How often have you had the experience of needing to make tough decisions that pull you in different directions?

You go round and round in circles, and in the end, you either make a snap decision or put off reaching a decision indefinitely because you’re just too tired to think anymore.

The stress and overwhelming emotions that simultaneously compel you to make a decision and make you unable to do so is labeled as decision fatigue. Poor decisions are made not because of incapability but because arriving at one or more choices takes its toll. It also severely weakens your mental energy over time.

This phenomenon isn’t restricted to judges overseeing high-stakes cases or doctors making life-saving calls—everyday situations can lead to decision fatigue. Whether it’s picking what to wear, deciding which route to commute, planning out daily errands, or choosing a health insurance plan, your mental reservoir can only handle so many decisions before it begins to run low.

In this in-depth article, we’ll dissect what decision fatigue is, why it happens, its detrimental consequences, how to identify it, the difference between normal decision fatigue and deeper, chronic issues, and the strategies you can employ to prevent or mitigate it.

Table of Contents

- What Is Decision Fatigue?

- Why Does Decision Fatigue Happen?

- The Detrimental Consequences of Decision Fatigue

- Are You Suffering From Decision Fatigue?

- Signs and Symptoms

- What Decision Fatigue Isn't

- How to Beat Decision Fatigue

- Practical Ways to Prevent Decision Fatigue

- When to Seek Professional Help

- Final Thoughts

What Is Decision Fatigue?

According to Dr. MacLean, a psychiatrist and featured physician in the American Medical Association:[1]

> “Decision fatigue is the idea that after making many decisions, your ability to make more and more decisions over the course of a day becomes worse. The more decisions you have to make, the more fatigue you develop and the more difficult it can become.”

When our cognitive processes are taxed by excessive decision-making, we experience a gradual depletion of mental energy. This depletion impairs our ability to carefully weigh trade-offs and consequences. The result: We might avoid decisions altogether (procrastination), choose impulsively based on what seems simplest, or rely on shortcuts that might not serve our best interests.

Real-World Example: The Parole Board Study

To explain the concept of decision fatigue, let us look at an often-cited example: parole board judges. In 2012, a research team from Columbia University examined 1,112 court rulings by a Parole Board Judge over ten months.[2] The judge had to determine whether individuals would be released from prison, granted parole, or have their parole terms changed.

While the facts of the case often drive decision-making, the study found the judges’ mental state had an alarming influence on their verdict.

The research showed that earlier in the day, the likelihood of the judge giving a favorable ruling was around 65%.

However, as the morning dragged on, the judge became fatigued and drained from deciding. As more time went on, the odds of receiving a favorable ruling decreased steadily until it was whittled down to nearly zero.

Right after their lunch break, the judge would return to the courtroom feeling refreshed and recharged. Energized by this second wind, leniency skyrocketed back to 65%—only to taper off again as the day drew to a close.

This conclusion was consistent across all 1,112 cases, regardless of the severity of the crime. The study highlights how crucial mental stamina is in decision-making.

Why Does Decision Fatigue Happen?

Decision fatigue can happen to anyone but often intensifies when:

- You Make Frequent, High-Stakes Decisions: Surgeons, judges, and executives are extreme examples, but many jobs require numerous quick (and important) decisions on a daily basis. On the home front, caring for children or family members can similarly feel like an endless stream of choices, adding up quickly.

- Your Decisions Impact Other People: The more people that a choice affects, the greater the pressure placed on the decision-maker.

- You’re in a Difficult Life Situation: Relationship challenges, financial woes, or major health concerns can compound the psychological burden.

- Uncertainty Looms: When not enough information is available (as in the early days of COVID-19), day-to-day choices can feel overwhelming.

- You Have Perfectionist Tendencies: Those who strive for perfection in each decision inevitably wear themselves down.

In an era marked by countless options (e.g., streaming services, job offers, technology upgrades), it’s no wonder decision fatigue is increasingly common.

The Detrimental Consequences of Decision Fatigue

When you’re just too tired to think, you stop caring—sometimes referred to as compassion fatigue in high-stakes roles. Decision fatigue can manifest in:

- Poor Decision-Making: Opting for the quickest or easiest option rather than the best.

