you will be able to get an approximate return of $2-$4.This might not seem a lot, but if you consider making 100 videos with 5,000 views each, that would already be $1,000-$2,000. That would be a decent amount of money.

However, it may not be that easy from now on. YouTube has applied a rule to the partner programme. Creators won’t be able to turn on monetization until they hit 10,000 lifetime views on their channel as an effort to remove bad actors in the community.[2] This is a heightened threshold for creators who want to earn a living from YouTube.

Having a million views on a video is nowhere near simple. Luckily, income does not flow only from YouTube revenue or ads, there are also other ways.

See YouTube as a facilitator to make money, not a monetizing platform.

It’s easy to get started, simply use Google’s Creator Playbook. But it’s more challenging what you do with it afterwards.

If you want to start a journey on YouTube, do not see it as a monetizing platform, rather, view it as a catalyst to further your income source. Here are some ways on how to make money on YouTube:

1. Use YouTube to get traffic to your website and blog.

If you’ve got a website or blog which brings in income, you need traffic.

Many websites were hard-hit by Google’s Panda, Penguin and Hummingbird updates. If this happened to you, you’re hurting. You can use YouTube to not only regain traffic, but also increase it.

Get started with the Creator Playbook. Once you’re set up, consider repurposing some older content into videos, as well as creating new videos. Make sure that you link to your own website in the first line of your video descriptions, so you can funnel your YouTube traffic to where you want it to go.

▲ The School of Life is an example of getting traffic from YouTube to their own blog.

2. Create products and promote them on YouTube.

If you’re creating your own products or would like to, YouTube offers unlimited ways for you to promote your products and make sales. Products you can create include ebooks, apps, art, and music.

Create your products, and add them to a shopping cart. Then use YouTube to promote them. Add a link to your product in your video’s description, so that viewers can buy.

3. Sell others’ products as an affiliate marketer.

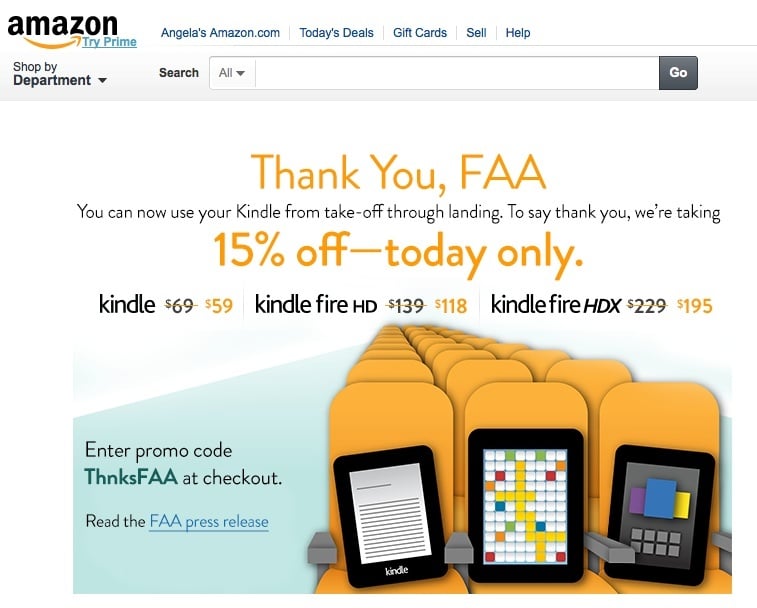

“Affiliate marketing” means selling products in exchange for a commission. Hundreds of thousands of companies offer attractive deals to affiliate marketers who promote their products, including huge companies, like Amazon and eBay, as well as smaller companies.

Additionally, there are many affiliate networks you can join. These networks include ClickBank, Commission Junction, and ShareASale.com.

▲ Amazon’s affiliate program

To make money from YouTube as an affiliate marketer, review your affiliate products on video, or create “how to use this product” tutorials. Don’t forget to link to your products in your YouTube descriptions – make sure you’re using your affiliate link, or you won’t get credit for sales.

4. Create a Web TV series.

Love telling stories? YouTube lets you create your own Web TV shows. You’re limited only by your imagination… and your budget.

You can create a comedy series, a drama series, or your own talk show. Be aware that YouTube limits your show’s length to 15 minutes. To upload longer videos, you’ll need to increase your limit.

If you’re a frustrated TV or screen writer, get a few friends together, and record your own TV shows. You never know. If you get lots of views, you may develop a new career.

▲ Smarter Every Day is a web TV series example

5. Become a YouTube personality.

YouTube stars can make a lot of money.[3] PewDiePie, despite having lost major advertisement recently, remains number 1 of the highest-paid YouTube stars with $15 million in 2016. It was estimated that he could receive over $13,000 for a week of publications.

If you’ve got quirky ideas, or are passionate about your interests, develop your YouTube channel. You never know, you may be the next YouTube star.

