In these tough economic times, most of us are doing what we can to save money. There are many websites that can help you do just that, and you can often get a lot of stuff for free. Here are 30 of the best websites in the world that will help you save money on just about everything:

1. Five Dollar Dinners: Recipes, Printable Coupons

Find recipes for family meals that only cost $5 or less to make and save money on your grocery bills. Check out saving strategies, coupon database and browse recipes by ingredients.2. PaperBack Swap: Trade Used Books for Free

Take those old books you’ve already read and trade them for some you haven’t read. It’s so easy to use PaperBack Swap: just list books you’d like to swap with other club members. Once a book is requested, mail it to the club member. It is that it’s totally free!3. Savored: Free Way to Make Online Reservations and Pay Lower Prices

Get restaurant free reservations and save money on your bills so you can afford to dine out more often. Site is designed well and extremely easy to use. Savored is a Groupon company, so it will help you save up to 40 percent. Just choose the city, number of people and date!4. Gazelle: Sells and Recycle Electronics

Don’t throw away your old electronics. Trade them on Gazelle and make money: select your device and get an offer in just a few steps. There is no risk at all and Gazelle offers free shipping!5. FreeCycle: Changing the World One Gift at a Time

Find a network of people who are trading free goods in their own communities. Freecycle has 7,888,541 members all over the world. It is free to use. To sign up, find your community by entering it into the search box above or by clicking on ‘Browse Groups’ above the search box.6. Free Printables: Printable Labels, Gift Tags and Note Cards

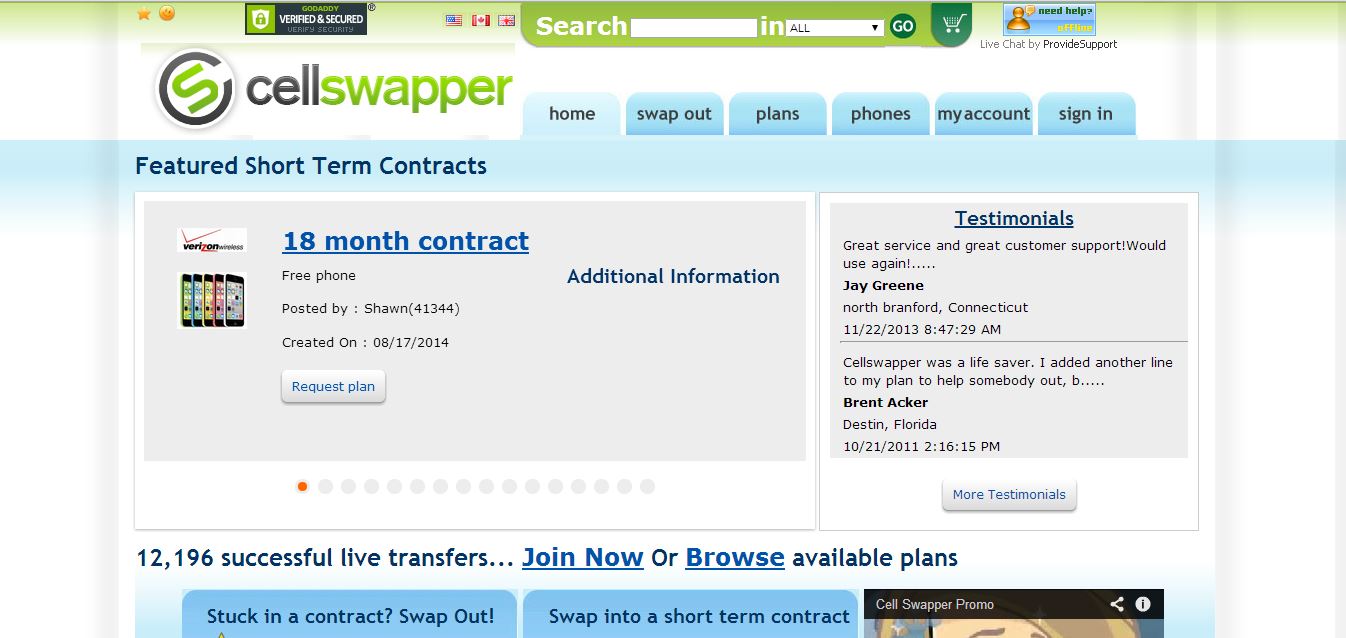

This is a Pinterest board with amazing DIY design ideas. You can save a lot of money when you use it for coloring books, calendars, cards, and other printed items.7. CellSwapper: Get Out of Your Cell Phone-Mobile-Wireless Contract

