Want to stop being broke?

One of the most common habits that all successful people have in common is that they read books. They’re continually learning, studying and implementing new strategies to better manage their money. They understand that it isn’t necessarily about how much you make, it’s about what you get to keep. That’s where proper money management comes in.

Here are 10 powerful books that will help you learn more about money management. If managing your money is a weak point for you, then you may want to consider picking up one of these books.

1. Rich Dad, Poor Dad by Robert Kiyosaki

This is a popular finance book that shares the powerful lessons learned from Robert Kiyosaki’s Rich Dad and Poor Dad. Growing up, Robert’s “Poor Dad” preached for him to “get a good education, get a good job and save your money”. While this may appear to be good advice, Robert realized that this advice would never get him rich. Instead, Robert’s “Rich Dad” would give him much different advice, such as “start a business, make passive income and invest effectively”. This easy to understand book will give you a new way of thinking about managing your money.

2. The Richest Man In Babylon by George Clason

A classic by George Clason, this book shares nuggets of wisdom that has been around for nearly 100 years. Some of the basic money management rules come from this short book, such as “Pay yourself first” and “Use the power of compound interest.”

3. The Millionaire Next Door by Stanley and Danko

What do all millionaires have in common? In this book, the authors interview and survey a variety of millionaires to discover the common traits amongst them. Living below your means, budgeting your money and managing it effectively are core concepts that you will learn in this book.

4. Secrets Of The Millionaire Mind by T. Harv Eker

This book will help reveal your “money blueprint”. T. Harv Eker shares how your beliefs and associations with money determine your financial destiny. While your psychology is extremely important when it comes to managing money, it also goes into a practical formula for how to allocate your money earned every month.

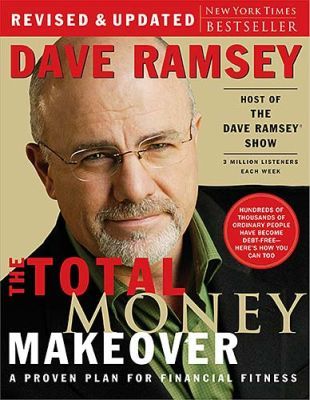

5. The Total Money Makeover by Dave Ramsey

If you are currently struggling with debt, then this is a fantastic book to start with. Dave Ramsey not only accumulated over $4 million dollars by his mid twenties, but managed to lose it all through bankruptcy. He’s now developed his own successful approach to getting out of debt and managing your money, which he shares in this book.

6. Your Money Of Your Life by Dominguez and Robin

This classic money management book preaches the power of simplicity. Simplifying your lifestyle to lower your expenses is a crucial element of being able to live below your means. The authors also go into developing passive income streams so that you can have your money working for you, becoming financially free.

7. The Money Book For The Young, Fabulous & Broke by Suze Orman

One of the most trusted money experts in America, Suze Orman, shares her money principles for getting out of credit card debt, school loans, improving your credit score, buying a home, insurance, and much more. This book covers all of the important money management strategies that all young people should know.

8. The Wealthy Barber by David Chilton

This entertaining book provides some useful money management advice in the guise of a novel. It shares the story of a group of friends that visit a barber shop once a month and receive powerful advice on managing their money from their “Wealthy Barber”. The book covers the popular advice of “pay yourself first” and “compound interest”.

9. The Automatic Millionaire by David Bach

David Bach shares his proven, automatic plan for becoming a millionaire in your lifetime. David’s simple strategies, such as his “latte factor”, will help anyone be able to cut back on expenses, manage their money effectively, and invest for financial freedom.

10. Get Rich Carefully by Jim Cramer

The host of CNBC’s Mad Money reveals his strategies to high yield, low risk investing in this powerful guide. Jim understands that in today’s economy, most people can’t take big risks with their money. That’s why this book is jam-packed full of practical, invaluable wisdom for turning your savings into lasting wealth.

By reading a few of these money management books, you will soon realize that managing your money is fairly straightforward and simple. Many of these books provide the same concepts and strategies. Why? Simply because they work.

Managing your money isn’t rocket science. It may seem intimidating at first, but once you get in the habit of managing your money effectively, it will change your financial future. You will have a sense of “control” over your money and it will greatly boost your self-esteem.

What money management books have you read?

Are there any that you’d recommend that are worth reading? Leave a comment below.

Featured photo credit: Money Book via s3.amazonaws.com