“Cash rules everything around me, cream get the money, dollar dollar bills ya’ll”, are famous lyrics rapped by none other than the infamous hip hop group the Wu-Tang Clan. Albeit, not overly eloquent in its execution, the sentiment is undeniably true. Pretty much every step in our life is governed by our monetary circumstances, meaning that balancing the books is a fine art.

So, if you’re not one of the lucky few who was born into an oil baron’s family or you didn’t invent a social media page that went bonkers, you’re probably apart of huge crop of individuals experiencing the challenge of getting on top of payments and struggling to save.

When looking at the old bank account, the knot in your throat might be suggesting a visit to a public library or prompt you to Google, “free things to do in my city this weekend” as a few tears pour out, (but only a few, the lack of sustenance you can afford will only produce so much!) Don’t fear, unless you live in Mogadishu or Kabul, there are plenty of ways to live like the Wolf of Wall Street and still fulfil your cash money goals.

So, where to? It all starts with budget and planning. Yes, the old ‘budgeting’, approach. No doubt we’ve all heard this method a hundred times from parents or that annoying accounting student we all know. It’s constantly mentioned for a reason; it works. It doesn’t matter if you’re earning mega benjamins or only a few, you have to look at what is coming in versus what is going out.

This helps you work out where you money is going and can then help you develop a strategy to start racking up pennies. Once you got a budget, you can then plan expenses by planning your life. You can plan a week of meals, transport, social hangs, whatever, meaning there will be no surprise costs that strike up like a jack in the box leading you to sing for extra coins at the train station.

We all have essentials and desirables. One obviously takes a bigger priority for quality of living, but here a few tips to merge those wants into your everyday hustle.

1. Eats

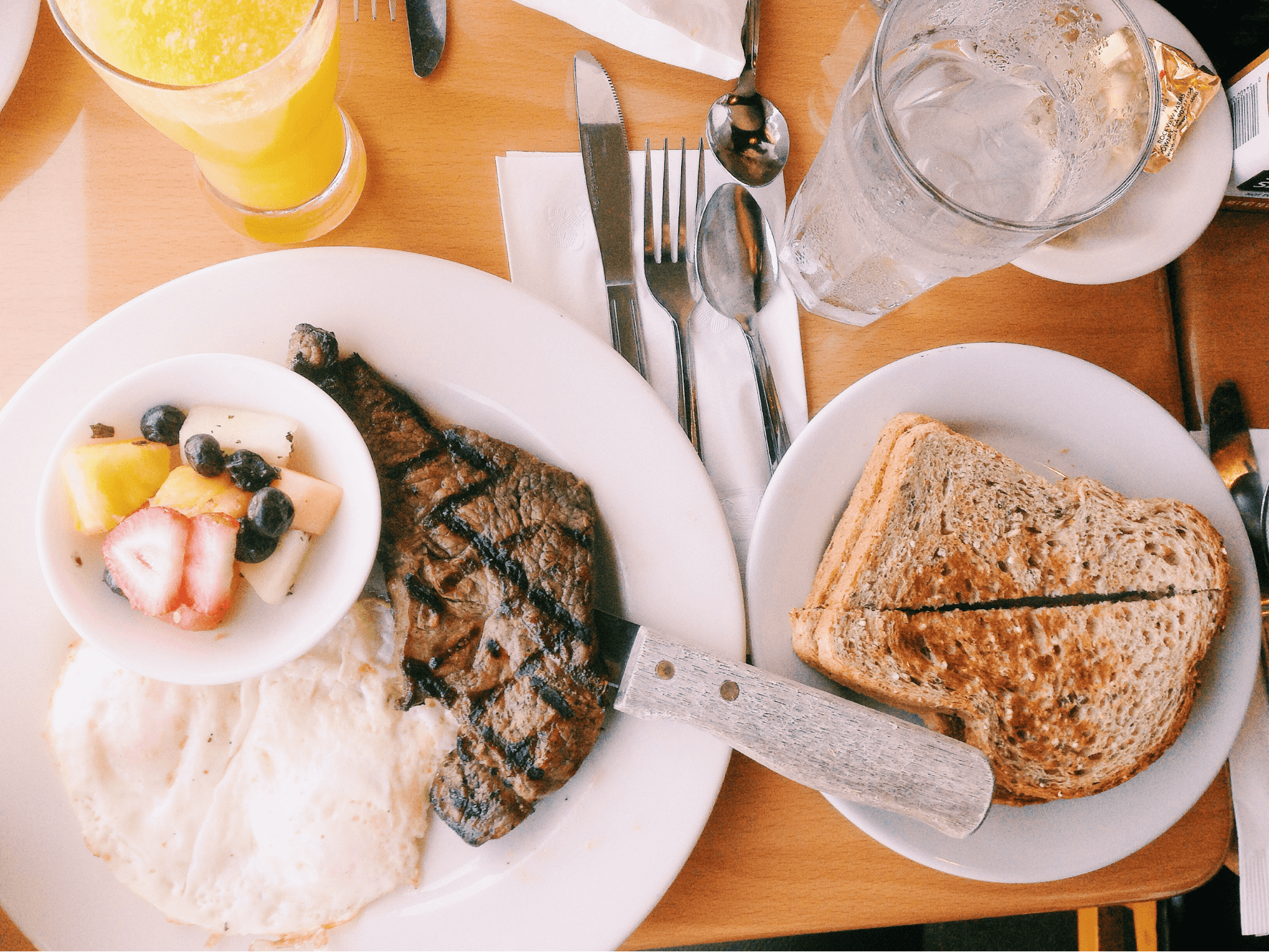

We all gotta eat. For your everyday life though, buy in bulk. With your grocery expenses buy for most meals of the week. Leave a few meals spare for eating out with mates and/or romantic mates. Yes, I feel ya, you’re probably thinking,”Eating out?! Isn’t that the worst? So expensive”. You’re not wrong, however don’t worry, I got you. As long as you’re not dining out everyday, there are plenty of ways to eat out on a budget.