Switch or give away unwanted cell phone plans without worrying about breaking contracts or additional fees. Here is the service idea: you post your cell phone plan details online and attract buyers; somebody takes over your wireless contract and you become 100 percent contract free! CellSwapper has great customer support.8. Trusted Cleaner: Find Your Local Professional

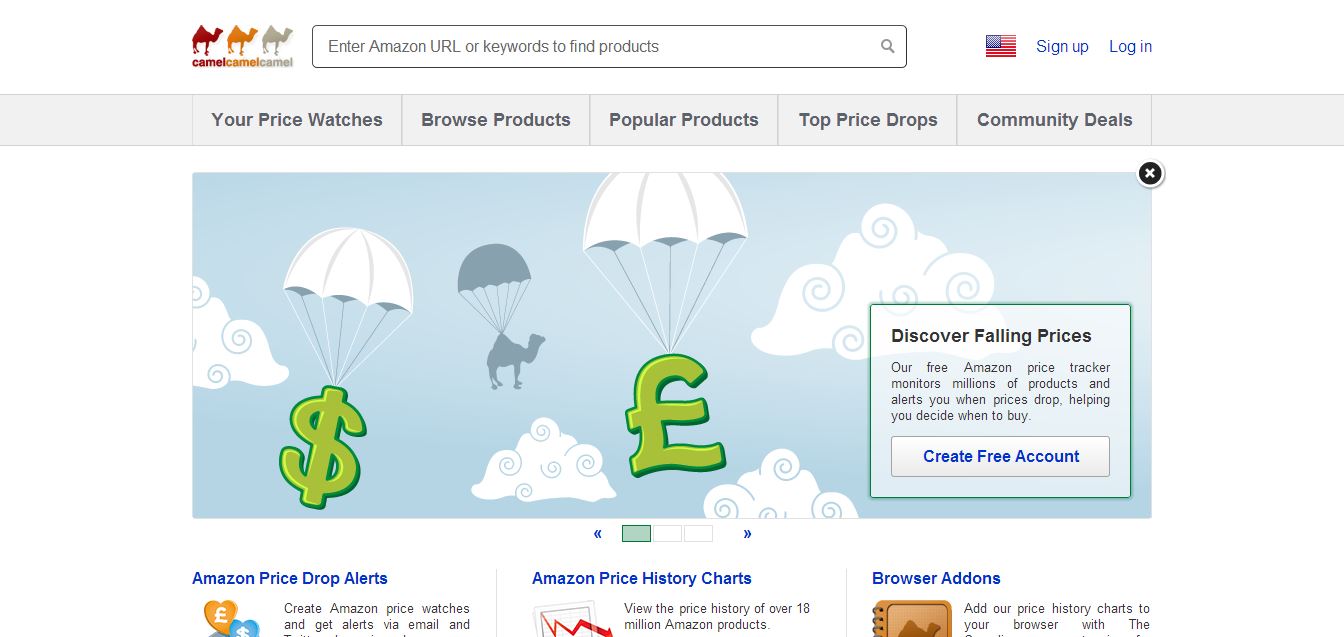

Find the best cleaning companies in your area, as well as the best deals on cleaning services. To find a list of recommended cleaners in your local area just enter the service you require and your location. Choose from carpet cleaning, home cleaning, gutter cleaning, office cleaning, and many other services.9. Camel Camel Camel: Amazon Price Tracker

