Contrary to what retailers (and reality shows) want us to believe, we do NOT need to buy new clothes every season (or every month). Nor do we need fifty pairs of shoes or an ever expanding wardrobe. We can be amazingly fashionable for significantly less money by changing our mindset about buying clothes and using an arsenal of money saving techniques. For strategies beyond “use coupons,” and “shop end of season sales,” consider the 51 clothing hacks below for your savings pleasure.

1. Apply the 75% Off Rule.

Only look at clothes that have been marked down at least 75%. Yes, it drastically narrows the selection, and, yes, some things may be harder to find. However, the sheer magnitude of clothing options out there is astounding. Plus, there will always be something new to pique your interest. Personally, I find that this clothing hack saves me time as well because I bypass the majority of clothing racks in the stores or only look at a couple of pages online. Of course, combine with coupon for additional savings. Confession: I have been known to cheat and purchase something that was 75% off AFTER combining the discount with coupon.

2. Wait a Month.

So you’ve found something that you just HAVE to have. It’s perfect in every way. Except for the price. Take a deep breath, walk away and wait a month. The act of waiting can have an amazing impact on how you view that must-have item. Within that time, I have usually completely forgotten about it (or replaced it with another must-have item – which gets the same wait-a-month treatment). Also, in a month’s time the price may have been reduced. Either way you’ll have money in your pocket longer. In the many years of applying this clothing hack to probably 10,000 (slight exaggeration) must-have items, I can honestly say that I have probably purchased two when all is said and done.

3. Make Room in Your Closet.

Many of us arguably have a closet full of clothes while simultaneously lamenting that we have nothing to wear. Before buying something new, get rid of one or two. If you get rid of (donate, sell) an item or two of clothing before you buy something new, it sets you up to be mindful of how much you are spending and what you are spending it on.

4. Buy Discounted Gift Cards (with a Rewards Credit Card).

Do this and you’ll be saving money before you even begin shopping. Purchase from a site like Cardpool or Gift Card Granny. Combine your gift card with deep discounted sales and coupons and work a triple whammy of savings. Extra bonus: when you buy with a rewards credit card you’ll earn points that can be cashed in for other free stuff.

5. Use a Coupon App.

Smartphone Apps like RetailMeNot make it easy to find coupons on the go. Always look before checking out at the store. When purchasing online always search for a discount or promo code.

6. Scan Before You Buy.

Download a barcode scanning app like RedLaser and scan the price tag before you buy. Unless the item you are considering is a store exclusive, you might find that it is significantly cheaper somewhere else.

7. Leave the Credit Cards at Home and Pay with Cash.

There is something about handing over those greenbacks that gives pause. When credit cards make it too easy to spend, even if you pay the bill in full when it is due, remove the temptation by paying with cash (or see gift card tip above).

8. Know if Deeper Discounts are Found Online or in the Brick and Mortar Store.

Some retailers typically have better sales online, while others offer deeper discounts in the store. Get to know which is the case for your favorite merchant and save some time and money.

9. Shop at Consignment and Thrift Stores in Wealthy Areas.

Even those who turn their noses up at consignment and thrift stores may be amazed with their finds when they shop in wealthy areas. Wealthy people sell their clothes too!

10. Host a Swap Party.

Have friends with styles you like? Invite them over and throw in a few friends of friends. Bring gently used clothes, shoes and accessories. Have folks bring a small food item (maybe some wine), and have a good time swapping. You’ll go home with new clothes and memories of a great time with friends.

11. Buy Clothes that Fit You Now.

Not for when you lose ten pounds or whatever needs to be done in order for it to fit. One, there’s no guarantee that the item will fit like you think it will. Two, be like me, and by the time it actually fits, it’s out of style. Either way, it’s like setting money on fire and calling it a light show.

12. Don’t Buy Print Jeggings.

Ever. Just Don’t.

13. Buy Timeless.

What is considered timeless is a little difficult to describe because it varies according to each person’s style. Ask yourself this. Can you see yourself wearing it often and years from now (no, not you Jeggings), and still feel confident and stylish? If the answer is yes, consider adding it to your wardrobe. The more well-made timeless pieces you have, the less you’ll need to buy.

14. Don’t Buy Into Trends.

This is not the same thing as buying timeless. Fashion trends are just that: popular, fun and fleeting. What is all the rage one moment may very well be done in two months. While your timeless pieces will get you through, sometimes you want to join in. Here’s how: first and foremost, NEVER buy a trendy piece that doesn’t look good on you. Just wait it out. Something else will come along. Since it’s only a temporary investment, always purchase at a deep discount store. Only buy one or two trendy items. You’ll be moving them along soon enough. If you’ve gotta have lots of it consider the next tip.