- Impulsivity: Impulse shopping, overeating, or other snap choices to avoid deeper thought.

- Procrastination: Avoiding decisions altogether, causing delays and mounting responsibilities.

- Mental and Emotional Exhaustion: Heightened irritability, mood swings, or anxiety.

- Work and Relationship Strain: Poor or delayed decisions can create tension both personally and professionally.

According to George Lowenstein, an American educator and economy expert, decision fatigue is to blame for poor decision-making among members of high office. The day-to-day stresses at work and in private life can drain mental resources, leading to mishandled decisions.

Are You Suffering From Decision Fatigue?

We all suffer from decision fatigue without even realizing it. Perhaps you aren’t a judge with someone’s life at your disposal, but the day-to-day decisions you make can still drain your mental energy.

Like every other muscle, your brain grows tired after prolonged use. One clear sign is a recurring feeling of overwhelm or noticing that you’re making trivial errors or subpar choices later in the day.

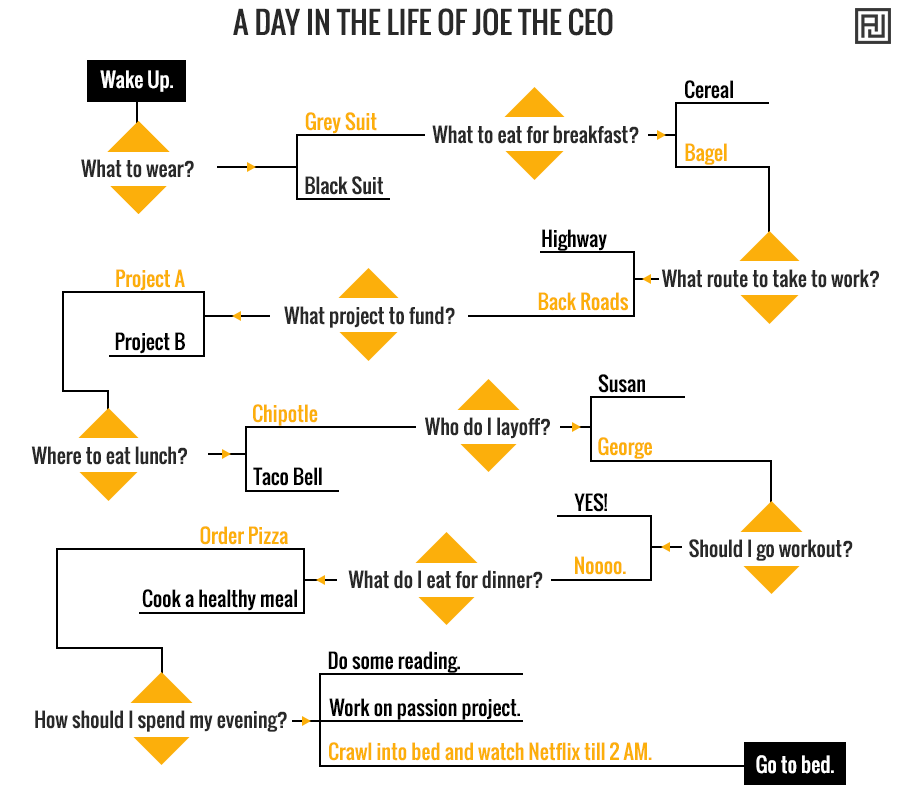

The chart below may resemble your typical day.[3]

Now that we’ve defined decision fatigue and seen some examples, let’s explore tangible ways to combat it.

Signs and Symptoms

Short-term decision fatigue often manifests in:

- Procrastination or Avoidance: Delaying tasks because making a decision feels overwhelming.

- Impulsivity: Snap decisions like late-night online shopping or fast-food binges.

- Exhaustion and Brain Fog: Trouble focusing or frequent forgetfulness.

- Irritability: Finding small triggers intolerable.

- Feeling Overwhelmed: A sense that you can’t keep up.

- Lingering Regret: Worrying and second-guessing choices.

- Physical Symptoms: Headaches, tension, or upset stomach.

If you’re experiencing any of these regularly, you may be dealing with decision fatigue.

