It goes without saying that your 20s come with lots of new things: new friends, new experiences, new perspectives, and new legal allowances.

As it turns out, they’re also packed with defining moments that will shape the rest of your life. And while it’s usually very difficult for young people to think about things like planning for retirement and investing in life insurance, the truth is that those AARP discounts are closer than you might think. So if you can learn these important things about money and finance now, in the future you’ll be happy that you did, and probably a lot richer too.

1. Pay Yourself First

“Don’t save what is left after spending; spend what is left after saving.” – Warren Buffett

While the concept of saving may be a familiar one, paying yourself first is often misunderstood. I didn’t understand the idea until I was well beyond my 20s, but I wish I had understood it sooner.

Paying yourself first means taking a portion of your earnings and putting it into a savings account or investment that can then work to earn you more money, all while you sleep.

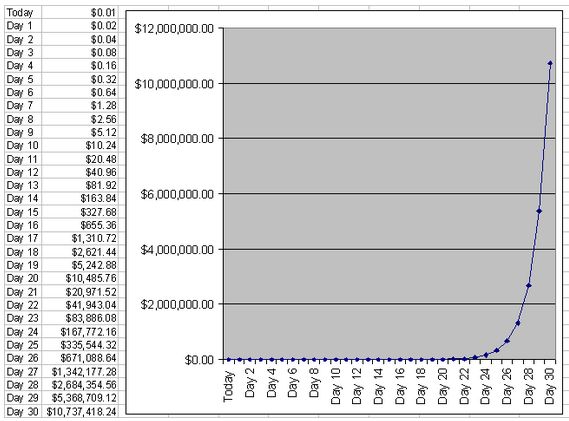

The reason why this is so important is because when you’re saving money it grows in relation to the interest it accrues, so the more money you have to save and the longer you’re saving, the more you can take advantage of this extra “free” money.

Alternatively, by not saving you’re also losing the money that could be gained in interest. That’s why it pays to learn how to pay yourself first.

2. Learn how to Leverage the Power of Compound Interest

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.” – Albert Einstein

In his book

Twenty-somethings have the best opportunity to take advantage of compounding because of the magic of time and the power that compounding gains as it grows. Unfortunately, many 20-somethings ignore this wealth-making practice and lose valuable opportunity in the process.

3. Grow Your Financial Education

Becoming financially literate is not rocket science, though it can seem like it — especially when the majority of us are not taught financial literacy in school. But just like a higher academic education helps you advance in your career, higher financial education helps you advance in life and in what you can do. Thankfully, there’s no better time than your 20s to start the learning curve with any number of great resources.

4. Know Your Credit Score and Keep it Up

In the September 2014 issue of Success Magazine, Suze Orman, the money guru herself, says that understanding your credit is key to financial health. “A FICO score will determine if a landlord will rent to you. It may determine if an employer will hire you. It determines if a telephone company will give you a phone, and it even determines what your car insurance premium happens to be.”

As credit scores go, anything below 500 is a red flag and, just like your grades in school, it’s a lot easier to slide down than it is to bring back up, so pay attention. For additional queries and your free credit score, use CreditKarma, Credit.com, or Bankrate.

5. Live Within Your Means

“Do today what others won’t, so tomorrow you can do what others can’t.” – Dave Ramsey

In theory, if you have an income that can pay for your basic needs, you can eventually amass at least a small fortune by paying yourself first, using the power of compounding, making smart investments, and living within your means. However, most 20 somethings are still honing these practices. Not surprisingly, this is also the time when many people begin using credit cards to pay for things not necessarily within their budgets.

Living within your means may look like skipping the movies on the weekends, trading your daily Starbucks for a homemade cup of coffee, or forfeiting that shopping spree in favor of recycling your wardrobe for a few seasons. However, when you practice this without reliance on debt, you give yourself a better chance to build a strong financial base. You might not think so now, but if you don’t put down that iced latte, you may be kicking yourself in the future.

6. Learn to Use Discipline to Manage Income and Expenses

“We must all suffer from one of two pains: the pain of discipline or the pain of regret. The difference is discipline weighs ounces while regret weighs tons.” – Jim Rohn

There’s a great book that every 20 something should read called The Richest Man in Babylon. Trust me, if I had read this book in my 20s, I’m sure I’d be a millionaire by now!

Through a series of parables the author, George Clason, relates the common experiences of poor money managers and outlines disciplines that lead to lifelong riches and wealth.

So imperative to financial health are the disciplines of managing income and expenses that these lessons serve as the foundation of the entire book. Unsurprisingly, failure to have a financial plan with these in mind is the number one regret of people when they reach retirement. Luckily for you if you’re in your 20s, it doesn’t have to be yours.

7. Learn to Manage Your Emotions Around Money

“In the world of money and investing, you must learn to control your emotions. High emotions equal low intelligence.” – Robert Kiyosaki

There’s no denying that having money (or not having it) comes with a lot of emotion. When we have it we’re happy (and often irrational), and when we don’t we’re sad. With each emotion come behaviors that can make or break our financial stability for the future. Many a divorce, bankruptcy, and heart attack have been attributed to the stress that people feel around money that could have easily been avoided.

Learning to manage your emotions with money is not only a good idea, it’s the thing that will help you to successfully navigate your way through the thousands of financial decisions you’ll need to make throughout your life, so it stands to reason that the better you can do this, the more money you’ll keep.

While it may be easier said than done, there are always resources that can help you identify your level of emotional intelligence around money and work to improve it at the same time.

Your twenties are a mixed bag full of fun experiences and new opportunities for growth. But if you can find a way to incorporate the seven practices above, you’ll not only thank yourself later, but even be able to afford to buy yourself an expensive treat!