15. Get an Extra Job with Your Favorite Retailer.

I have no illusions about this one being popular, but it certainly is a good idea for the broke fashionistas who continue to buy clothes. Get an “extra” job at your favorite retailer. Don’t make it your primary place of employment or you may find all of your paycheck going right back into the store! Your extra job will probably come with the benefit of a deep employee discount and you’ll have a specific fund from which to use for clothes.

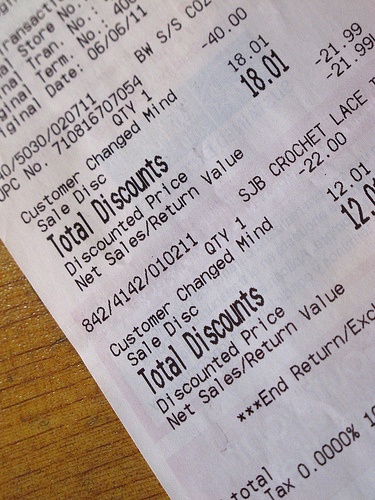

16. Return It.

It was kinda cute. Check. The price was awesome. Check. You got it home. It looks alright, but you know it’s not going to be a favorite. Check. If you feel this way, return it if the store policy allows. I have done this even when it didn’t seem worth the time, energy or cost to do so. It was my self-imposed punishment for wasting money. After a while, I got very good at making sure I loved it before I brought it home. Still not worth it? Then try this:

17. Sell Your Clothes.

Do you have a closet (drawers, bags) full of clothes you don’t wear, but won’t give away or swap because ___________________(fill in the blank)? Sell them. There are so many ways. In addition to brick and mortar consignment stores, you can sell to online consignment stores such as ThredUp. Ebay still works. Garage and yard sales do too. Mix it up and use all of the mediums. You’ll open up some much needed space and score some extra cash to boot.

18. Get a Price Adjustment.

You just got an amazing deal, and the following week you see it at an even more amazing price. Many stores have a price adjustment policy where they’ll credit you the difference between what you paid and the current price. Just make sure the difference is worth a trip back to the store.

19. Use Cash-Back Sites for Online Shopping.

Sites like Ebates and Fat Wallet share the wealth by giving you a small percentage of your purchase price back in the form of a cash rebate. They are simple to join and easy to use. Once you hit your cash out threshold the site will send your cash. The hardest part of this clothing hack is remembering to use them when you shop online! Tip: if you go to the retailer site first, and then go back and click through from the cash-back site, you may not qualify for the rebate. To get around this, open a different browser to access the cash-back site and click through to the merchant to complete your purchase.

20. Buy one Excellent Winter Coat.

Winters are cold where I live. I used to have ten cute coats that I got at rock bottom prices. The problem? None of them kept me warm, so I was always in search of another. I finally invested in a well-made, stylish coat. Though I bought it on sale, and combined with a coupon and discount gift card, it was not cheap. It was, however, very warm and I wore that thing every single cold day. Two years later I still do. Guess which ended up costing me more. I gave all of the other coats away.

21. Don’t Buy Linen.

If you hate how easily it wrinkles, you’ll probably avoid wearing it, which means it’s a waste of good money.

22. Buy One Good Swim Suit that Looks Amazing.

All of the $4.99 tops, bottoms and one pieces in the world are not worth the price if you don’t feel amazing in it, prefer not to wear it, and are always looking for the next one. When you find one you love, take care of it by rinsing it out after every use and letting it hang dry, and it will last a long time.

23. Avoid the Bridesmaid Dress Effect.

Don’t buy clothes that you know you are only going to wear once. If you need something for a special event, try to borrow it from a friend or family member who is a similar size. Renting is also a good alternative for expensive items such as suits and evening dresses.

24. Don’t Buy Cute Shoes that Hurt Your Feet.

Seems like common sense doesn’t it it? Then someone please explain the plethora of band aid covered Achilles heels and toes from shoes that have caused painful blisters and worn the skin away. Cute shoes that hurt, whether you paid $10 or $300 (BTW, I would never pay that much for one pair of shoes) are a waste of money upfront when you stop wearing them or later on at the back end when you’re paying podiatrist bills. On that note. . .