First move, get on social media, no not to perve on hot people or watch funny cat videos, get on there and follow any local restaurants, bistros, diners, bars, if it serves food, follow it. Food businesses and eateries are always posting deals, ranging from 2 for 1’s, discount hours, special offers, events, it’s how they market and build customers, why not take advantage?

For budgeting purposes you can save bulk dimes and still enjoy the luxury of someone else cooking you up a feast.

2. Stay Fashion Relevant

You might remember that moment at school when you’re sported new sneakers or mad clothes and the whole class was like “Damnnnn!!!!”. Contrarily, you also might remember that moment where you got picked on for wearing daggy threads or looking like a Kmart mannequin. Fearing that the latter may come again due to budget constraints? Stay calm, a world of affordable and trending fashion is out there.

Companies like Asos, H&M, Zara, the Iconic, present magic and freaking awesome options for styling up a storm. Forget about the last catalogue of Abercrombie and Fitch and Ralph Lauren, you can pick up quality plain tops, sweaters, shirts, pants, jackets, shoes for anywhere between $10 to $40 and look fit for anything from a fashion show to an ivy league party.

The rise of the hipster and serious gentrification has meant picking up second hand apparel is also a cheap and stylish option. Fortunately, op shops are everywhere so get rummaging. The world of fashion is no longer all about labels, it’s about style and there a plenty of sources available to maintain yours on a budget.

3. Date Nights

Candlelight: the perfect real-life Instagram filter.

You don’t have to hire Hitch to spark romance or maintain it. Staying in with your significant or attractive other provides great ways to inspire love, cuddles, romance and even savings on the finance scene. Ever heard of “Netflix and Chill?” Yes, while the term has its dubious associations, it is a darn impressive service full of great, versatile content for just over $10 a month. There’s something for everyone and every mood.

Cosy up on the couch and watch classics or discover new favourites. Don’t hesitate to follow your local cinema on social media if you prefer a bigger screen, just like restaurants, they’ll be promoting hot deals too. Or, If you happen to be a Masterchef, cooking in at home can serve up a dish of good times and speaks for itself when saving cash.

If you’re going to, make something edgy like burritos, arancini balls, something that is fun. Pair this with a bottle of wine or drink of preference, light a few cheap candles, dim the lights and voila, you’re on your way to recreating a scene from The Notebook. To throwback a few paragraphs, pair your date/s with a local dinner deal, even better!

4. Bulk Gains, For Less Cash

Provided you’re not living under a rock or militantly disbelieve basic science, exercise is pretty important when it comes to your health. Luckily, we live in a time of #fitspiration. In a nutshell, you don’t have to fork out bags of cash to stay fit and healthy, nor have you ever had to. There are plenty of cheap, small 24 hour gyms that offer more than enough for your everyday sweat and shred production.

If budget doesn’t permit, your heartbeat can still be increased by more than just your financial anxieties. The internet is a great place to resource intel on exercise. Take notes, then hit your local park or lounge room floor and get sweating. Remember that push-ups, sit-ups, squats, running are all free and still widely used in military and professional sporting team programs. Last I checked, those guys are pretty cut.

If you’re chasing zen, check your local council or shire as many throw free Yoga and Tai Chi classes. For more #healthyliving tips on the cheap, follow fitness fanatics or athletes on social media outlets to get even more daily workout and exercise tips. Do you even lift? No excuses.

5. Grind and Hustle

“I need a dollar, dollar, dollar man what I need,” Aloe Blacc isn’t wrong. Having an actual income when assessing finances and budget is a pretty good start, (obviously). But if you’re unlucky enough to be working hard for less, or just need more capital on top of your paycheck, the world is your oyster to make a few extra scraps.

With a global service like Uber, you can drive up the figures displayed in your bank account. All you need is a car that meets the required specs imposed by Uber, and then let the extra cash floodgates open. If you’re not riding dirty in the vehicle game, there are plenty of creative alternatives.

For example, roll deep with a couple of canines providing your own dog walking business. Not only does it give you great company, it’s also a method to integrate fitness while earning dosh. If you’re one of those weird people allergic or just don’t happen to like pooches, look to jobs posted on things like Gumtree or Craigslist. House-sitting, cleaning or even selling some of your possessions are easy and generally stress free ways to generate remuneration.

Failing these options, pick up a part-time job at a bar or restaurant, a fantastic place to earn wages, get cash tips, and socialise. Eat, sleep, earn, repeat

Alright, we may have overstepped the mark when saying live like royalty. Unfortunately that privilege is only destined for a select crop of lucky individuals. So if you’re eating rice in the dark in your apartment, with bills coming in while seeing your friends tagged in photos out and about, turn that frown upside down.

There are countless methods to live a stimulating and adventurous life on a budget. Need help budgeting? Why not seek out a professional wealth advisor, the pay-off from an investment like this could be the ticket you need to your financial success. At the end of the day, it’s your life, your money, your budget, your goals, treat yourself where you can and know full well the world offers more than just paying the man.