What Decision Fatigue Isn’t

Decision fatigue is typically an acute phenomenon—something that happens in bursts when we’re overburdened by decisions. Once you get a good night’s sleep or pass through a busy period, your decision-making capacity usually returns.

If you notice constant indecisiveness, anxiety, or significant distress making even minor choices, you might be dealing with something beyond decision fatigue (e.g., anxiety, depression, or burnout). A mental health professional can help distinguish the root cause.

How to Beat Decision Fatigue

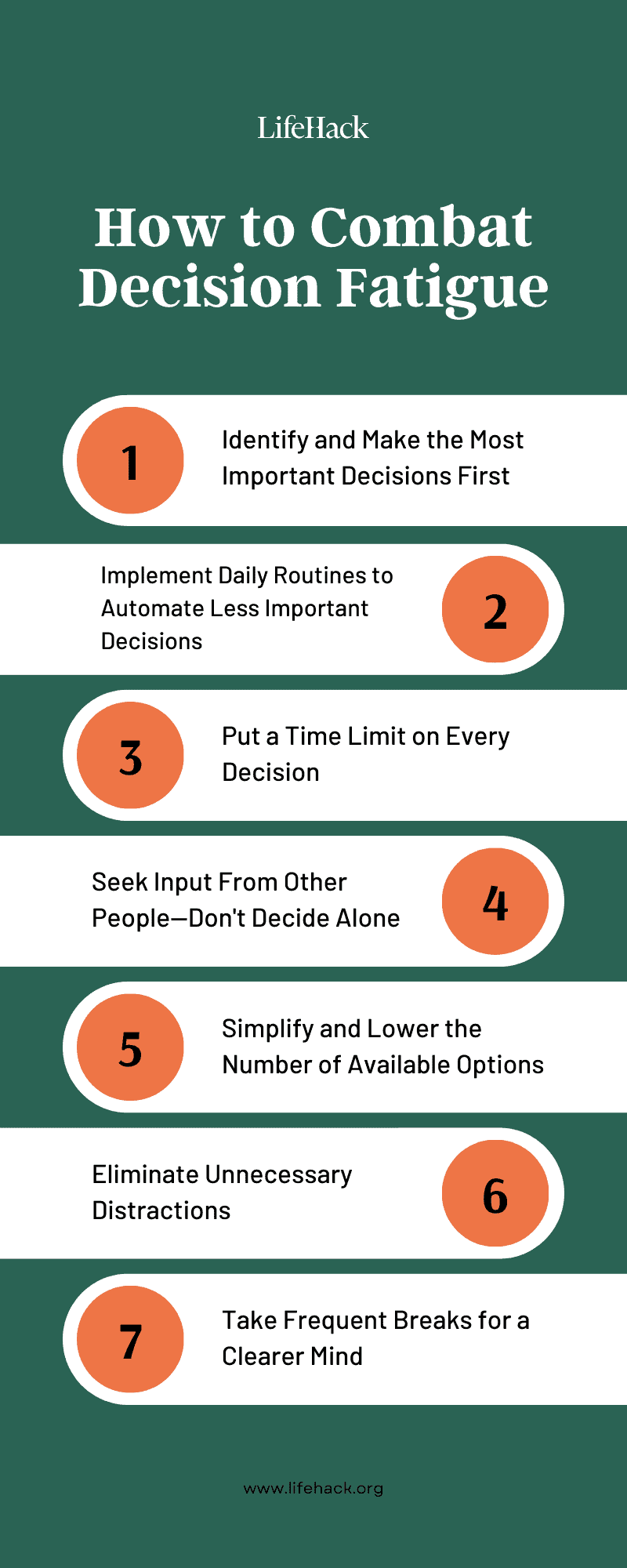

Two possible ways to overcome decision fatigue are either altering the time you make decisions (when your mind is fresh) or limiting the volume of decisions.[4] Below are seven key strategies.

1. Identify and Make Key Decisions First

If you have a busy personal or work life with multiple pressing decisions, start your day or your most focused time by tackling the most critical ones. Write them down, then prioritize.

This prevents the spiral of decision fatigue before it sets in.