Get the price history of any item on Amazon, and be alerted when items go on sale. You can easily create Amazon price watches, it is free! Camel Camel Camel has extension for Mozilla Firefox and Google Chrome called The Camelizer.10. Money Saving Mom: Intentional Finance. Intentional Family. Intentional Business

Here you will find money-saving tips, as well as coupons and weekly deals on household items. What you’ll find at MoneySavingMom: Deals, Steals & Coupons; Money-Saving Tips & Frugal Ideas; Deals at Your Local Stores; Coupon Database. Website goal is to tell you about practical ways to help you save money in everyday life.11. ThredUp: The Largest Online Consignment & Thrift Store

This is an online consignment store for women and children. Instead of tossing out kids’ clothing that has been outgrown, simply sell it on consignment and get some of your money back. ThredUp donate proceeds from the items they do not accept to charities like Teach for America. Orders over $50 ship for free. If you want to return an item they will refund you. Just return it within 30 days.12. GasBuddy: Find Low Gas Prices in the USA and Canada

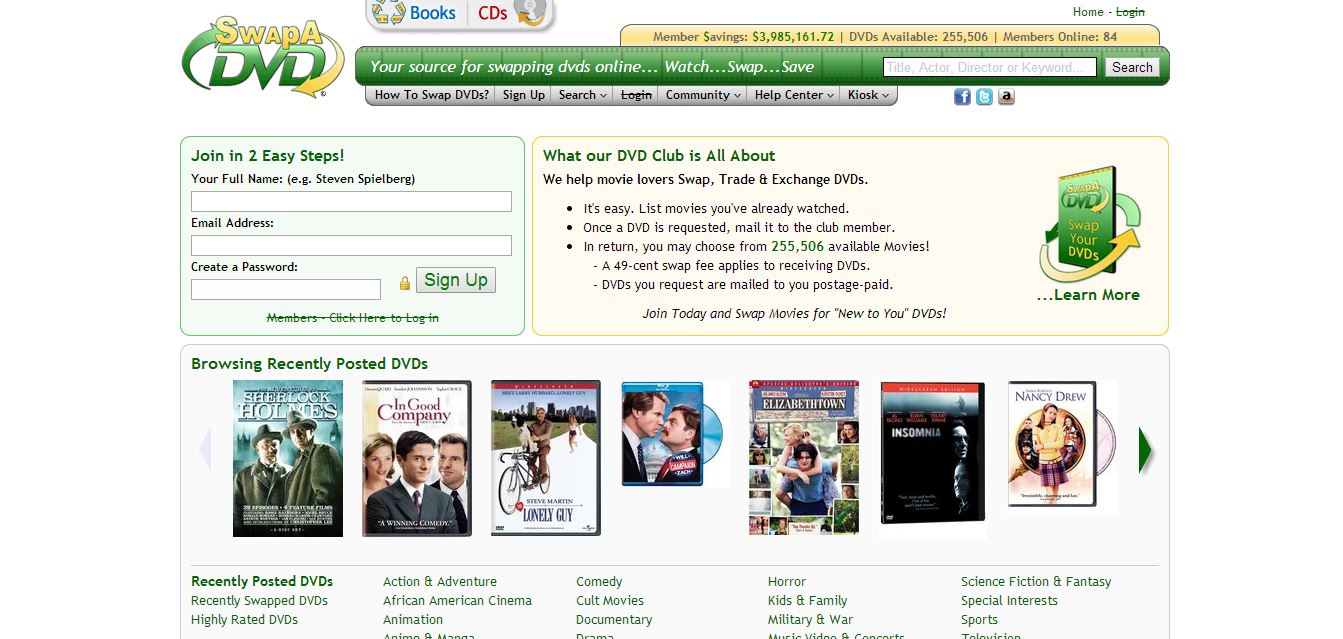

Find out where to find the best prices on fuel in your area. Join now, and get a chance of winning a $100 gas card by reporting gasoline prices. GasBuddy also provides historical gas price data, charts and statistics.13. Swap a DVD: Movie Club to Swap, Trade & Exchange Used DVDs