25. Don’t Buy It Because it’s Kinda Cute and Really Cheap.

I’ve fallen into this trap before. It was marked down to $6.99 from $200. It was kinda cute and well-made, but I was more enamored by the original price, wore it once, realized I didn’t love it, and never wore it again. That was a waste of $6.99. Tip: look at the price tag AFTER you decide you love it. It may hurt sometimes when you see it’s out of your price range (I almost cried once), but it could just as often stop you from buying something just because it’s cheap. And that’s a good thing.

26. Shop the Men’s and Boy’s Section.

Some items such as sports socks, sneakers and tee shirts tend to be cheaper in the men’s and boy’s sections of the store.

27. Unsubscribe from Store Email Lists.

When you pay attention to your lists, you’ll notice how cyclical they are. The same discounts come around again and again, very regularly and frequently. There’s rarely, if ever, a need to rush to jump on a particular sales promotion. However, if seeing the sale makes your mouth water and you feel the urge to buy coming on, unsubscribe to remove temptation. Or send those emails to an email address dedicated to your subscriptions. You’ll be more likely to only check it if you’re looking for a discount for a specific store.

28. Take Advantage of Birthday Freebies.

If you can withstand the temptation of sales promotions in your email, there is one time of year when you can truly cash in. Your birthday. Many stores send you “gifts,” in the form of certificates good for a specific item or a dollar amount off of anything in the store. Victoria’s Secret sends a certificate for a pair of free undies.

29. Don’t Window Shop.

Some people find window shopping enjoyable, inspirational, motivational even, and can leave without spending a penny. If that’s not you, don’t tempt the fates. Avoid it and keep your money in your pocket. Same goes for browsing online!

30. Don’t Get Sucked in by the Background Music.

Have you ever had a moment (or two or three) in your life where you wish there was a real life movie soundtrack playing in the background? A moment where it would be absolutely perfect if a certain song were playing to externally represent what you’re feeling internally? Oh, that’s just me? Well even so, don’t let the malls suck money out of your wallet with their music. Retailers know that shoppers are influenced by many senses. Smart retailers will do so with music designed to make you feel good and happy, or get you to linger a little longer, all tricks to get you to loosen your grip on your wallet. It’s the same reason why it’s difficult to find a clock in a store.

31. Don’t BOGO.

Buy one, get one. It’s an old trick to fool you into thinking you’re getting an awesome deal by giving you something for “free.” Seems like a good deal at first, but consider this. If you wait a little bit you can usually do better than 50% off each, which is what BOGO amounts to. Besides, do you really need two? Don’t even bother with the other versions like buy one get one 50% off. That’s an even worse deal because you end up getting only 25% off of each.

32. Don’t Pay for Free Shipping.

Truly free shipping, the kind with no minimum purchase is optimal. Free shipping that requires a minimum purchase amount . . . not so much, as it immediately puts you in the position of searching for more stuff to buy to meet the minimum requirement. This, of course, doesn’t matter if what you were going to buy meets the limit. Free shipping discount codes seem like a good deal until you realize that many times you can’t combine them with percentage or dollar off discounts.

33. Read Reviews Before Buying.

There may be a reason that garment is priced so cheaply. It’s not uncommon for an excellent price to be trumped by poor fit, quality or both. Reading reviews can clue you in and help prevent you from making a bargain hunting mistake.

34. You Really Don’t Need One in Every Color.

Awesome fit. Excellent quality. Amazing price. You still don’t need one in every color. Inevitably, you’ll wear one, maybe two, consistently while the others will sit in your closet.

35. Use the Two Outfit Rule.

Before you buy, make sure there are at least two other items currently in your wardrobe that can be paired with it. If you don’t have anything to wear with your new find, leave it on the rack. It’s not a bargain if it’s hanging in your closet unworn.

36. Know Your Triggers.

Some people are emotional eaters. Some are emotional shoppers. If you notice that you shop more when you’re feeling down, work at being intentional about finding a less expensive form of therapy.

37. Ask for a Better/Additional Discount.

The worst that can happen is that you won’t get one. Sometimes, more often than you might expect, the store associate will surprise you with a positive response which saves you even more money.

38. Don’t Buy Pajamas (or Lingerie).

Victoria’s Secret may beg to disagree, but it’s true. Do you really need 16 pairs of pajamas when you wear the same two or three over and over? How many times have you thrown on your comfy sweats instead?

39. Remember that Dressing Room Mirrors Belong in the Funhouse.

Have you ever tried something on in the store and you looked absolutely fabulous when you checked yourself out in the dressing room looking glass? Then you try it on again at home and look at yourself and think, “What just happened?” I’m not saying stores do this on purpose. Okay, they do. It’s just another example of how retailers use psychology and slights of hand to get you to spend money. From softer lighting, to tilted mirrors that make you look slimmer, retailers know how to get you to buy their clothes. If this happens to you, take it back.