2. Automate Less Important Decisions

Small decisions can eat away at your productive energy. Automating repetitive choices—from daily meal prep to a minimal wardrobe—frees your mind for more significant decisions. Powerful individuals like Steve Jobs or Mark Zuckerberg have famously used this strategy to focus on what truly matters.

3. Put a Time Limit on Decision-Making

Research shows you’re often most productive in the first few hours of your day.[5] Don’t waste that window on trivialities. Set a time limit, decide, and move on.

Grow in Confidence by Reducing Hesitation

Once you’ve made your decision, don’t look back unless new information arises. This builds self-confidence and momentum. Confidence comes from trusting your own judgment.

4. Seek Input and Delegate When Appropriate

You don’t have to make every decision alone. Collaboration with friends, family, or colleagues can lighten the cognitive load. Delegating when others are capable also prevents overextending yourself.

5. Simplify and Reduce Options

Too many options can overwhelm and cause decision fatigue—classic “choice overload.”[6] Narrow down choices by using filters or binary outcomes (Yes/No). If you’re grocery shopping, for instance, limit yourself to a few brands rather than scanning an entire aisle.

6. Eliminate Distractions and Preserve Focus

Your attention is precious. Constant pings and notifications deplete mental resources. Schedule deep work blocks, mute notifications, or use do-not-disturb mode. Minimizing disruption helps you tackle important tasks with clarity.

7. Take Frequent Breaks

Judges in the parole study made better decisions in the morning and after lunch. Roy Baumeister’s research suggests low glucose levels negatively impact decision-making.[7] Short breaks and quick, healthy snacks can replenish energy.

Research also shows that working for roughly 50 minutes followed by a 15-20 minute break maximizes productivity.[8]

Practical Ways to Prevent Decision Fatigue

Combating decision fatigue isn’t only about managing decisions in the moment—it’s also about creating a lifestyle that protects your mental reserves.

1. Prioritize Sleep and Downtime

Lack of rest makes you more vulnerable to impulsivity and poor judgment. Ensure you have regular sleep hours and screen-free breaks to recharge.

2. Manage Stress with Intentional Activities

High baseline stress drains mental energy from the get-go. Mindfulness practices, journaling, or hobbies can help alleviate your stress load.

3. Build Self-Care into Your Schedule

Self-care is not selfish. Scheduling short “me time” ensures you have space to decompress and maintain mental clarity.

4. Stay Physically Active

Exercise improves executive function, boosting your capacity to make sound decisions. Even brisk walks or desk stretches help break monotony and revitalize the mind.

When to Seek Professional Help

Decision fatigue, when acute, should fade once you rest or leave a busy phase behind. However, if you chronically feel anxious or overwhelmed, consult a mental health professional. They can rule out conditions like anxiety, depression, or burnout and provide targeted strategies.

- Signs You May Need Help:

- Ongoing indecision or fear of making even minor choices.

- Persistent anxiety or mood issues.

- Physical symptoms like chronic headaches or insomnia tied to decision stress.

Final Thoughts

Decision fatigue is a real phenomenon that can deplete energy levels and raise stress. It affects everyone—from top executives to busy parents—whenever the sheer volume or complexity of decisions outstrips mental resources.

Overcoming decision fatigue requires patience and commitment. By putting into practice the strategies discussed here—automating trivial decisions, scheduling breaks, minimizing distractions, and seeking support—you can protect your cognitive bandwidth for the decisions that truly matter.

In doing so, you’ll discover a greater sense of focus, higher productivity, and the mental resilience needed to navigate life’s challenges with confidence.

Reference

| [1] | ^ | American Medical Association: What doctors wish patients knew about decision fatigue |

| [2] | ^ | PNAS: Extraneous factors in judicial decisions |

| [3] | ^ | Medium: Everything You Need To Know About Decision Fatigue |

| [4] | ^ | FlexRule: Decision Automation |

| [5] | ^ | The BRC Academy Journal of Education: Productivity: Time of Day, Day of week, and Morningness Effects |

| [6] | ^ | Behavioral Economics: Choice Overload |

| [7] | ^ | The New York Times Magazine: Do You Suffer From Decision Fatigue? |

| [8] | ^ | TIME: The Exact Perfect Amount of Time to Take a Break, According to Data |