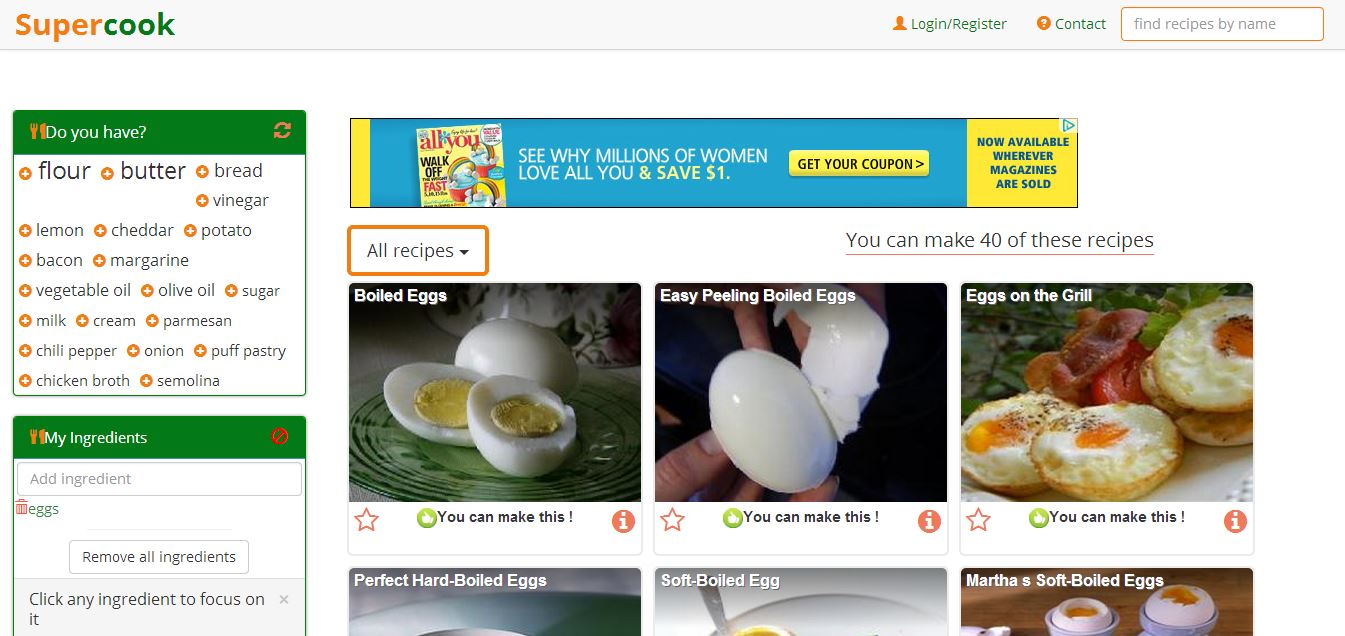

This is the same as PaperBack Swap, but you are trading movies instead. List movies you’ve already watched. Once a DVD is requested, mail it to the club member. In return, you may choose from 255,333 available movies! However, a 49-cent swap fee applies to receiving DVDs. DVDs you request are mailed to you postage-paid.14. Supercook: Recipe Search by Ingredients You Have at Home