▲ PewDiePie is famous for doing game review

6. Monetize your videos with the YouTube Partner Program.

After you’ve created several videos, it’s time to join the YouTube Partner Program. All you need to do is enable your channel for monetization, and you’ll receive your share of the income from advertising on YouTube.

Just as the YouTube stars do, you’ll get paid for each thousand views on your videos. Click this link to get started – your first step is to verify your channel.

7. Teach: share your knowledge with tutorials.

Tutorials are huge on YouTube. If you know how to do something, you can teach others, and make money from your videos. Beauty videos are popular. Michelle Phan, for example has over 1.3 million views.

▲ Michelle Phan is famous for doing online makeup tutorials.

8. Test-market your products.

YouTube is an amazing resource for market research – you can soon discover whether your brilliant, innovative idea is likely to be profitable.

For example, if you’ve got an idea for a product, but need funding, create some videos before you create a Kickstarter.com campaign. The views and comments on your videos will tell you whether your idea is viable in its present form. The YouTube audience can even help you to make it viable, so that your efforts to get funding are successful.

9. Become an expert on metadata: use keywords to get an audience.

One hundred HOURS of video are uploaded to YouTube every MINUTE.[4] This means that there’s a huge competition for attention. You need to do everything you can to ensure that your videos get found. Your videos’ meta data will help.

“Meta data” is data which gives information about your videos. In its Creator Playbook, YouTube tells you how to create your meta data:

To maximize your presence in search, promotion, suggested videos and ad-serving, make sure your metadata is well optimized – your video’s title, tags and description

Optimizing your videos for search makes the difference between success and failure, so be sure to do it.

10. Build your brand using YouTube.

As marketing guru Tom Peters pointed out way back in 1997, you’re a brand, and you have power.[5] YouTube helps you to amplify YOU.

Whatever you’re doing, and whatever your job, YouTube can help you to become known for your strengths, and make money. Even if you have no clear idea on how you could make money on YouTube, get started creating videos about your interests.

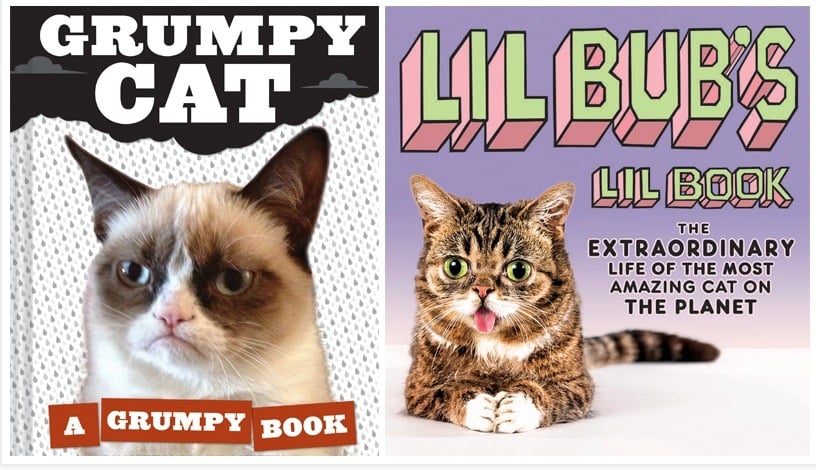

You may just stumble across a gold mine… just as the people who turned their pets into stars have done.

11. Turn your child or pet into a star (and make money).

Two cats, Lil Bub and Grumpy Cat, started out on YouTube, and have become worldwide stars, with book deals.[6]

▲ Grumpy Cat and Lil Bub

As Forbes points out,[7]

“You do not have to be a singer to become a YouTube star. If you are lucky, you could shoot a video of your child, pet, or a double rainbow that strikes a chord and goes viral.”

So keep your video camera handy. If you see something cute, video it, and upload the video. (Don’t forget the meta data.) You never know who or what will be the next video sensation. Create that sensation, and you’ll make money. So there you have it – eleven creative ways you can make money on YouTube.

12. Scheduled videos

It would be much more easy for viewer to catch your content if you publish it in a specific timeframe in a regular basis. It might also make them more tending to following your channel, which is to subscribe to you.

It is crucial to have base audience which would always come for your content so that you can ensure your number of views for each video. This also is ensuring a steady amount of income.