40. Avoid Flash Sales.

Just because your favorite retailer tweets that they are offering 50% off everything for the next two hours doesn’t mean you have to buy something. I’m speaking to myself here. The truth is, if you weren’t thinking about buying something from the store before the flash sale, don’t tempt yourself by checking the flash sale out. There will always be another, better, sale of some kind where you can score a better discount.

41. Dry Clean Only? Wash them Anyway.

I try to avoid dry clean only garments at all costs, but it’s not always possible. So I wash them. In the washing machine. On the extra gentle hand wash cycle. Then I hang dry followed by a light ironing. I haven’t ruined anything yet. I have used this technique with cotton, wool, silk and polyester blend.

42. Vodka as Febreeze.

As someone who had to wear suits everyday, finding a way to keep the, um, armpit area smelling fresh was a challenge. No one wants to declare bankruptcy due to dry cleaning bills and I never could get myself to invest in those clunky, somehow more embarrassing armpit pads. Besides, dry cleaners do a good job of removing stains, not odors. Vodka to the rescue. Pour some unflavored vodka into a spray bottle, spritz the smelly area on both sides until damp and let hang dry. This works for me between washing in the machine if possible (see above tip). Buy a cheap brand of vodka. Save the good stuff for happy hour.

43. Hem Tape is Your Friend.

Have you passed on an incredible deal on an amazing pair of pants or blazer because they were too long and you didn’t want to spend money on alterations? Never again, as hem tape is your friend. If you can fold evenly, apply double sided tape and iron, you can now alter the length of your own clothes.

44. Remove Grease Stains.

You can save a grease stained garment! Sprinkle talcum powder, cornstarch or baby powder on it, and rub it in. You may need to repeat until the stain is gone. The talcum powder soaks up the grease. This clothing hack works on leather furniture too. I once placed a greasy bag of french fries on my nice leather ottoman (V-8 smack to the forehead). I rubbed talcum powder into the (very large) stain every day for 5 days until it finally disappeared.

45. Clothes as a Magic Marker Canvas.

Have you every had a small bleach stain on a dark colored shirt, or pants? Color it with magic marker, let it dry, and wear. Yes, the mark will probably reappear after a few washings. In this case, Wash, color, repeat.

46. Learn to Sew a Button.

This may very well be the holy grail of clothes saving techniques. When buttons fall off or start to hang by a thread, do you sew them back on or basically retire the item to the back of the closet hoping that the button sewing gnome will somehow repair it? Me? I ask my mom to sew my buttons back on. She finally told me to learn for myself. It is not difficult and will save you from having to buy new clothes. Lost most of your buttons? Buy new ones, even different ones to give your garment a fresh look.

47. Shave Your Clothes.

Nothing is as disappointing as when your favorite clothing starts to pill and look like a collection of fuzz balls. Don’t despair. They can be saved. An electric shaver is one solution. Carefully raking a straight edged blade over the pilled area works too. Sticky masking tape is another option, gently patting and pulling to remove the fuzz.

48. Hang Dry.

Instead of throwing your clothes in the dryer, hang them on a line (or indoor rack) to dry. You’ll use less electricity which will save you money, and your clothes will last longer (the lint in your dryer trap is evidence of fabric being lost each time you dry).

49. No. Wire. Hangers.

Wire hangers are vile things that pucker sweaters and ruin the shape of clothes. They may be cheap, but they will cost you in the long run. There are hangers out there that cost an arm and a leg. There is no need to invest in expensive hangers. In fact, don’t spend any money at all. The plastic ones used in the stores work just fine. Whenever I buy something, if the hanger doesn’t automatically accompany it, I ask if I can keep it. I have even asked for a few more. I have only been refused once.

50. Remove Armpit Stains.

Yes, people really can see them. Once my light colored shirts and blouses started to show armpit stains I converted them to under tops. You know, tops worn under something like a sweater. No more! Use a mixture of lemon juice and baking soda to make a paste. Rub it into the stain and wash as usual. Now I get to choose how I want to wear those tops. It’s good to have choices.

51. Those Boots are Made for Walking. Just Not Through Water.

If your leather or suede boots have unsightly salt and/or water stains, this clothing hack will make you click your heels. Gently rub the stains with a cloth that has been dipped in distilled white vinegar and let dry.

52. Don’t Buy Print Jeggings.

What? I said that already? Okay, but it bears repeating.

I’m always looking to add more money saving clothing hacks to my repertoire. Please shares yours below!