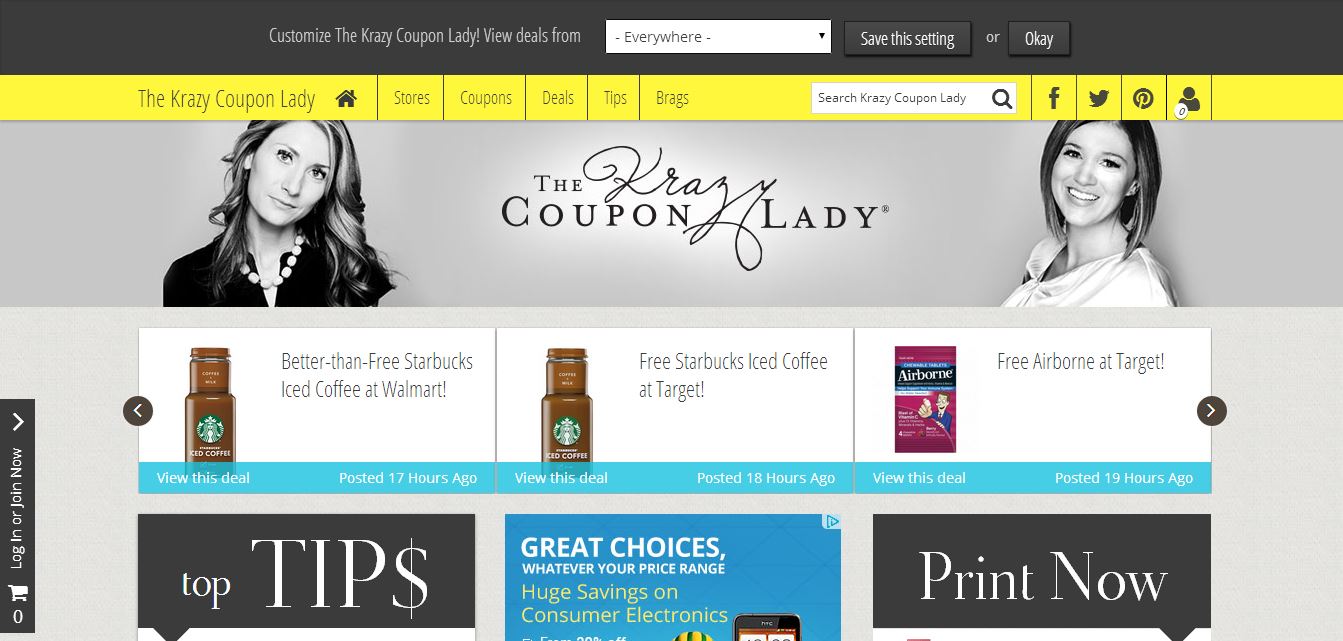

Find money-saving recipes that using the items you already have in your kitchen. Just click any ingredient to focus on and you’ll get the list of recipes.15. The Krazy Coupon Lady: Extreme Couponing

This is a giant database of printable and mobile coupons, as well as deals from national retailers. Also the sites has a huge Tips section with the DIY, Family, Money, Home, Recipes, Style, Travel information.16. SecretSales: Secret Sales, Discount Designer Clothes Sale

Get the lowest prices on luxury gear from Burberry, Firetrap, and other fine retailers. Experienced team of buyers work with over 600 brands to bring you new sales every day. The best selection of products across a range of categories including fashion, accessories, beauty and homeware. Mostly sales last between 2-4 days and have discounts up to 70 percent off, so you’ll need to be quick!17. Yapta: Track Flight Prices and Check for Airline Refunds

You will be alerted in real time when the prices go down on airline and hotel prices so you can have the most economical vacations. Yapta has an app to track flights and hotels, with real-time iPhone alerts.18. Temptalia: Beauty Blog, Makeup Reviews, How to Makeup

Find high quality copycat versions of your favorite high-end makeup brands at affordable prices. Temptalia was founded in October of 2006 by Christine Mielke. SIte is a global reference and resource for beauty enthusiasts featuring in-depth reviews, photos, swatches, tutorials, and beauty tips.19. Superior Resource: Print Shop

Do you need to get anything printed? Superior Resource is the best way to save money on printing and get the best result. Superior Resource provides printing on all kinds of invitations, brochures, envelopes, stationery, labels, pocket folders, annual reports, also large format pieces can be printed.20. AirBnb: Vacation Rentals, Homes, Apartments & Rooms for Rent

Save money on vacation rental properties with AirBnb! Find cheap accommodations: rent a room, apartment, house, or even a castle. Airbnb is a trusted community marketplace for people to list, discover, and book unique accommodations around the world — online or from a mobile phone. Airbnb connects people in more than 34,000 cities and 190 countries.21. Swap: Swap, Sell and Buy Pre-Owned Kids’ Items