13. Crowdfunding

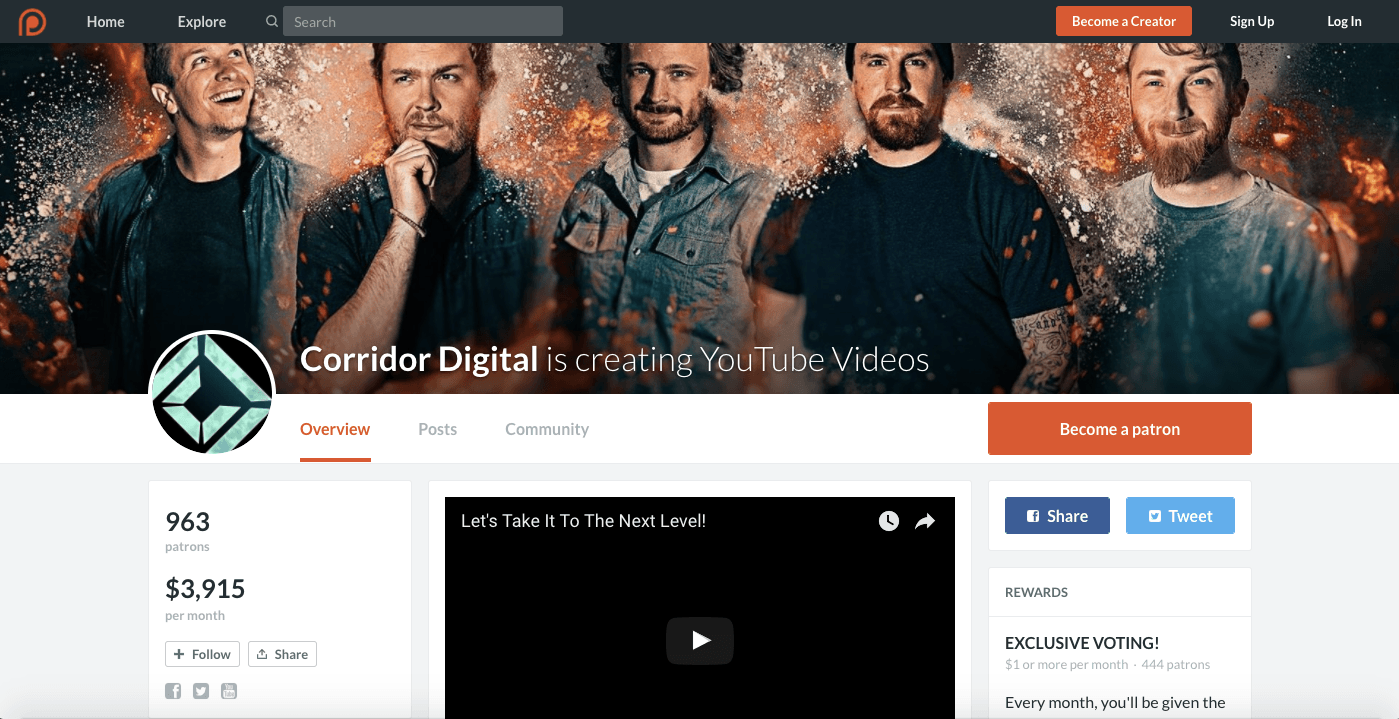

Crowdfunding is becoming more and more common with the introduction of Kickstarter and Indiegogo. It could be a great source of money if you have a great idea for a media project on YouTube. Not only does it generate your initial fund, it also contributes to establish audience and revenue for your project in the future.

For example, famous YouTube channel Corridor Digital uses Patreon as a way to fund their videos or movie projects, with return of special perks for these supporters.

▲ YouTube Channel Corridor Digital

14. Seek sponsorship

Lots of company nowadays provide sponsorship to YouTube channels for direct advertisement. A common source would be Audible from Amazon which frequently sponsor knowledge-giving show such as Vsauce and Veritasium. The good thing about it is that you can directly receive the sponsored amount rather than splitting it with YouTube.

To reach for a sponsorship you might need to work on a detail proposal about the things you are able to provide. Make sure you know well about your audience and the brand you are approaching.

▲ Example of sponsorship for YouTube Channel

Bonus Tips!

Measure your earning goals

It is important to check your progress regularly in order to tell if you are still on the right track in terms of finance.

Sets goals for yourself to measure. If you are not meeting the goals. the current way for income may not be working for you, or that the quality of the videos are falling . It might be a signal for you to work on some changes.

Be creative

Quality content is always the key to attract viewers. And to have high quality content you can never be lack of creativity.

The internet is changing so fast that a trend can come and go within a week. New ways for you to gain extra revenue could pop up without you noticing.

So be creative with your use of resources. Always explore new ways and ideas for production and you may have unexpected returns.

Reference

| [1] | ^ | Youtube Statistics |

| [2] | ^ | The Verge: YouTube will no longer allow creators to make money until they reach 10,000 views |

| [3] | ^ | Mail Online: The Top 10 Highest Paid YouTube stars of 2016 |

| [4] | ^ | Youtube Statistics |

| [5] | ^ | Tom Peters: The Brand Called You |

| [6] | ^ | USA Today: Lil Bub and Grumpy Cat claw their way into bookstores |

| [7] | ^ | Forbes: 5 Ways To Get Rich Online |