Every penny helps. A little savings here, a little savings there, and you could be richer than you think. Here are some money-saving tips that might help you to minimize your spending and avoid being in the red. Some of these tips will also benefit your health — so you can save money AND your life!

1. Buy fresh groceries

Having ample amounts of fresh vegetables and fruits will greatly improve your body in various ways. Studies have shown that consuming seven portions of vegetables and fruits a day is more effective at preventing diseases than the current five-a-day recommendation. Maintaining a healthy diet reduces the possibility of needing to visit the doctor, hence less medical spending. An apple a day still keeps the doctor away.

2. Make your own food and snacks

Restaurant food is generally expensive. Many restaurants serve small portions for the same price of a full meal. When you cook for yourself, you can control the portions, and you know exactly what is on your plate. Moreover, if you plan accordingly, you can save money and time by eating meals made from your leftovers. For example, pork loin, vegetables, and a package of rice cost under $20. From these ingredients, you can make a stir-fry dish with enough leftovers for several days. Depending on your appetite, you’d have healthy meals costing you about $5 each. You can also make a number of meals with any leftover rice. Here are some sites that offer a variety of recipes.

Do you snack a lot when you work? I know I do. Carrots, celery, cucumbers, bell peppers, ham, and cheese are good things to snack on. You can be environment-friendly and wallet-friendly by bringing in your own homemade snacks. Here are some of my favourite easy-to-prepare office snack recipes. Constantly buying snacks is pretty costly, so make sure you always have something to snack on when you’re out.

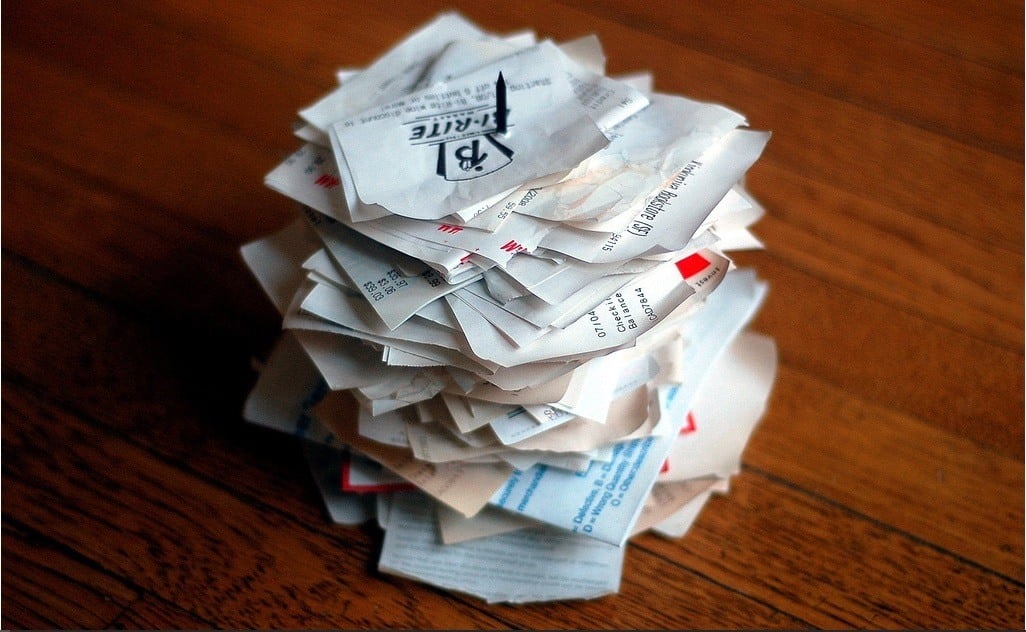

3. Keep your receipts

The receipt you keep from buying groceries is crucial to saving money. Some grocery stores separate the food into different categories, making your receipt a handy list of your perishables. Use a magnet and stick the receipt on your fridge, then highlight the items so that you won’t forget they are sitting inside your fridge. When you use up something, make sure to cross it out. This way, you won’t waste anything – and you can really get your money’s worth!

Keeping your receipts also lets you easily double-check your spending with your bank transactions online. This is useful for finding any unauthorized transactions on your account. Keep a box specifically for receipts so that you can find them easily when needed.

4. Keep a written record of the money you spent in red ink

Keeping your receipts makes it easier for you to record your spending. When you write down the amount of money you spent in red, your brain automatically recognizes that number as a “danger” or “beware” sign, which may subconsciously help you notice how much money you have been spending. In my case, I write my spending on my calendar on the day I made a purchase. When I look back at a particularly extravagant month, I cringe from seeing all the red and the next month I tend to be particularly frugal to make up for it.

5. Floss your teeth

Seeing the dentist is both costly and uncomfortable, so wouldn’t it be nice if you could minimize how often you need dental procedures? My dentist once told me that almost all cavities he has to fill are due to the patient not flossing regularly. As we eat, tiny fragments of food get stuck between our teeth, and bacteria slowly eats away at the food, causing bad breath and tooth decay. Flossing your teeth every day (or better yet, after every meal) will reduce bad breath, reduce spending on mints or gum, and reduce cavities.

6. Turn off your power bar at night

Ever wonder how your hydro bills could be a bit cheaper? Other than the most essential electronic items you need to keep on in your house, like the fridge, turn everything off when you go to bed. The easiest way to do this is to have your devices connected to a power bar, that way only one switch is needed to turn off several devices. Don’t underestimate how much electricity is used to keep these devices powered every single day.

7. Have a good sense of time

Having a good sense of the passage of time is a skill. A successful career relies on being punctual and conscientious. I find that the easiest way to keep track of time is to have clocks everywhere. When you can actually see time represented, you are likely to be more conscious of the amount of work you can do and procrastinate less. Keeping good track of time prevents spending money on cabs or breakfasts on the go because you’re running late!

8. Use essential oils as perfume and air fresheners

Perfume is quite expensive, and recent studies have shown that some ingredients in perfumes can trigger allergies and migraines. A good way to replace your artificial scent is to buy your favourite essential oil at your local health store (go on the days when they have discounts), and mix a few drops of essential oils into a body mist. By diluting a few drops of the oil in water, one tiny bottle of oil can lasts for months! To make an air freshener, just drip a few drops of the oil into a spray bottle, fill the rest with water, and you have a homemade air freshener that’s not bad for the environment or your wallet.

9. Always have a bottle of water

Having a bottle of water with you when you’re out means that you can save money on drinks, stay hydrated, and be healthy. Drinking water (not tea, juice, or coffee) is the best way to hydrate your body. Additionally, drinking enough water means your skin will be better because it’s moisturized from within, and that will save you money in the long run on skin care products.

10. Pay with cash instead of plastic

Nowadays, people don’t carry cash with them because of the convenience of debit and credit cards. However, withdrawing cash from your bank account means that you can associate a sense of realness to your money: each piece of paper is a physical representation of the money you worked hard for. When you pay with cash, money isn’t just some number in your bank account – it’s actually a symbol of your time and work. On the other hand, using a debit card removes the sense of loss when you spend money, and a credit card gives you a false sense of wealth because you don’t have to pay right away. Keep no more than $20 in your wallet, so that when you can’t buy what you want with cash, it’s a good chance to reconsider your purchase. Try it out!

Being frugal is not always easy, but it does come with lots of perks. You’ll be able to save money for the things you need rather than the things you want, start a fund for emergencies, and avoid accumulating debt. It’s the habit that matters. By saving a bit of money here and there today, you’ll find it easier to do the same every week, and then every month. Every penny counts! What are your money-saving tips?

Featured photo credit: Save Money via flickr.com