This the world’s largest swap marketplace, with 1.2 million members worldwide. Swap books, CD’s, and other media to get new stuff and get rid of old stuff. You can pay for the items with your own items. You can also buy or swap items from multiple users and combine them into one shipment.22. FashionVouchers: Fashion Voucher Codes, Fashion Sales and Fashion Deals

Get vouchers for shops as well as online stores and get the latest looks at low prices. It’s really easy to use FashionVoucers: you can browse all vouchers, check out the top 10 vouchers, browse all stores, and even find vouchers by category.23. Made: Great Design Direct From the Makers

Save as much as 70% off contemporary furniture designs when you buy directly from the manufacturers (No warehouses! No physical stores!). Special features of Made are grouping order, real time tracking and fuss-free returns.24. HomeDiscount: Everything For The Home Up To 75% Off

You can save as much as 75 percent off items for the entire home, including the bathroom and kitchen. They are so confident of their low prices, that site offers a Price Match Service. HomeDiscount has a huge selection – over 20,000 products.25. Visitbritain: Destinations and Attractions Throughout England, Scotland, Wales & Northern Ireland

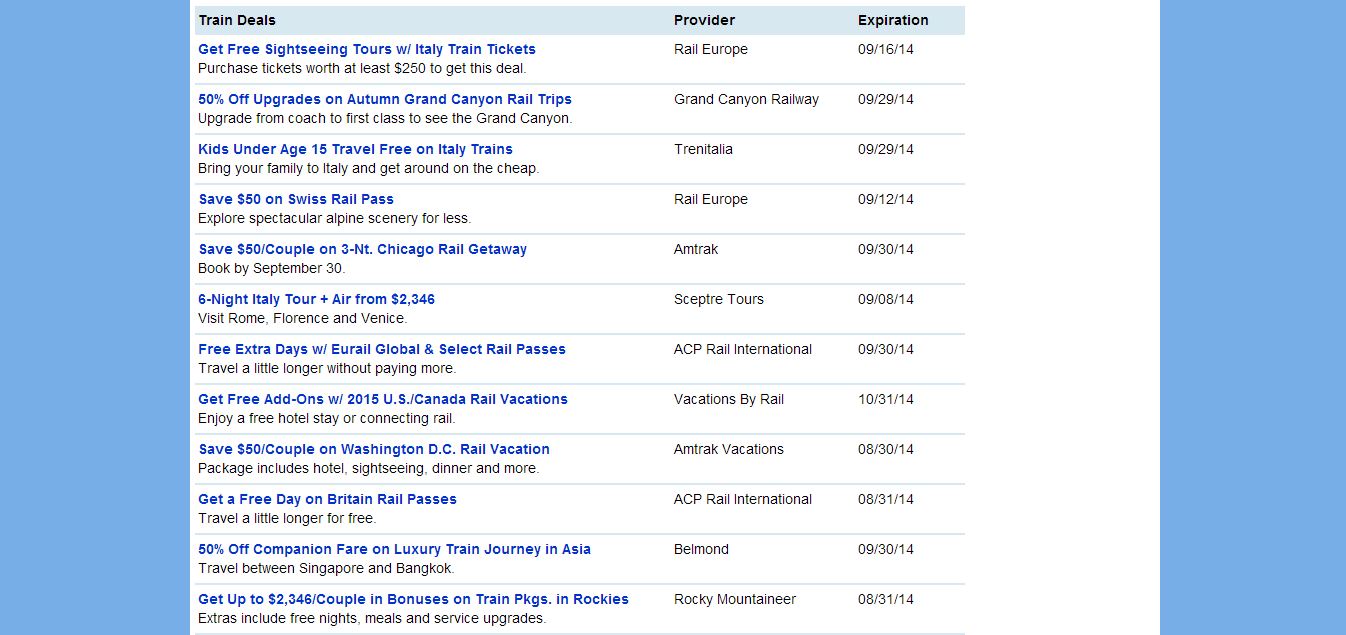

Find the most fun and least expensive activities for economy vacations in Britain. Visitbritain has over 150 Britain products in their online shop: from transport tickets to popular attractions and sightseeing passes.26. Independent Traveler: Train Deals

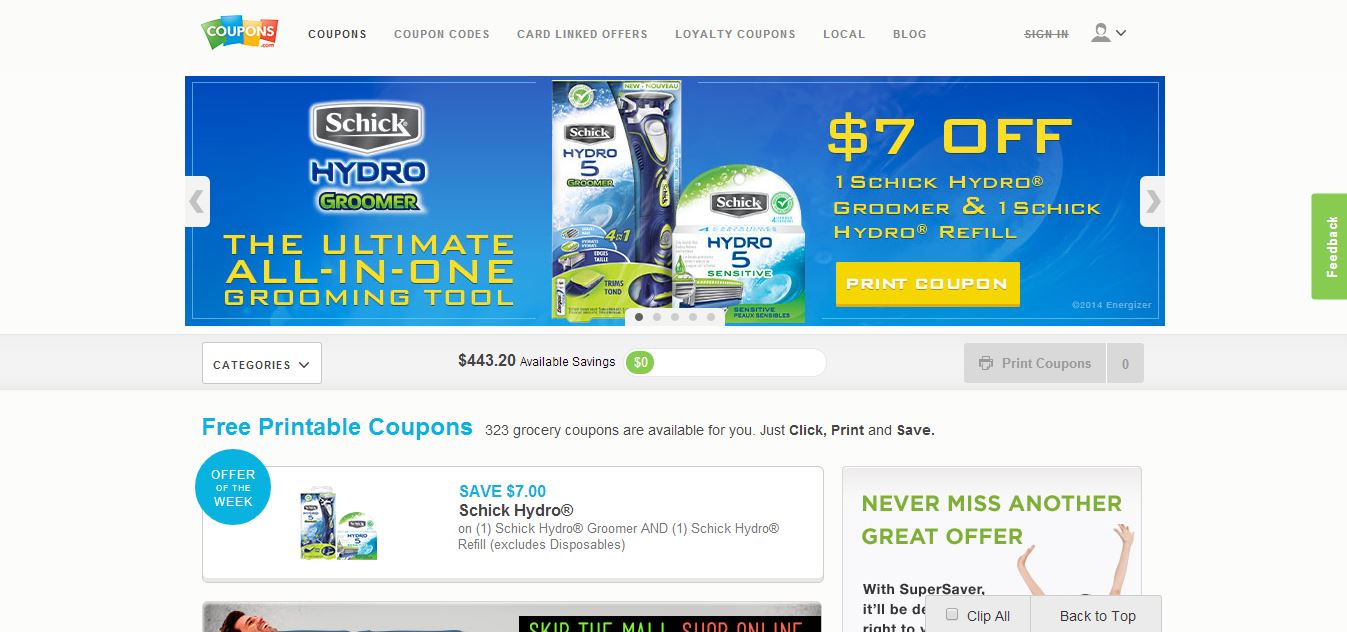

Get the best deals on train travel, as well as deals on many attractions. Check out trip reviews and forum.27. Coupons: Free Printable Coupons, Grocery Coupons & Online Coupons

You can find deals on just about everything here. Instead of waiting for coupons in your local newspaper, you can get as many as you like on this website, whenever you want them. There is also the mobile app GroceryIQ, where you can get mobile coupons.28. Getaround: Peer-To-Peer Car Sharing and Local Car Rental

This is a great site for those who need reliable transportation but don’t have automobiles. This site allows people to borrow or rent vehicles. This is also great for car owners who want to make some extra cash. You can use the iPhone app to borrow or rent cars.29. HomeAway: Vacation Rentals, Beach Houses, Cabins & More

If you want to travel but don’t want to stay in hotels, you have the option to rent a home. There are approximately 1 million rentals at any given time on HomeAway. All you need to do is sign an agreement, pay a deposit, and start your vacation.30. JustPark: Find Your Perfect Parking Space

You can rent out a private parking space or garage. JustPark is exactly like AirBnb, except for parking spaces. Just Search – Book – Park.Featured photo credit: Carol Pyles via flickr.com